2026-2-22 22:25 |

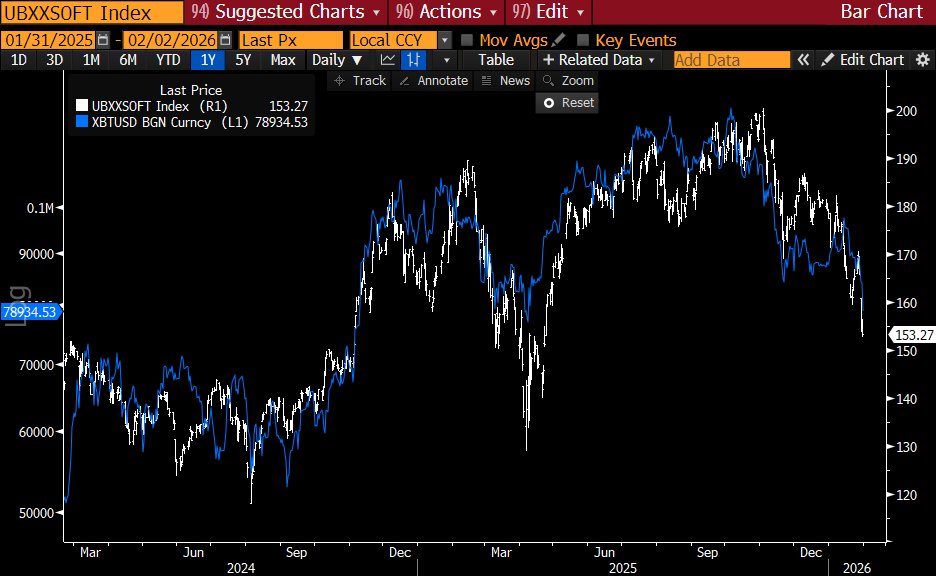

AI's rise could reshape money markets, leaving traditional players behind as crypto gains traction. The post Jordi Visser: AI and crypto will disrupt existing market structures, stablecoins are processing more volume than Mastercard, and Bitcoin’s performance is closely tied to software ETFs | The Wolf Of All Streets appeared first on Crypto Briefing. origin »

Bitcoin price in Telegram @btc_price_every_hour

Emerald Crypto (EMD) на Currencies.ru

|

|