2020-3-24 20:15 |

One of the largest digital currency exchanges, Bitfinex, has made on Tuesday the announcement that it’s going to deploy a proprietary surveillance tool that can combat all the abuse happening in the crypto trading market.

The tool is called Shimmer and will help Bitfinex both identify and investigate potential suspicious and manipulative practices, an activity that’s supposed to improve the market’s visibility and integrity, according to the exchange.

Bitfinex Decided to Develop Its Own Surveillance SystemBitfinex’s CTO, Paolo Ardoino, said about the new tool that:

“Comprehensive market and trade surveillance capabilities are integral to operating a leading cryptocurrency exchange. To meet the complex needs of an evolving digital asset class and to protect our sophisticated participants, Bitfinex has chosen to develop its own state-of-the-art surveillance system. This will help to assure that potentially manipulative practices are rooted out and suspicious behaviour detected.”

In case Shimmer finds anything unusual, it immediately sends the details of the potential manipulation to the exchange’s surveillance team. The information arrives in the form of emails and includes summaries of the suspicious trading patterns on the exchange’s pairs.

What Measures Will be Taken to Stop Manipulation?One of Shimmer’s ways to block manipulative tactics is wash trading. Wash trading can take place when users buy and sell assets to mislead the market, or are trying layering, the situation of buy orders being used to confuse what’s being circulated about the demand and supply of a specific token.

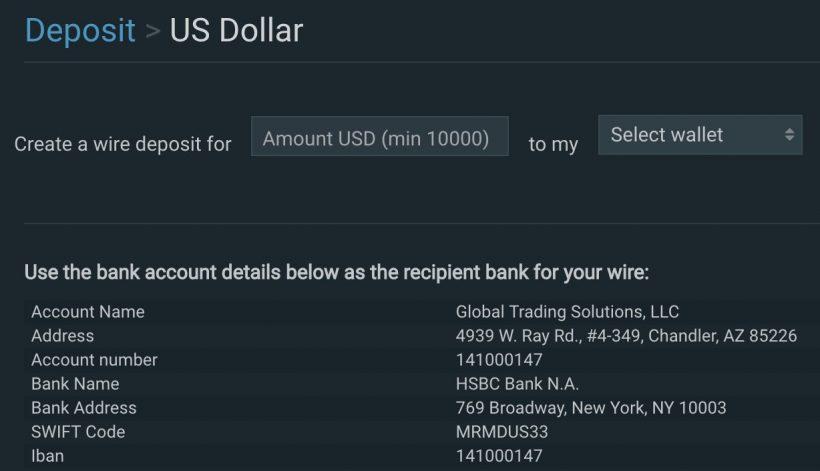

Bitfinex Suspected of Market ManipulationSome voices are saying Shimmer is only a mirage, as Bitfinex has ties with Crypto Capital, the controversial payment processing company. It seems the exchange lost funds worth about $1 billion more than a year ago, and the money were in Crypto Capital’s holding. Crypto Capital claims Portuguese, American and Polish officials have seized those funds.

In other words, Bitfinex faces charges of manipulation the market itself, seeing it lost so much through Crypto Capital. More than this, iFinex, which is the company owning Bitfinex and Tether, has a lawsuit going on. This lawsuit was filed by the New York Attorney General’s office and charges the iFinex with using Tether reserves illegally to replace about $850 million of Bitfinex users’ funds.

origin »Bitcoin price in Telegram @btc_price_every_hour

Open Trading Network (OTN) на Currencies.ru

|

|