2020-8-11 16:38 |

The Irish government aims to implement stricter and more stringent laws to curb money laundering and terrorism financing in its financial system, including digital assets. In a report first published by Irish Examiner, the Cabinet is set to approve Justice Minister Helen McEntee’s bill, Money Laundering and Terrorist Financing Amendment Bill 2020, to place more stringent AML/CFT laws within Ireland.

As the only remaining English-speaking state in the EU, Ireland aims to see through the implementation of the proposed EU AMLD 5 directives by including cryptocurrency service providers. The bill also follows the Travel rule, which targets the regulation of virtual asset service providers (VASPs) such as crypto wallets and exchange providers and custodians.

The report further states there will be an introduction of new government ‘designated bodies’ to keep in check money laundering and terrorist financing after the bill is signed into law.

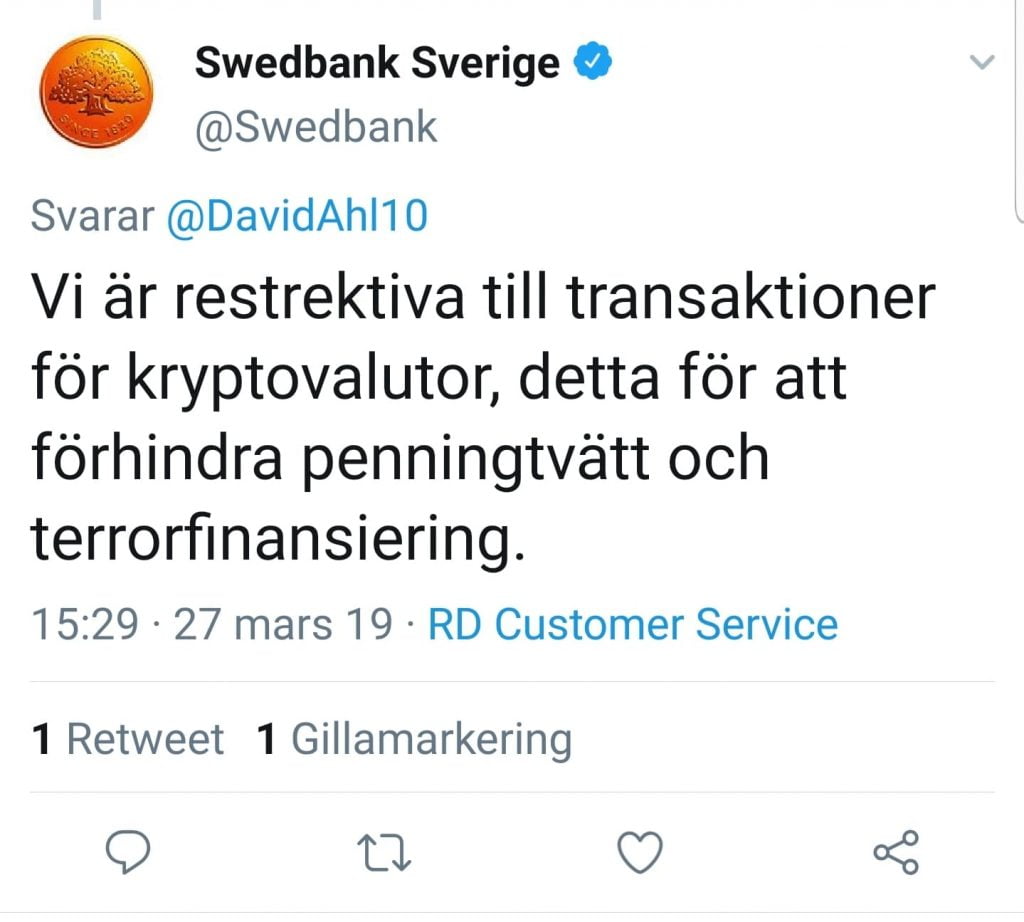

While the bill focuses on cryptocurrencies at length, traditional financial systems will also be under the spotlight, the Justice Minister said. Some provisions in the law state that traditional banking systems will also introduce tougher customer due diligence (CDD) processes to ensure the integrity of the financial transactions.

Moreover, the law prevents banks and financial institutions from creating anonymous safe deposit boxes for their customers in a bid to increase transparency. Corporate entities registered in the country will also be forced to disclose their ownership and funding fully.

The Irish authorities started clamping down on VASPs earlier in the year as these crypto services were denied any services by the banking institutions, slowing down trading processes. Most of the banks blamed the slow process of implementing the EU AMLD5 directive and lack of a clear path to regulate crypto in the country.

Expressing his frustrations at the time, CEO of Irish crypto exchange, Boinnex, Bryan Tierney said,

“Entering into a formal relationship with entities carrying out this type of business activity is outside of our risk appetite at this time.”

origin »Bitcoin price in Telegram @btc_price_every_hour

Money ($$$) íà Currencies.ru

|

|