2023-11-3 15:58 |

MicroStrategy, the software firm led by prominent Bitcoin evangelist Michael Saylor, is once again demonstrating the potential of Bitcoin as a store of value.

With a strategic approach to accumulating the Bitcoin through the entirety of the most recent bear market, the company is now sitting on a nearly $1 billion gain.

MicroStrategy's journey into Bitcoin began in August 2020 when it first announced its entry into the world of digital assets. The company's initial investment, at a cost basis of $4.68 billion, has now soared in value to $5.62 billion, representing a $932 million profit, according to data from BitcoinTreasuries.

This increase in MicroStrategy's Bitcoin holdings has only reinforced Saylor's unwavering confidence in the digital currency.

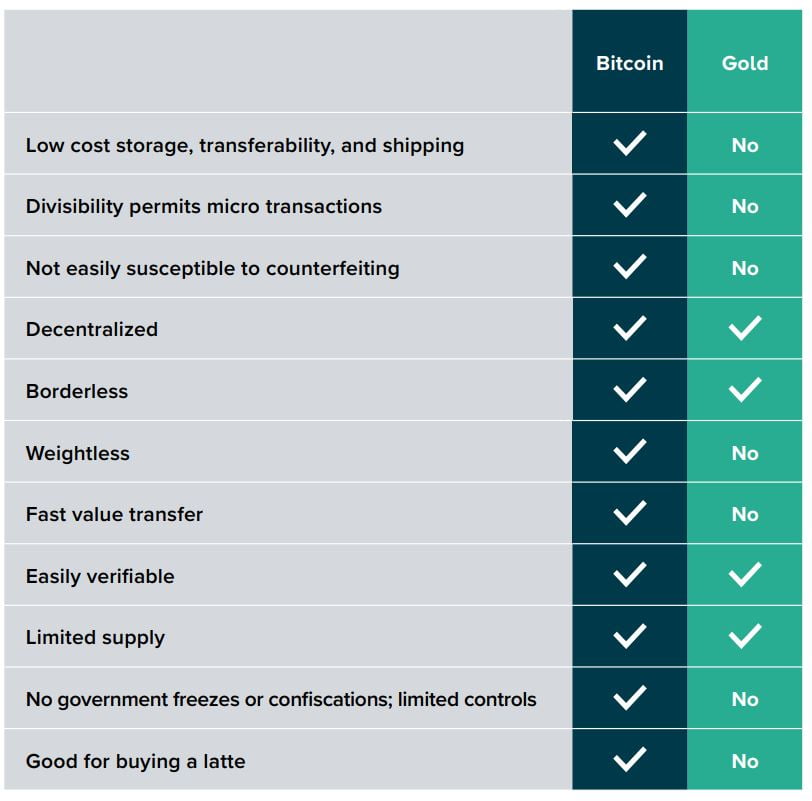

Saylor, a fervent advocate for Bitcoin, has been vocal about his belief that the cryptocurrency is not just an asset but a revolutionary monetary network. He asserts that Bitcoin's inherent qualities, including scarcity and decentralization, make it a superior long-term investment and a hedge against inflation.

Saylor's conviction extends beyond his role at MicroStrategy, as he has been a prominent figure in the broader financial landscape, advocating for the adoption of Bitcoin by other institutional investors. He has encouraged companies to allocate a portion of their treasuries to Bitcoin, as a safeguard against the devaluation of fiat currencies and the erosion of purchasing power.

The rise in MicroStrategy's Bitcoin investment serves as a testament to Saylor's vision and persistence. Despite fluctuations in Bitcoin's price, Saylor remains steadfast in his belief that it represents a paradigm shift in the world of finance.

He often characterizes Bitcoin as "digital gold" and sees it as an essential component of any forward-thinking investment strategy.

Still, looking ahead questions remain for the MicroStrategy empire. With a Bitcoin Spot ETF on the horizon, institutional investors may have new options for acquiring Bitcoin, dampering what has long been a driver in the company's stock price.

Regardless, his firm will likely be well positioned for the return of a sound money era with a Bitcoin stash that will be unrivaled among public companies.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|