2021-3-2 19:06 |

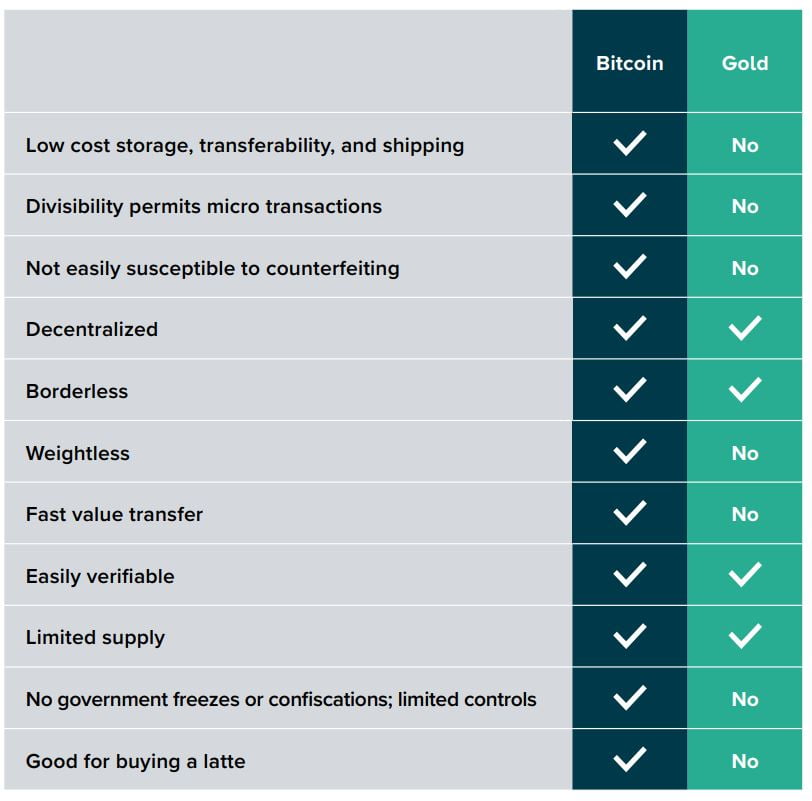

The Director of Fidelity’s Global Macro Jurrien Timmer says that Bitcoin has evolved as a form of digital gold.

Fidelity Endorses BitcoinTimmer wrote a report titled, “Understanding Bitcoin,” weighing the pros and cons of investing in Bitcoin. He believes Bitcoin may make “one component of the bond side of a 60/40 stock/bond portfolio.”

The 60-to-40 ratio allocation in stocks and bonds, respectively, is a general rule followed by many asset managers.

Ever since the COVID-19 induced crash last September, the bond yields have slowed and despite the recent surge, there is little hope for better yields in the future. Currently, there is $18 trillion of negative-yielding debt floating around the world. Timmer sees Bitcoin and gold as alternatives to the bonds in a low yield environment.

Bitcoin: In my view, bitcoin has evolved to the point that it could be treated as a form of digital gold…a possible counterweight to future monetary inflation. My current take on the cryptocurrency, here: https://t.co/Ud6GrBpIp2

— Jurrien Timmer (@TimmerFidelity) March 1, 2021

Comparing the $160 trillion in stock markets and the $11 trillion-dollar valuation of gold’s market capitalization, Fidelity’s asset manager predicted a continued uptrend in Bitcoin.

Moreover, he also found on-chain demand based on Metcalfe’s Law in the increasing number of addresses and reduced supply after each halving event citing the Stock-to-flow model. In conclusion, Timmer found that the “bitcoin growth curve may still be in its early, exponential phase”

According to him, Bitcoin will become scarcer than gold, becoming a “more convex form of gold.” Still, the road won’t be straight up and investors may feel “dismaying at times” as well.

Fidelity Investments has a digital assets wing that provides custodial services to institutions and also allows trading of crypto shares on its brokerage platform.

Disclosure: The author held Bitcoin at the time of press.

origin »Bitcoin price in Telegram @btc_price_every_hour

Macro (MACRO) на Currencies.ru

|

|