2020-1-12 19:34 |

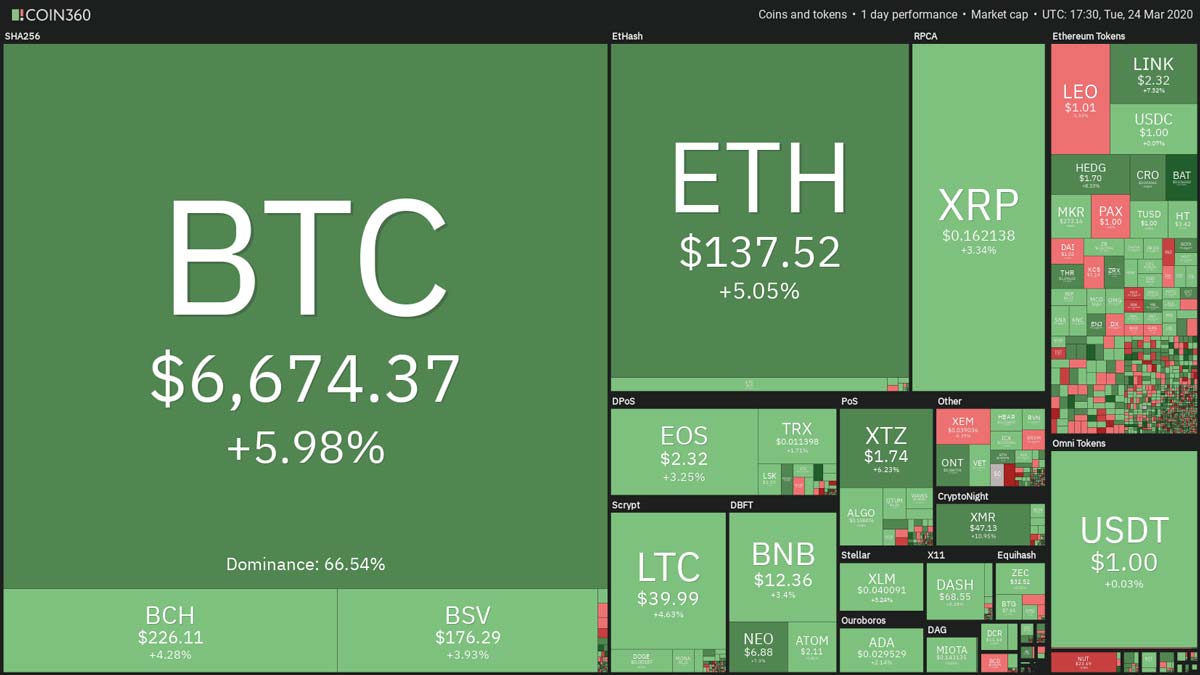

In 2019, the Bitcoin price surged about 90%, going from $3,750 to end the month at about $7,200.

What contributed to these gains in 2019 was the events in Q2 that took Bitcoin to its yearly high at $13,900, recording the gains of 160%.

According to Fundstrat Research, these were on the back of Facebook announcing its Libra plan in June and then US President Donald Trump, Federal Reserve Chairman Jerome Powell, and Treasury Secretary Steven Mnuchin publicly talking about Bitcoin and digital currencies.

“Bitcoin returned 92% in 2019, trouncing all other major assets classes, an impressive return given the significant policy and regulatory headwinds that emerged in 2019 — the Congressional blowback from Facebook's Libra and the correlated White House bashing of Bitcoin marked the highs for 2019.”

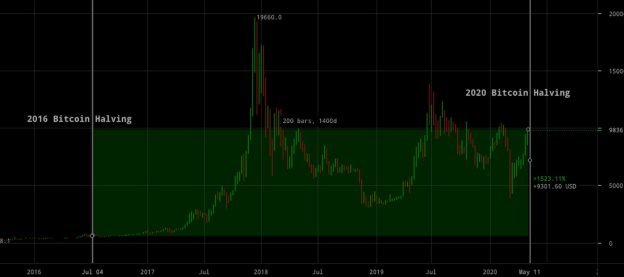

In 2020, Fundstrat says Bitcoin would be seeing yet another such bullish momentum that would push BTC prices up by 100%, meaning we would be climbing to a level that would be higher than that of 2019 and moving closer to its peak of nearly $20,000. The 2020 Crypto outlook” report to its clients:

“For 2020, we see several positive convergences that enhance the use case and also the economic model for crypto and Bitcoin — thus, we believe Bitcoin and crypto total return should exceed that of 2019. In other words, we see strong probability that Bitcoin gains >100% in 2020,” states the company in.“

What will bring over 100% of restaurants for bitcoin in 2020?But what would push BTC prices at above $14,000? According to Bitcoin bull, Tom Lee founded a research company that has three main drivers for this uptrend.

One of the drivers is the much-anticipated halving event scheduled to occur in May 2020. This event will decrease the coin reward from 12.5 BTC to 6.25 coins and cut down its inflation from 3.68% to 1.80%. This supply shock, while many commentators believe to be a non-event this time, Lee says,

“Bottom line: financial markets tend to discount 1-3 months, and maybe 6 months (max). So highest probability is halvening not priced in.”

The second driver is the 2020 United States presidential election to be held on Nov. 3. The race for the White House has already begun in earnest and the outcome of the election will not only have an impact on BTC but also around the world.

“We've never listed U.S. domestic politics as the top risk, mainly because U.S. institutions are among the world's strongest and most resilient,” write Ian Bremmer and Cliff Kupchan, president of Eurasia Group, a New York City headquartered political risk research and consulting firm.

“This year, those institutions will be tested in unprecedented ways.”

Apart from the 2020 elections, Fundstrat believes geopolitical risks will also contribute to BTC’s 100% bull run.

We already saw Bitcoin reacting to the US-China trade war and US-Iran’s crisis. This year, US-China tensions, U.S. policy toward Iran, Iraq, and Syria, discontent in Latin America over sluggish growth, corruption, and low-quality public services, are some of the top geopolitical risks for the world in 2020 that could play a role in driving BTC prices up.

Bitcoin (BTC) Live Price 1 BTC/USD =$8,204.3569 change ~ 0.30%Coin Market Cap

$148.96 Billion24 Hour Volume

$4.7 Billion24 Hour VWAP

$8.17 K24 Hour Change

$24.2403 var single_widget_subscription = single_widget_subscription || []; single_widget_subscription.push("5~CCCAGG~BTC~USD"); origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|