2024-6-19 20:59 |

Investment giant VanEck announced that after three years of effort, it has received the regulatory nod to launch a spot Bitcoin exchange-traded fund (ETF) on the Australian Securities Exchange (ASX), giving Australian investors a regulated avenue to invest in Bitcoin.

According to the announcement, trading will commence on the ASX on June 20. This comes just months after VanEck was approved by the United States Securities and Exchange Commission to start trading its spot Bitcoin ETF, the VanEck Bitcoin Trust (HODL), on Jan. 11.

VanEck’s Bitcoin ETF Approved For Thursday DebutThe Australian Securities Exchange (ASX) has approved VanEck’s listing of the first exchange-traded fund (ETF) that invests directly in Bitcoin. ASX is the top equity exchange in Australia, managing roughly 90% of the local trades. The VanEck Bitcoin ETF (VBTC) will debut on the exchange on Thursday and will be the “lowest-cost Bitcoin ETF in Australia.”

The global investment firm stated in a blog post that it has been planning to launch a Bitcoin ETF on ASX since early 2021. VanEck resubmitted an application for the investment vehicle in February, becoming the first to submit paperwork to offer a Bitcoin ETF.

“Despite hurdles to clear in Australia, including regulatory and exchange framework challenges,” the company postulated, “VanEck intends to lead the way in bringing the first Bitcoin ETF to ASX investors.”

Arian Neiron, chief executive officer for VanEck in the Asia-Pacific region, noted that the demand for Bitcoin exposure is increasing in Australia, particularly via a “regulated, transparent and familiar investment vehicle.”

“Notwithstanding that crypto investing is a polarizing topic, we recognize Bitcoin is an emerging asset class that many advisers and investors want to access,” Neiron said.

As ZyCrypto previously covered, reports had claimed that the first batch of spot BTC ETFs would be greenlighted by ASX before the end of 2024, making VanEck’s approval an earlier-than-expected development. The asset manager has invited prospective investors to register their interest in the product on its website.

While this marks the first time a spot Bitcoin ETF has won approval from the ASX, other Bitcoin ETF products have launched in Australia in recent years.

Earlier this month, Monochrome Asset Management’s Bitcoin ETF (IBTC) was approved and began trading on the Cboe Australia exchange, a smaller rival to the ASX. Monochrome touted its product as the first and only ETF in Australia to hold BTC directly.

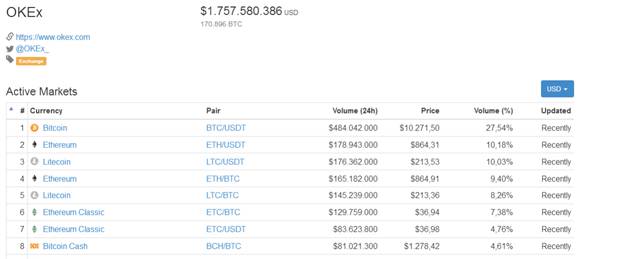

Explosive Popularity Of Spot BTC ETFsU.S.-listed spot Bitcoin ETFs were approved in mid-January this year and initially registered record-breaking inflows. However, in recent months, the flood of funds into the BTC ETFs has slowed and turned negative on some days amid the Federal Open Market Committee’s (FOMC) hawkish stance.

Notably, the investment vehicles saw a 4% drop to around $15.10 billion in its holdings in the week ending June 14, according to data from Farside Investors. The withdrawal trend continued this week, with the spot ETFs registering $146 million in outflows on June 17, bringing the net ETF reserves to $14.8 billion.

Waning enthusiasm for U.S. spot BTC ETFs, nonetheless, doesn’t seem to have dented hunger for the products across the globe. In April, Hong Kong’s Securities and Futures Commission (SFC) approved a handful of spot Bitcoin and Ethereum ETFs from asset managers Bosera Capital, China Asset Management, and Harvest Global Investments.

origin »Bitcoin price in Telegram @btc_price_every_hour

Cryptospot Token (SPOT) на Currencies.ru

|

|