2022-1-4 17:30 |

What is Deribit?

Netherlands-based exchange Deribit is completely focused on options and futures trading, spot trading is not available on this exchange.

The exchange offers up to 100x leverage when trading Bitcoin futures which is one of the largest leverages in the branche (Primebit offers 200x as the top provider in terms of leverage). Even though other bigger exchanges like BitMex, Bitfinex and since recentlry Binance dominate this section of crypto trading, Deribit is growing in popularity thanks to their user-friendly interface and trustworthy team. In the recent months, Deribit is dominating the options market in terms of trading volume.

Where is Deribit located?Deribit (derivative + bitcoin =deribit) was started in 2016, and is officially registered as Deribit B.V. on an address at Stationsstraat 2 B, 3851 NH, Ermelo, The Netherlands.

Visit Deribit Now Deribit TeamThe platform is run by CEO John Jansen and CTO Sebastian Smyczynski and prouds itself as one of the rare crypto exchanges that has never been hacked. This is the result of the Deribit team placing a heavy emphasis on security.

Between 95 and 99% of Deribit’s users Bitcoin is held in cold storage which deters hackers from attacking the exchange since, even in the case of a successful attack, they would steal only small amounts of coins. The downside of this system is prolonged clearing time but in a tradeoff between security and a bit of waiting time, we would all choose security of our funds.

Deribit is quick to emphasize their superior matching engine that was in development for more than two years and is designed to offer extremely low latency trading, less than 1 millisecond. Deribit advises traders looking for the lowest possible latency trading to set up a server in Strasbourg, France as that’s where they keep their own servers.

Despite full team transparency, all funds on the platform can be loaded only with BTC and ETH and all transactions are processed solely in BTC and ETH. Deribit is currently working as an unregulated platform as European regulators haven’t categorized cryptocurrencies as financial instruments and legal framework is still work in progress.

Key features Functionality – Deribit is a web-based trading platform with streamlined and relatively user-friendly interface with standard trading options like order book, trading history, and recent trades. The exchange also features charts for futures, index, and volatility and a host of different statistics, technical analysis indicators, and key data related to futures and options trading. They also have mobile apps packed with all options just like the web-app.Technology – The exchange prouds itself with its match order machine that enables users to trade with less than 1MS latency. Deribit also supports trading bot software such as HaasOnline, BotVS, and Actant. Trading Options – Deribit offers no spot trading and is exclusively focused on Options and a Futures trading. The exchange specializes in offering leveraged trading at up to 10x leverage, while BTC futures are available at up to 100x leverage. Traders can also hone their skills with Deribit’s free demo account on https://test.deribit.com/ that gets loaded with 10 test BTCs. However, Deribit US customers are prohibited to use their platform.Customer Support – The site is translated in a couple of major world languages, from English, Spanish, Chinese, Russian, Korean, Japanese to Turkish.The Deribit team can be contacted via their email support system but also their social media channels like Twitter account or Telegram group. They also have extensive help center with FAQs and their own YouTube channel where they offer tutorials and guides around Deribit and futures/options trading in general. Deribit mobile appsDeribit has mobile apps for both major mobile platforms: iOs and Android.

The mobile app for iOS is downloadable in the iOS App store: https://itunes.apple.com/us/app/deribit/id1293674041?l=nl&ls=1&mt=8.The mobile app for Android is downloable in the Google Play store: https://play.google.com/store/apps/details?id=com.deribit&hl=en. Futures and Options trading on Deribit Trading FuturesFutures contracts are set at $10 with the 1:10 as the default leverage even though the leverage can go as high as 1:100. The mid-market price is an index called the Deribit index and is calculated from the average prices from 5 major exchanges – Bitfinex, Bitstamp, GDAX, Gemini, and Kraken. Similarly, the expiration price also uses the average of the Deribit index but is calculated from the prices indicated for every 6 seconds starting from 30 minutes prior to the trading day settlement.

When you outbid the order book, you have placed a market order which can be edited or canceled the order under the open order tab. However, Deribit offers no options for stop loss or take profit and you can’t close your position under the open order tab. To place your stop loss, take profit level or close your position, you must do it from the trade slip.

Trading OptionsDeribit is one of the few platforms around that offers Bitcoin options as this is a novel trading category with little liquidity and interest from traders, for now. While the trading accounts are initially set up with a margin requirement of 10%, you are required to maintain a 3% margin on your position. If your margin falls below the maintenance margin, you will be liquidated until the margin balance surpasses the maintenance margin.

Deposit and Withdrawal OptionsDeribit allows only BTC as a means of funding the account. Actually, it is purely crypto focused, just like BitMex – there is no support for any kind of fiat currency.

Depositing is easy, if you ever did it on any other exchange, you won’t have issues with Deribit.

To deposit your BTC, simply log in to your account and get the deposit address. When you have processed the transfer, Deribit will only require one confirmation before allowing you to begin trading.

The withdrawal process is very much the same, and you can access the “Withdrawal” tab via “My Account”. Next, provide the address of the wallet that you want to withdraw to. After you entered the amount to be withdrawn, the fee will be automatically calculated.

Deribit Exchange Supported CurrenciesIt’s important to highlight what we already said: Deribit does not accept Fiat deposits, they only accept deposits in Bitcoin. Traders who want to use Deribit will have to buy Bitcoin first from an exchange like Coinbase or Cex.io.

As for the trading pairs – you can only trade BTC and ETH paired with USD.

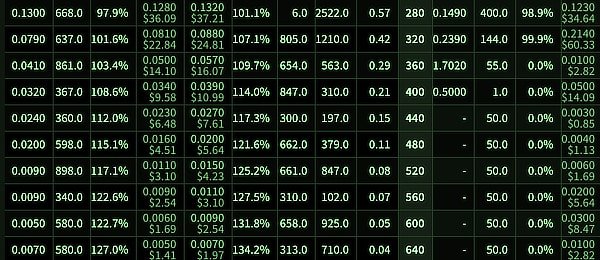

Deribit FeesDeribit works under a maker/taker fee system.

For their perpetual contracts they charge a 0.075% taker fee and 0.025% maker fee.

Their futures contracts incur a 0.05% taker fee and a 0.02% maker rebate.

For options there is a 0.04% fee on the underlying asset although Deribit states that the fee can never exceed 12.5% of an option’s price.

Liquidation Fee

0.15% for futures trades (0.1% will go to the insurance fund)0.1% of the underlying option contractDeliveries

Deliveries incur half the fees of taker orders, therefore:

Futures: 0.025%Perpetual Futures: 0.025%Options: 0.02%Here is a tabular overview of Deribit and its competitors in terms of their fee systems:

ExchangeLeverageCryptocurrenciesFeesLinkPrime XBT1000x50.05%Trade NowBitMEX100x80.075% – 0.25%Trade NowBinance Futures10x170.012% – 0.06%Trade NowDeribit100x20.025% – 0.075%Trade NowBithoven20x130.2%Trade NowKraken5x80.01 – 0.02% ++Trade NowGate.io10x430.075%Trade NowBitfinex5x250.1% – 0.2%Trade NowPrimeBit200x40.02%-0.05%Trade NowByBit100x8-0.025%-0.075%Trade NowPhemex100x40.025% – 0.075%Trade NowPoloniex2.5x220.09%Trade Now Is Deribit Safe?Deribit has no KYC requirements, a rare sight in today’s crypto climate. You just sign up for an account and deposit BTC and start trading – the whole process can take as long as one bitcoin transaction (10 minutes).

The reason why Deribit doesn’t require any verification is that the platform is BTC exclusive and has no obligations towards regulators like other platforms that deal with fiat money.

Deribit has an insurance fund that should cover all losses of bankrupt traders. Any liquidation orders are charged 0.50% transaction fees. The extra proceeds compared to default trading fees are added every hour to the insurance fund.

Any liquidation orders for ETH are charged 0.90% transaction fees. The extra proceeds compared to default trading fees are added every hour to the insurance fund.

Is Deribit beginner-friendly?

By virtue of the service they offer, Deribit is not suitable for noobies. Derivatives are highly complex and risky section of financial world and only seasoned traders dare to tackle this world.

However, through their aforementioned testnet, newcomers can gain some exposure and learn basic skills with this type of trading. So, if some of them decide to test their skills with real money, Deribit’s interface will be familiar to them.

Their channel on YouTube is a great learning resource and also their Telegram group or integrated chat that is accessible directly from the platform itself.

Deribit Pros and Cons ProsOne of the few exchanges that offers leveraged options and futures trading on both Bitcoin and EthereumPotentially lucrative affiliate programMobile app support for Android and AppleLow withdrawal feesConsNo Fiat support, all deposits must be made in BitcoinLimited number of supported currenciesMinimum order requirements are high at 1 ETH or 0.1 BTC Visit Deribit Now Deribit alternativesIf you are not fond of Deribit, here is a list of potential crypto margin exchanges that can be good alternatives:

Binance reviewBitMex reviewStormGain reviewFTX reviewSimpleFX reviewPhemex reviewCex.io reviewPrimeXBT reviewPrimeBit reviewCoinbase Pro reviewBitfinex reviewKraken reviewIs Margex legit?The post Deribit Review 2022 – Is Deribit Scam or Legit And Safe For Trading? appeared first on CaptainAltcoin.

origin »Bitcoin price in Telegram @btc_price_every_hour

Open Trading Network (OTN) на Currencies.ru

|

|