2024-12-5 21:22 |

MicroStategy’s Michael Saylor has projected more gains for Bitcoin (BTC) in the coming months. The Bitcoin bull continues to add more assets to his company’s balance sheet on the back of rising institutional investments.

In a recent CNBC interview, Saylor stated that Bitcoin price will soar to $180K and make a correction. Responding to a question on the asset’s volatility and expected regulatory changes, he noted that the volatility comes with its nature because it remains a 24-hour market that moves with bull peaks and panic seasons.

According to Saylor, Bitcoin will surge through the roof, hitting $180k before declining to $140K. Volatility remains part of the crypto market, and traders are watching levels.

“Volatility is like fire, and some people run away from the fire but Henry Ford put the fire via a carriage created an entire industry and he gave humanity wings…

Bitcoin Bulls Follow Saylor’s LeadOver the years, Michael Saylor has remained a big pro-Bitcoin executive, with his firm adopting Bitcoin into its balance sheet. As adoption soared, this strategy bolstered market sentiment, leading to more companies following a similar strategy. Currently, Metaplanet, Semler Scientific, and others have made similar moves.

Meanwhile, MicroStrategy holds 402,100 Bitcoin with an average price of $58,219 per coin. This stash has attracted all categories of investors, including whales, to the crypto market. The company sold $1.5 billion worth of stock backed by $500 million worth of Bitcoin, buying $1.5 billion of the largest crypto asset.

Apart from Saylor’s approach, a major upswing in whale activity remains the approval of spot Bitcoin ETFs by the United States Securities and Exchange Commission (SEC). This move opened a new window for traditional investment, increasing the asset’s price.

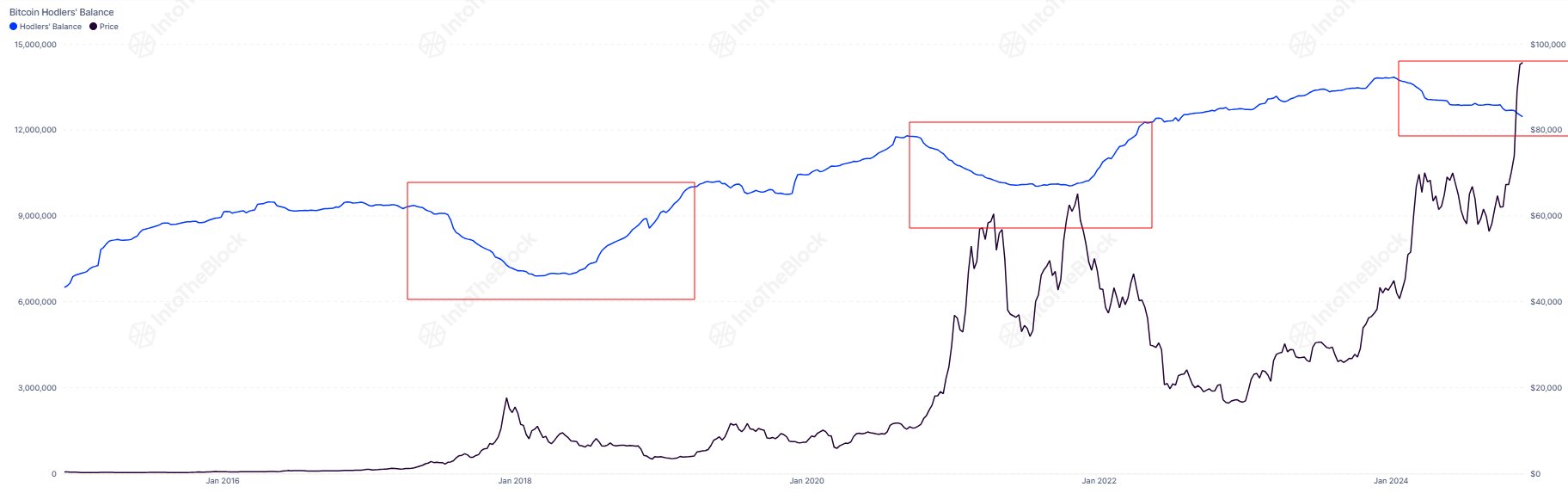

BTC Holders Set New Price TargetFollowing ETF approvals, Bitcoin surged above $73K before making a correction. However, Donald Trump’s election has become a game changer, with sentiments upswinging as users expect positive crypto laws. The market uncertainty lowered investment, driving innovation to other jurisdictions.

After the election, BTC soared to $99K as bulls target a short-term leap over $100K. Next year, Bitcoin holders project larger gains, citing positive macro factors in the ecosystem. Recently, Cathie Wood projected a bull case scenario above $1 million in the next five years.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) íà Currencies.ru

|

|