2024-12-4 18:30 |

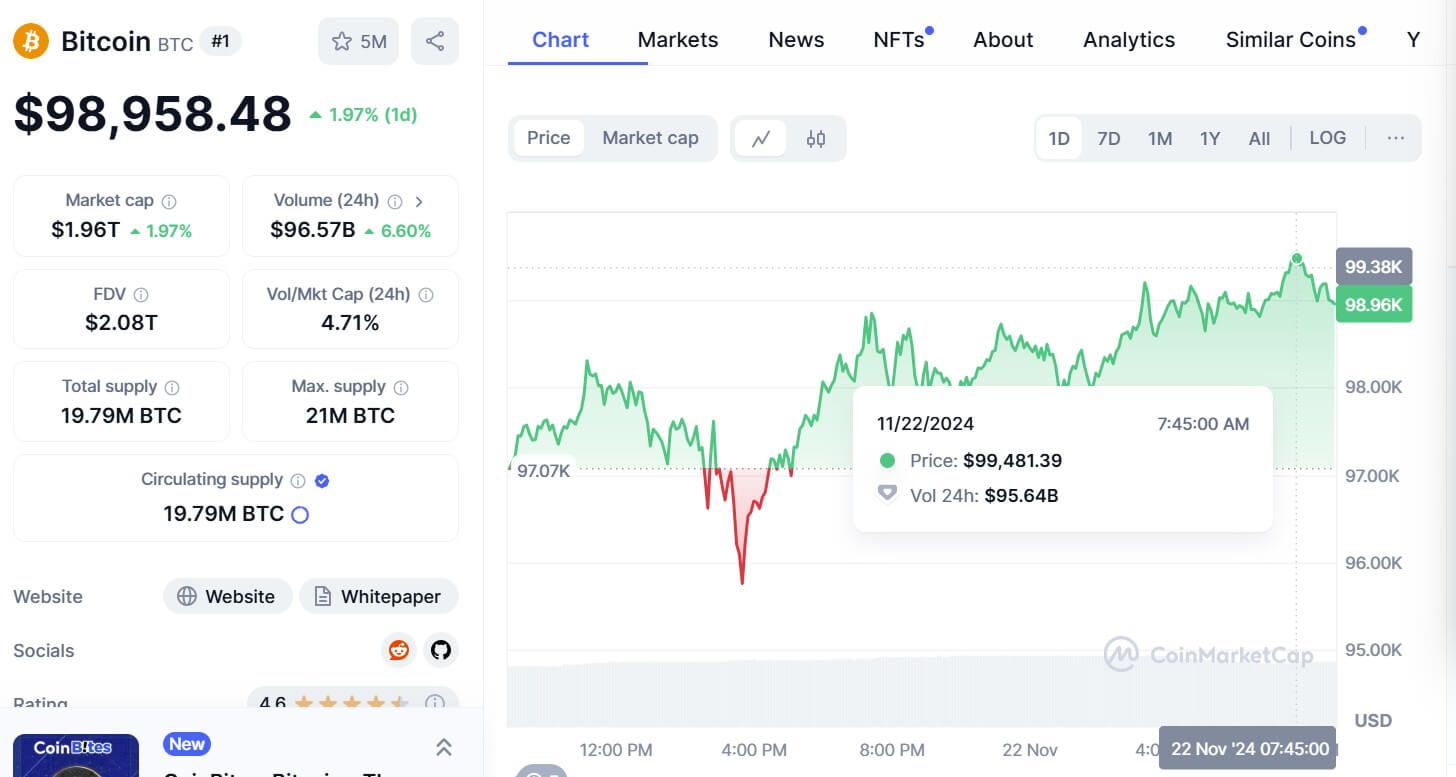

Bitcoin has been consolidating below the $100,000 level for twelve consecutive days, marking a pause in its recent historic rally. The aggressive surge since November 5 appears to be cooling off, with market attention gradually shifting toward altcoins. Despite the slowdown, Bitcoin remains a cornerstone of market strength, holding firmly above the critical $90,000 support level.

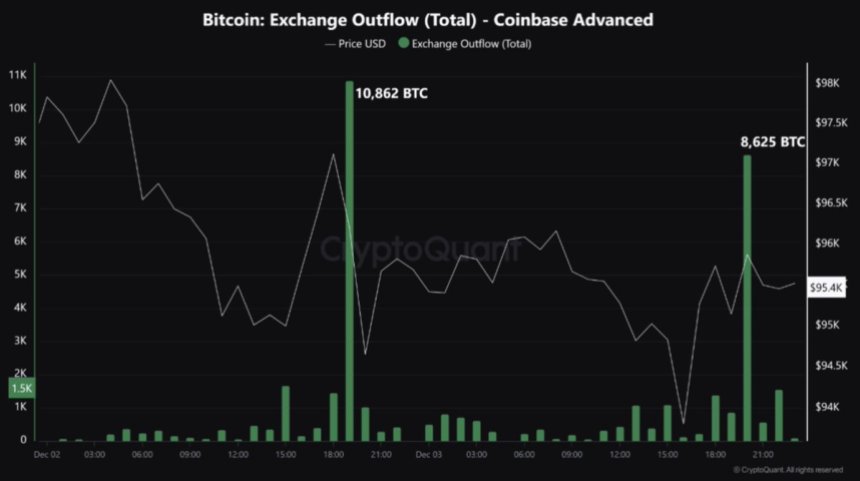

Key data from CryptoQuant highlights two significant outflows exceeding 8,000 BTC each from Coinbase in the past 24 hours, signaling sustained institutional interest and potential accumulation. These outflows suggest that major players remain optimistic about Bitcoin’s long-term trajectory, even as short-term price action steadies.

As Bitcoin maintains its consolidation phase, the broader crypto market is poised for dynamic changes. Analysts are closely watching whether this stabilization period will pave the way for BTC’s next leg upward or signal an opportunity for altcoins to take the spotlight. The next few days will be crucial in determining whether Bitcoin reclaims momentum or continues its current range-bound movement.

Bitcoin Leading A Heated MarketBitcoin continues to lead the crypto market with remarkable gains, even as it halts just below the highly anticipated $100,000 level. The current pause in its rally has triggered a liquidity shift, gradually pumping capital into the altcoin market. However, analysts and investors anticipate that Bitcoin may slow down in the short term after its aggressive recent surge, providing an opportunity for other cryptocurrencies to shine.

Metrics from CryptoQuant highlight notable activity on Coinbase, where two massive outflows, exceeding 8,000 BTC each, were recorded in the last 24 hours. A total of 19,487 BTC, valued at an average price of $96,043, was withdrawn in these transactions, amounting to approximately $1.87 billion. Such significant movements indicate the involvement of institutional players or whales who may be positioning themselves for Bitcoin’s next major move.

Historically, market dips have followed similar outflows, as large transactions often signal profit-taking or redistribution of holdings. However, these transactions could also suggest growing confidence among major investors in Bitcoin’s long-term potential.

If BTC maintains its position above $90,000 and demand continues to build, the market may see a renewed push toward six-figure territory in the weeks ahead.

Price Levels To WatchBitcoin is trading at $96,700, continuing a range-bound movement between $93,500 and $98,700 without establishing a clear direction. This consolidation follows a period of aggressive rallies, with BTC approaching but not yet surpassing its all-time high.

Market participants are closely watching the $90,000 mark, which has proven to be a critical level of support. Holding above this level has been essential in signaling market strength and sustaining bullish momentum.

If Bitcoin maintains its position above the $95,000 mark over the next few days, the likelihood of a breakout to new all-time highs becomes significantly stronger. A stable consolidation above this level would fuel buyers to push BTC past the psychological $100,000 barrier.

Conversely, losing the $95,000 support would raise concerns, potentially prompting a test of the $90,000 level again. Should this key level fail, Bitcoin could experience a deeper correction with lower support zones.

Bitcoin’s ability to remain above $95,000 will be crucial in determining its next move. Bulls are eyeing another upward push, while bears are looking for signs of exhaustion to capitalize on.

Featured image from Dall-E, chart from TradingView

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|