2024-11-1 16:30 |

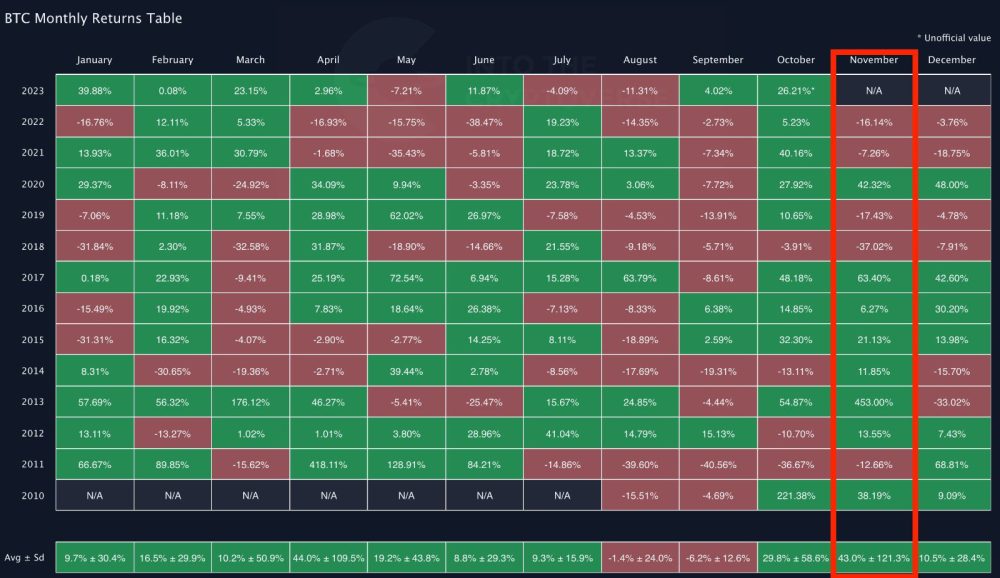

Institutional traders are betting that Bitcoin will surge to $79,300 by the end of November. This bullish sentiment is evident in recent trading activities on the Chicago Mercantile Exchange (CME), where Bitcoin options have experienced some of their highest trading volumes ahead of the US presidential election.

Bitcoin To Rise Above $79,300?Joshua Lim, co-founder of Arbelos Markets—a trading firm providing liquidity across cryptocurrency derivatives markets—shared insights on X about these notable trades. “CME Bitcoin options just experienced some of its largest volume days ever, ahead of the US election,” Lim stated.

He highlighted two substantial transactions that occurred in the past week. On Friday the 25th, traders purchased 1,875 Bitcoin units of the 29-November $70,000 strike calls. In options trading, a call option gives the buyer the right, but not the obligation, to purchase an asset at a specified strike price before the option expires. In this case, the strike price is $70,000, meaning the buyers are betting that Bitcoin will exceed this price by the end of November. Lim detailed that at the time of the trade, “$8.3 million of premium was paid, $147,000 of vega, $65 million of delta.”

Then, on Tuesday the 29th, another significant trade occurred with the purchase of 3,050 Bitcoin units of the 29-November $85,000 strike calls, where the strike price is $85,000. Lim noted that “$4.6 million of premium was paid, $173,000 of vega, $42 million of delta” at the time of the trade.

The amounts of $8.3 million and $4.6 million indicate substantial investment, reflecting strong confidence in Bitcoin’s potential rise. The high vega suggests that the traders expect significant volatility, which could be massive around the US election. Delta represents how much the option’s price is expected to change with a $1 change in the price of the underlying asset. High delta values of $65 million and $42 million imply substantial exposure to Bitcoin’s price movements.

The total notional value of these positions—the total value of the underlying assets represented by the options—is approximately $350 million. Lim pointed out that this is “large even in the context of Deribit,” referring to the world’s largest crypto options exchange.

The breakeven point for these positions is just below $79,300. This means that for the traders to start making a profit, Bitcoin’s price needs to exceed this level by the option’s expiry date. This price represents about a 16% increase from Bitcoin’s price when these trades were executed.

“Very bullish positioning into the election, and great to see institutions sizing up like this on CME,” Lim commented. He added, “Perhaps a good sign that there is and will be growing liquidity in the crypto derivatives markets as the asset class matures.”

The timing of these trades is particularly noteworthy. With the US presidential election imminent, market volatility is expected to increase, potentially impacting the entire Bitcoin and crypto market. Overall, the majority of experts believe that a Trump victory is bullish for the BTC price.

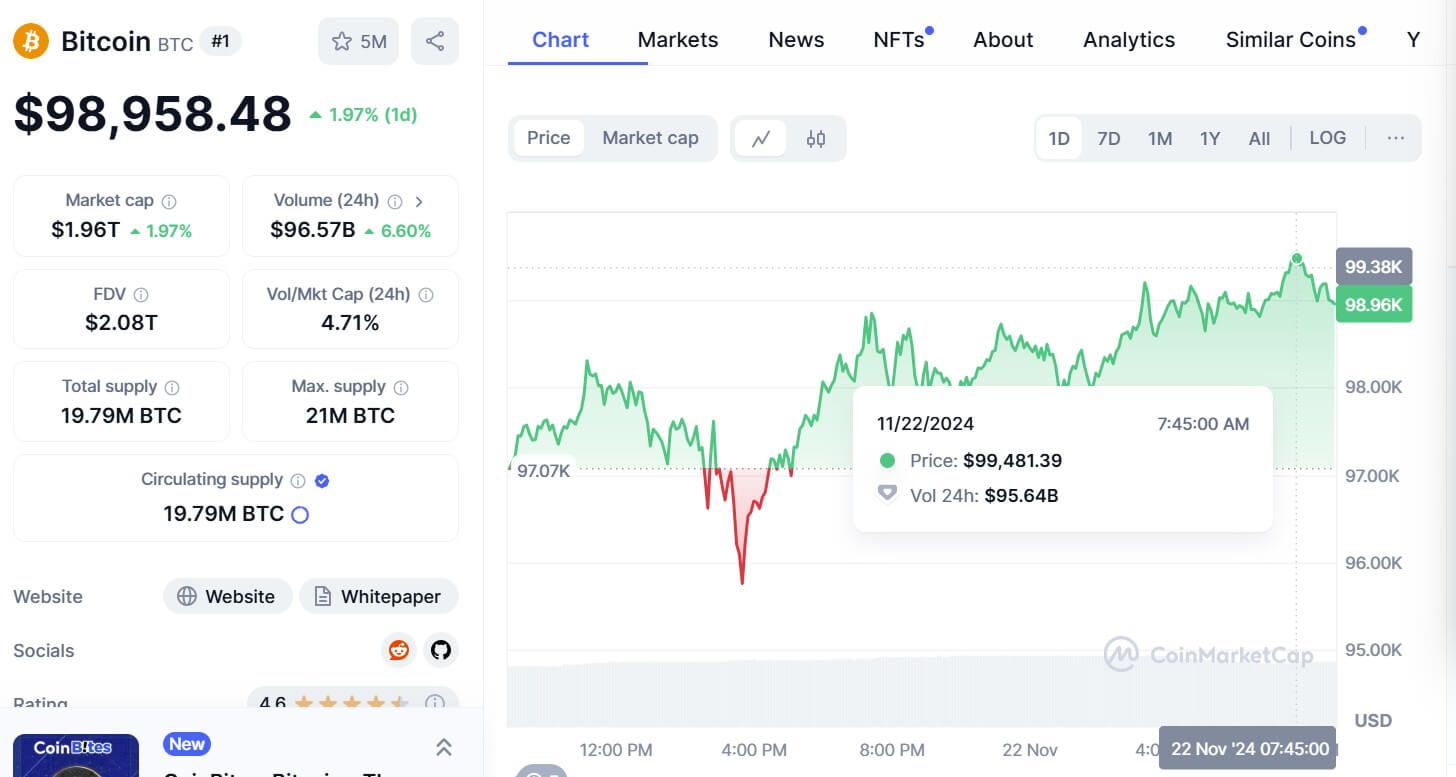

At press time, BTC traded at $72,382.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|