2020-8-13 19:46 |

Even since Bitcoin entered August, the price has taken to test the $12,000 level after successfully breaching the key levels, $10,000 and $10,500 last month.

But so far, the digital asset hasn’t been able to sustain above $12k despite breaking above it twice, resulting in a crash afterward. We are now back to trading around $11,500.

While the price has taken a breather here, people are not passing this opportunity to buy the dips.

In the past two weeks, Grayscale Investments added 14,422 BTC to its bitcoin product Grayscale Bitcoin Trust (GBTC). Although the real BTC purchased might not be this high given that these figures are based on the outstanding shares created by Grayscale’s institutional clients which involve “in-kind” purchases as well, there is some level of activity going on, for sure.

Interestingly, Grayscale Bitcoin Trust saw its value increasing by $1.6 billion in the first half of 2020. The number of BTC held in the GBTC fund grew from 261,192 to 386,723.

In total, Grayscale has $5.6 billion in assets under management.

The Big NamesBesides Grayscale, the first publicly listed billion-dollar company MicroStrategy dived in Bitcoin. As we reported, within a fortnight of announcing in its Q2 2020 earnings call, the company bought 21,454 BTC, to replace cash in its balance sheet as a reserve asset. Arcane Research noted,

“To put that into context: MicroStrategy just bought the next 23.8 days of new bitcoin supply.”

The company shared in its official announcement that they see bitcoin as digital gold and a superior asset class with the potential for incremental returns. The decision to invest in bitcoin was taken in the light of ongoing currency debasement because of the unprecedented money printing, quantitative easing, and the lack of yield.

Going with Bitcoin for treasury management purposes resulted in the company's market cap increasing by 11% “relative to the straight fiat cash exposure.”

Interestingly, the largest asset manager in the world, BlackRock, and largest mutual funds provider Vanguard together own 25% of MicroStrategy.

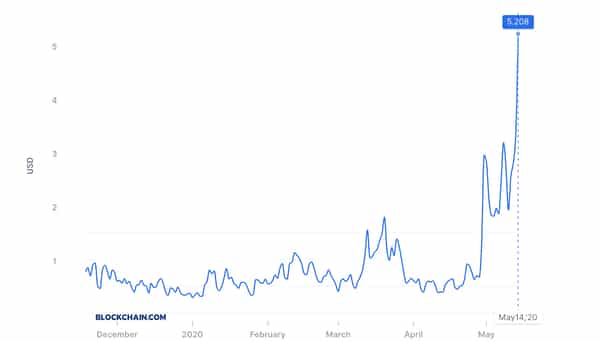

More Demand than SupplyThis demand actually outstrips the supply of Bitcoin which has been 900 BTC per day since the halving.

In these past two days, while Grayscale and MicroStrategy combined bought 35,876 BTC, only 12,594 BTC were mined during this period, showcasing the growing demand for this “alternative” class as an inflation hedge.

Institutional interest in Bitcoin is strong as we have been seeing throughout 2020. As of June, about 90% of North America’s cryptocurrency transfer volume came from professional-sized transfers, those above $10,000 worth of digital assets, as per Chainalysis. The report states,

“Over the last two years in North America, we’re seeing the impact of a growing class of institutional investors whose transfers account for the growing dominance of professionals in the North American market since December 2019.”

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|