2018-12-24 01:35 |

Tether margin trading now available on Bitfinex

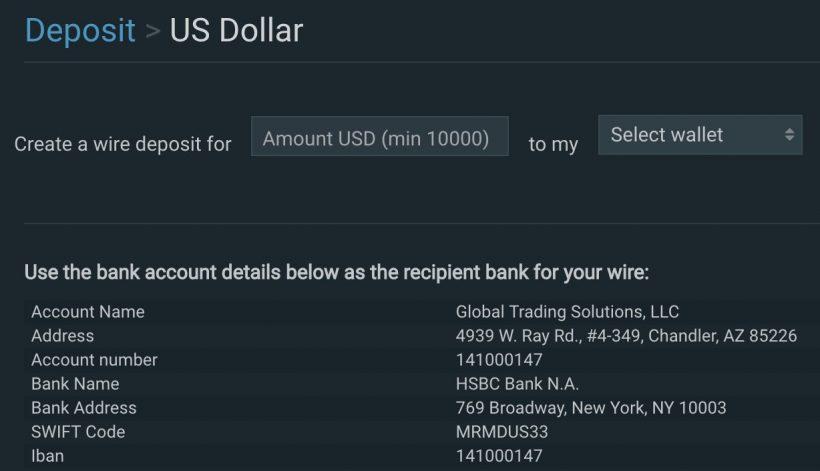

Cryptocurrency exchange Bitfinex introduced margin trading for the stablecoin Tether (USDT) on December 21st.

“At Bitfinex we work tirelessly to ensure our platform reflects the needs of professional traders, offering market differentiating order types for unique trading strategies. Today, adding margin trading on USDT/USD pair will not only allow for more efficient price discovery, but in an important move for risk management, unlock the ability to hedge the exposure taken on stablecoins. Along with a dedicated lending market, USDT will be available as collateral for margin positions,” they explain in a blog post published on their website.

Bitfinex and Tether have a lot of things in common, namely several mutual key executives and a history of propping up the price of Bitcoin throughout 2017. The margin trading feature for USDT will be initially limited to USDT/USD pairing. These news come at the same moment where Tether is being questioned regarding how much of its supply is actually backed by real USD deposits.

Huobi might delist 32 cryptocurrenciesRecently we’ve witnessed a wave of asset delistings by major cryptocurrency exchanges. Projects that were added under rather suspicious pretenses are being removed left and right as exchanges are “cleaning up their acts”. Huobi is the latest platform which decided to reconsider its trading portfolio.

Looking to “promote the healthy development of the blockchain industry and protect the legitimate rights and interests of investors”, the exchange decided to review its cryptocurrency assets in accordance with its Token Administration Regulations of Huobi. The review was concluded on December 20th and it revealed 32 cryptocurrencies that, among other things, suffer from insufficient volume.

The list of tokens is as follows:

APPC, BCV, BFT, DAT, DGD, EKO, ENG, EVX, GAS, IDT, IIC, LUN, MDS, MT, MTL, MTN, MTX, OST, PRO, QSP, QUN, RCN, RDN, RTE, SALT, STK, TNT, UTK, WPR, XMX, ZJLT and ZLA.

The tokens will be re-examined on December 26th when Huobi will look to see if the assets meet the terms of Article 16 Handling of “ST” in Chapter IV Handling of Violations of the Rules. If they are found in violation of mentioned rules, the tokens will be given an “ST” tag next to them, a tag that will inform investors of the potential risks that come with investing into said tokens. Check out the complete Token Administration Regulations of Huobi here.

Xtrabytes scam exposed onlineReddit user cameron0208 created a thread today explaining why Xtrabytes, a master node-based project utilizing a unique consensus mechanism called Proof of Signature, is in fact a scam. The project has recently come under some scrutiny from the community, as people started asking questions about the code and Xtrabytes higher-ups.

The post opens up by analyzing Borzalom, XBY’s cofounder and developer. Apparently Borzalom has a history with dead, scam projects, being an investor in a now-defunct projects like Identity and Bitmox. There is also an issue with Borzalom choosing to remain under a pseudonym and keeping the details of the code private, all while claiming to be “transparent” and “open”. The user even reveals that some data describes Borzalom as someone who is pretending to work from Hungary while actually being situated in Florida.

Considering his lack of transparency and an overall lack of proof that he has any real developer knowledge (his Bitmox mismanagement being the biggest smoking gun pointing to his lack of skills), there is an abundance of reasons to believe that the man behind the pseudonym might be up to no good. Additionally, the team suggests they are in fact working on the code and the technology, but are choosing to keep it hidden until they manage to patent its key parts. The “patent” talking point has been debunked by the community as just another delay tactic deployed by the team.

The community has called the project out multiple times for their lack of progress and overall vagueness of their updates. Looking at their most recent update, it is indeed full of buzzwords, empty promises and doesn’t really give any idea what to expect from the project and when. Some community members insinuated that this has been going on for over a year now and they have clearly had enough.

Xtrabytes has created a Reddit FAQ thread addressing most of the issues cited above, but most of their arguments are rather weak and don’t address anything concrete. At the moment, there’s a pretty intense discussion regarding this project happening here, so go and check that out for additional information.

Voyager trading platform offers a plethora of cryptocurrencies and some free BTC to lure you inBeta version of the Voyager trading application has been launched just a couple of days ago. Founded by Uber co-founder Oscar Salazar, as well as early Uber investor Philip Eytan, the company also has Stephen Ehrlich as its CEO, a man with previous online trading experience at the stock broker E-Trade.

The platform will operate as a place where individuals will be able to trade cryptocurrency assets across multiple exchanges. It will offer solutions for both the average and the institutional investor. Alongside that, they’ve secured a strategic partnership with Ethos wallet service provider to ensure safe custody of its customers’ funds.

Voyager will allow for simple, cheap trading of various cryptocurrencies, including:

Bitcoin (BTC)

Ethereum (ETH)

Ripple (XRP)

Bitcoin Cash (BCH)

Bitcoin Satoshi Vision (BSV)

EOS (EOS)

Stellar Lumens (XLM)

Litecoin (LTC)

Ethereum Classic (ETC)

Ontology (ONT)

Zcash (ZEC)

Tron (TRX)

Cardano (ADA)

Iota (IOT)

Neo (NEO)

VeChain (VET)

Qtum (QTUM)

ICON (ICX)

Anyone who signs up for the beta will be awarded with $25 worth of BTC in their wallet. Check out the full app here.

The post Huobi might delist 32 coins while new altcoin scam is exposed appeared first on CaptainAltcoin.

origin »Bitcoin price in Telegram @btc_price_every_hour

BitFinex Tokens (BFX) на Currencies.ru

|

|