2020-9-30 16:00 |

As LINK trends lower and leave behind a trail of lower highs and lower lows, the decentralized finance token is forming a Descending Channel.

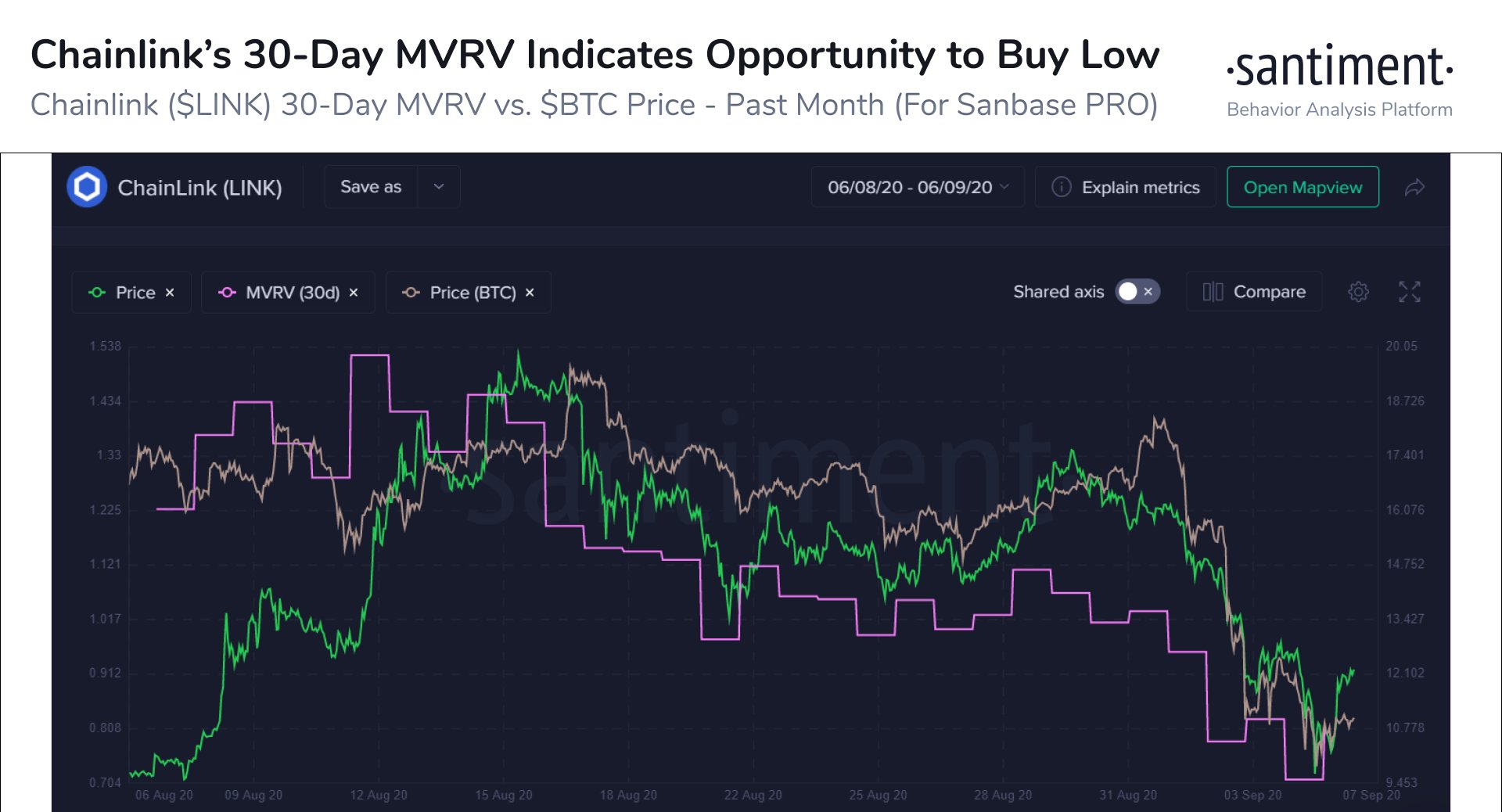

LINK trade setup hints at a further breakdown. Source: TradingView.com LINK trade setup hints at a further breakdown. Source: TradingView.comThe area between the green trendlines has been where the LINK downtrend is taking place since August 15. After posting a humongous 1,500 percent price rally, the token corrected lower by as much as 65 percent from its yearly top at $20.62.

LINK’s downside move also saw a periodic weakness in its buying strength, according to its daily Relative Strength Index that – too – formed lower highs and lower lows. The sync between the price and the momentum showed a brewing bearish trend in the market.

That leaves LINK possibilities of continuing its downside move, with the Ascending Channel serving as an indicator for traders to identify the token’s rebound and pullback levels. Based on its recent performance, LINK/USD is now pulling back after testing the upper trendline of the Channel.

LINK Price TargetsLately, any pullback from the Channel’s resistance trendline leads the token lower towards its support trendline. That means the price could fall towards $5.82 in the coming sessions – a 40 percent crash from where LINK/USD is trading at the time of this writing.

The $5.82-level has earlier served as support on two occasions during LINK’s uptrend in July 2020. That also gives the floor a historical context of capping LINK/USD from falling anywhere lower.

Nevertheless, there may be a possibility that the pair breaks below $5.82 based on the level’s volume profile, as shown in the chart below.

LINK price targets based on VPVR readings. Source: TradingView.com LINK price targets based on VPVR readings. Source: TradingView.comIn retrospect, Volume Profile is an advanced charting study that displays trading activity over a specified time period at specified price levels. It allows traders to realize where the trades are higher active based on a historical volume log.

The indicator shows $5.82 as the level as one of the minimum trading activities since February 2020. Meanwhile, the $4.09-level below it shows a higher VPVR reading.

It typically points to a weak retest of $5.82 as support, which may lead LINK lower towards $4.09. After that, the DeFi token could attempt a pullback towards $5.82, followed by a breakout towards $8.98.

Or $8.98-Support?Conversely to the whole bearish narrative, LINK could attempt an early rebound at $8.98, followed by a retest of the Descending Channel’s upper trendline. In the event of a breakout, the next levels to watch are $11.20, $13.43, and $16.18.

origin »Bitcoin price in Telegram @btc_price_every_hour

ChainLink (LINK) на Currencies.ru

|

|