2020-8-27 14:41 |

Despite analysts’ bullish sentiment, the recent dump in the crypto market has seen Bitcoin and key altcoins making lower highs and lows.

This week’s most-watched coins include Bitcoin, Ethereum, and Chainlink, whose trend reversals will have a fairly accurate estimate on the direction of the crypto market.

Technical analyst Crypto Michael indicates the following price movement for all three coins as telltale signs for predicting the crypto market’s performance in the next few days.

BitcoinBitcoin’s price has been rejected at both the $11,900 and $11,800 resistance levels, dropping down to the most essential level to hold at $11,300.

If bitcoin’s price falls below the $11,200 and $11,300 support levels which served as a critical sentimental mark when it was breaking out above $11,000, the price could further plummet to $10,800.

This will most likely be followed by a few rejections up at $11,300 to create hoping lower lows until a full market bottom is confirmed. The reversal will potentially shoot Bitcoin’s price up above $11,900, ready to regain higher levels above $12,000.

At the time of writing this, Bitcoin is up 1.24% trading sideways near $11,400 for the past 24 hours, with its next key resistance levels at $11,600 and $11,800.

EthereumEthereum dropped from $440 down to a crucial support area at $363 to $375. ETH’s failure to hold this level could lead to a further drop to the next support level at $320 to $310.

The price has recovered well above the support area after gaining 1.2% trading at $387. ETH will likely retest the $400 level a few times with the next two key resistance levels at $415 and $430.

However, failure to hold above $300 could land ETH at the $290 level, which is considered a healthy trend that traders are anticipating to buy the dip in bulk.

“The majority of people were looking for dips, and now we’re getting dips, and I only see fear all across social media, and I think these dips are essentially there to buy.”

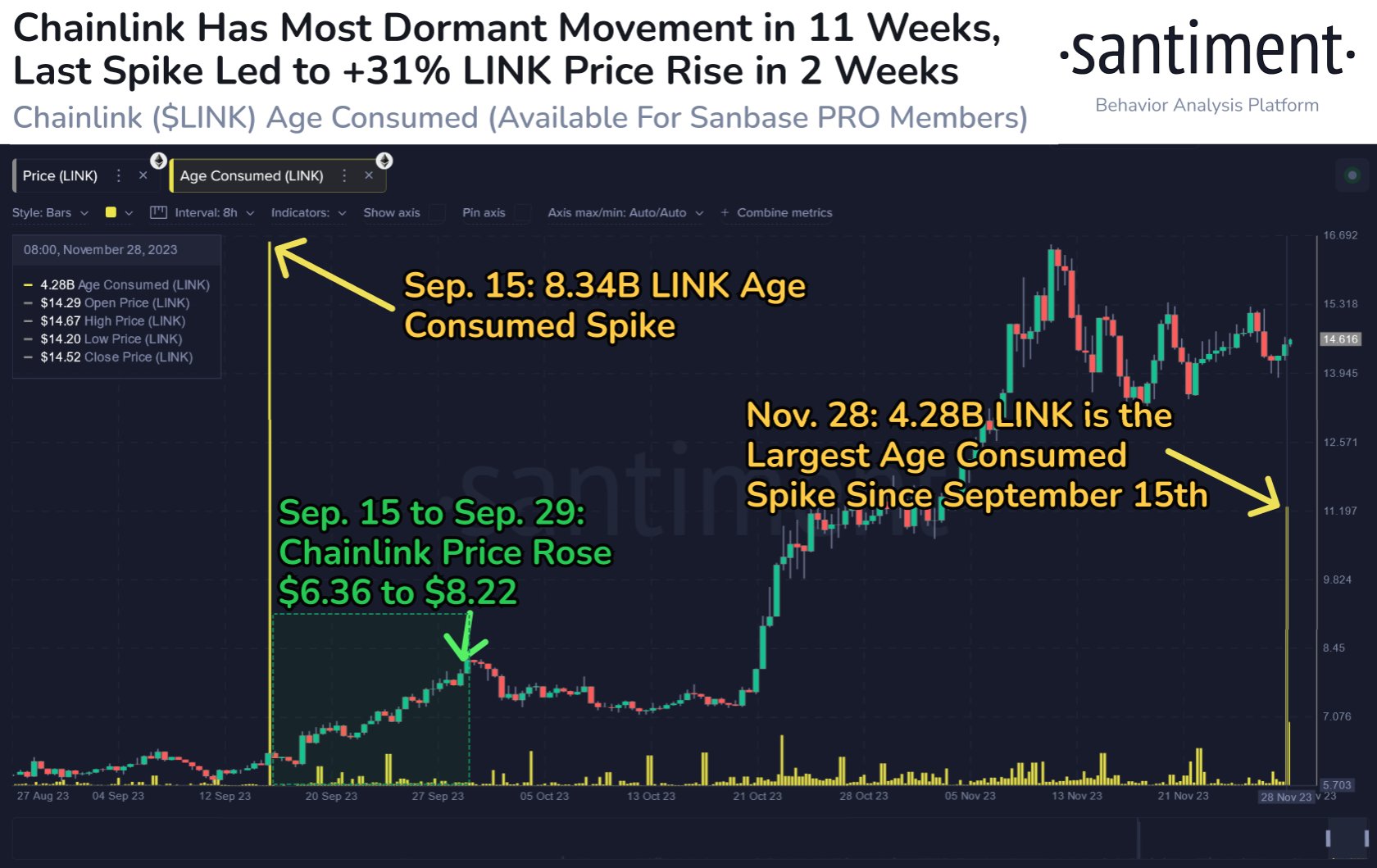

ChainlinkLINK is looking good, currently up 5.94% to trade at $15, and facing its next resistance level at $16, with a support area down at $14.

Meanwhile, altcoins with the lowest market caps have shed the heaviest as BTC’s falling prices lead to more liquidation from other long positions as data from Santiment shows.

“Today’s $crypto market dump indicates that low market cap #altcoins are being punished hardest. The top 100 # blockchains are down a median of -7.7% and $BTC, as has historically been the case, is holding up relatively well.”

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|