2024-7-9 03:30 |

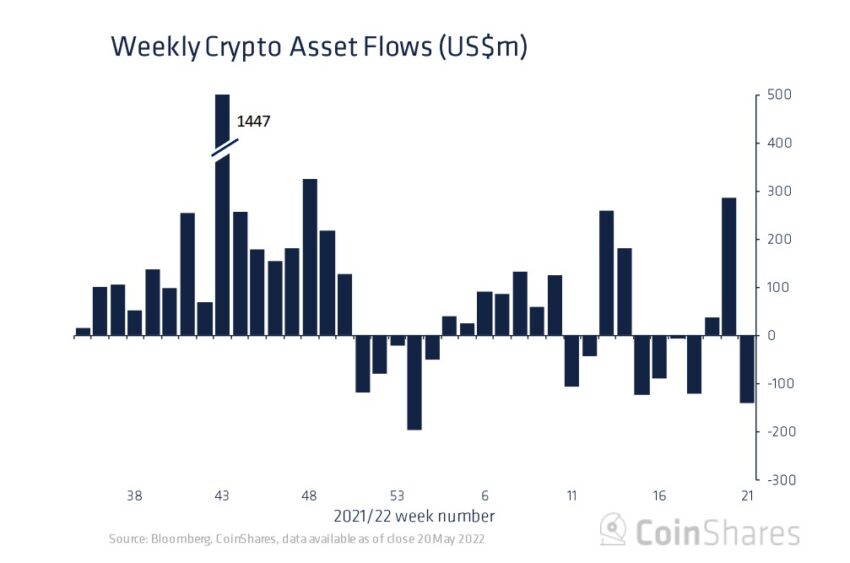

While the crypto investment sector has experienced significant outflows in recent weeks, the reverse has now been the case, with combined inflows reaching $441 million in the past week alone. This follows three consecutive weeks of net outflows ramping up concerns over investor confidence.

As reported by CoinShares head of research James Butterfill, the inflow recorded in the past week, despite the recent market conditions, suggests that many have likely considered the recent declines to be a “buying opportunity” for investment rather than a signal to retreat.

Details of The Crypto-Fund FlowsBitcoin purchases saw inflows from a wide range this week, with Ethereum and other altcoins, such as Solana, seeing significant interest. Bitcoin is still heading the pack with $384 million; however, this represents a move away from its customary near-total dominance.

The report from CoinShares shows that Solana especially did well, drawing $16 million in inflows, “bringing year-to-date (YTD) inflows to US$57m, making it the best-performing altcoin from a flows perspective,” according to James Butterfill.

Ethereum also witnessed a favorable adjustment with $10 million coming in, albeit the only main crypto asset still seeing a year-to-date net outflow.

Meanwhile, huge investment firms like Ark Invest, Fidelity, and BlackRock have all noted similar trends in inflows. In the US, Bitcoin garnered $384 million from local funds, marking a particularly strong market.

However, not every region mirrored this optimism; German-based funds experienced $23 million in net outflows, likely influenced by recent asset sales by the German government, according to Butterfill.

Market Performance: BTC, ETH, and SOL Show Signs of StabilizationHowever, the broader market has still been relatively bearish, with several major cryptocurrency assets falling sharply last week. Bitcoin fell to a low of $53k on Friday for the first time since February. Nonetheless, over the last 24 hours Bitcoin, Ethereum, and Solana have recovered modestly.

Bitcoin has seen a slight increase of 0.5%, reclaiming the $57k threshold, while Ethereum gained 2.2%, also returning to the crucial $3k mark. Similarly, Solana followed these major crypto assets closely, seeing a 2.4% increase to trade for $140.86 at the time of writing.

The $16 million investment in Solana-based products also comes at a time when VanEck, one of the world’s largest asset managers and Bitcoin exchange-traded funds (ETF) issuers, is planning the launch of a Solana-based ETF.

VanEck has recently filed with the US Securities and Exchange Commission (SEC) for the first-ever Spot Solana ETF, marking a pivotal moment for the cryptocurrency.

Featured image created with DALL-E, Chart from TradingView

origin »Bitcoin price in Telegram @btc_price_every_hour

Emerald Crypto (EMD) на Currencies.ru

|

|