2023-5-24 17:58 |

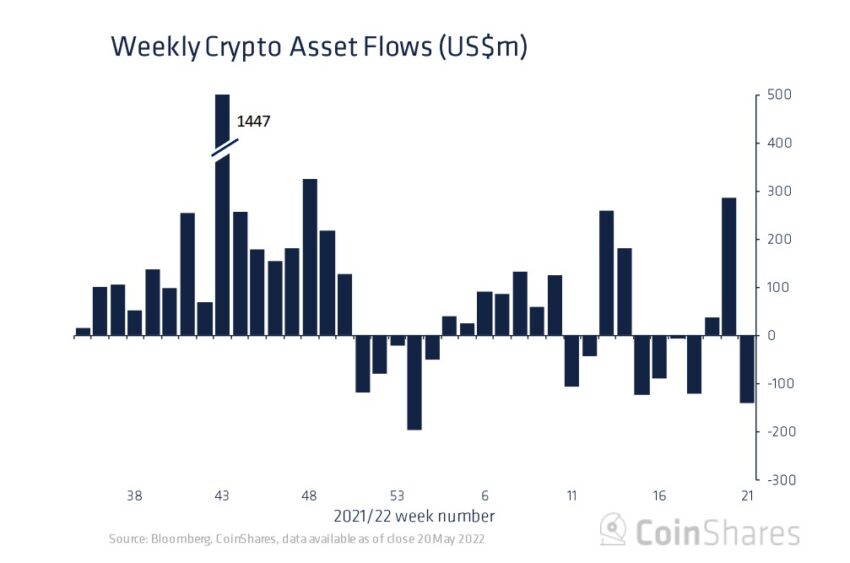

Digital asset funds have registered the 5th successive week of outflows. Meanwhile, the space lost another $32 million within the last seven days. The leading crypto, Bitcoin (BTC), dominated with outflows of $33 million.

According to CoinShares data, $32 million out of crypto funds took place last week. The focus of fund outflows was Bitcoin. Thus, at the end of the 5th week, the output amount reached 232 million dollars.#Bitcoin2023 #BTC #Crypto #CryptoNews #cryptomarket #BTCUSDT #NEWS pic.twitter.com/lfvHA9d9Mj

— Hedef Capital (@HedefCapital) May 22, 2023 Bitcoin funds saw $33m outflows over last weekIt was yet another week of withdrawals in digital asset funds. That comes as the industry experiences increased regulatory pressure. Digital asset investment funds recorded outflows of $32 million within the previous week, completing the fifth consecutive week of pessimistic sentiment. That’s according to the latest CoinShares digital asset funds report.

The report highlighted that $232 million, accounting for 0.7% of the overall AUM (asset under management), left the market from mid-April. Meanwhile, the bellwether crypto dominated the outflows, with $33M withdrawn from BTC funds within the past week.

Germany recorded the most outflows, representing 73% (or $24M) of the overall figure. The U.S. and Switzerland followed with $5M and $3.3 million, respectively. Minor figures emerged from Brazil and Canada, at $1.3 million and $2.2 million, respectively.

Short-BTC products also saw outflowsSimilarly, short-bitcoin products witnessed slight outflows of $1.3 million. CoinShares stated that these investment products have outflows totaling $235 million within the past five weeks. It added that it remains unclear why both long and short products retain coordinated negative sentiment.

While Ethereum products also recorded outflows of $1 million, other altcoins, including Litecoin and Avalanche, had inflows of $0.3 million and $0.7 million, respectively. Remember, digital asset funds witnessed 6-month high inflows in January’s final week – $117M. That came as the cryptocurrency market soared early in 2023.

Bitcoin poised for a bearish waveDigital asset funds flow measures cash movement into & out of investments. Meanwhile, they can be an impressive indicator of how institutional players move their money. Inflows show optimism among investors, whereas outflows indicate investor fear of upcoming market trends.

In that context, the $232 million outflows over the last five weeks indicate wariness among institutional investors. Bitcoin’s sentiment will likely suffer in the upcoming sessions, translating to bearish waves. Invezz.com shows Bitcoin lost 0.42% over the past day to trade at $26,782.56.

The post CoinShares: Bitcoin, Ethereum experienced outflows while Avalance and Litecoin benefit appeared first on Invezz.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|