2026-2-10 12:00 |

Markets have modernized in almost every way—except one. Trading infrastructure has gone digital, execution is instantaneous, and information moves globally in real time. Yet most traditional markets still shut down on nights, weekends, and holidays.

This is where TradFi intersects with crypto-native infrastructure. Platforms like Phemex are narrowing that gap by listing TradFi futures—price-tracking contracts tied to assets such as gold and silver—on infrastructure built for continuous markets.

Spot trading vs futures contractsSpot and futures markets work differently, and that difference explains why TradFi futures matter. Put simply, spot trading means you buy the asset itself at the current price, whereas a futures contract tracks price under contract terms rather than giving direct ownership.

In traditional spot trading, buying a share or commodity involves a complex chain of custody, legal ownership transfer, and T+2 settlement cycles. This infrastructure requires banks and clearinghouses to be open, which is why trading halts on weekends and holidays.

A futures contract is a derivative, an agreement based on the price of an asset, not the exchange of the asset itself. Because of this, there is no physical action or need for a transfer in the event of a closed exchange market.

When the market closes, only the conventional infrastructure ceases to function; assets retain their worth. Phemex fills this gap by delivering a marketplace where price discovery and risk management continue uninterrupted.

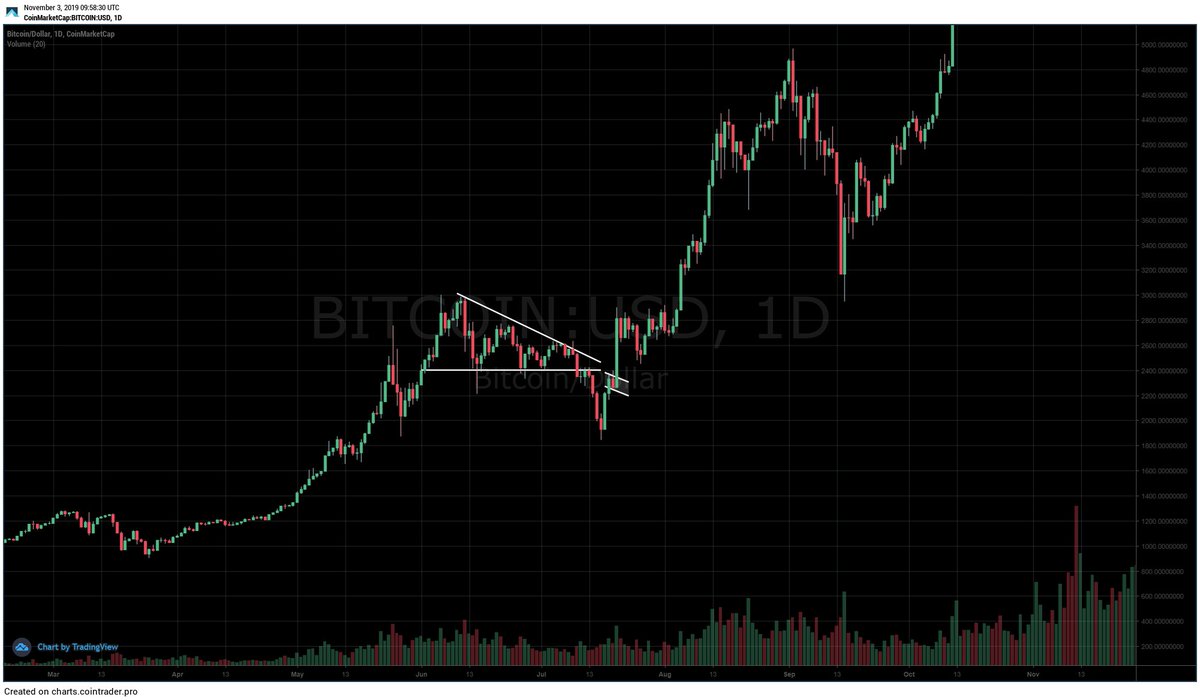

Macro News Don’t Wait for MondayTraditional finance (TradFi) and cryptocurrency markets are increasingly moving in the same direction. As crypto trading has matured, digital asset prices have become more closely linked to macroeconomic indicators that have long driven equities and commodities.

Interest rate decisions by the U.S. Federal Reserve, inflation data, labor market reports, and geopolitical developments now influence both stock indices and major cryptocurrencies. This growing correlation has reshaped how traders think about risk, timing, and market access across asset classes.

The introduction of TradFi futures on crypto-native trading platforms allows traders to respond to macroeconomic developments in real time. Instead of waiting for traditional market hours, traders can hedge positions or manage volatility as events unfold—an approach that is increasingly central to modern risk management.

Whether it is hedging a position or capitalizing on volatility, the ability to execute trades based on real-time macro news is no longer a luxury,; it is a necessity for modern risk management.

Why TradFi Futures Matter for 24/7 Market AccessThe 24/7 openness of markets, remaining functional even during holidays and non-working days, is not merely a new generation innovation; it represents the natural evolutionary progression of trading. In the traditional financial world, when the market is closed, uncertainty and suspense tend to take hold.

If a major event occurs over the weekend, traditional investors face significant gap risk, where the price jumps or drops substantially between Friday’s close and Monday’s open.

Through TradFi futures trading found on Phemex, traders can manage their positions at any time, day or night. This eliminates the waiting game that often leaves investors vulnerable to global news cycles that do not stop for bank holidays.

Unified Trading Across Crypto and TradFi Futures on a Single PlatformPhemex focuses on reducing the liquidity and access friction typical of traditional markets.

The platform offers USDT-settled derivatives linked to traditional assets such as gold, silver, and selected stocks, alongside crypto derivatives. This structure allows traders to access multiple asset classes from a single account, without opening separate brokerage relationships or navigating lengthy funding and settlement processes.

(USDT-settled derivatives mean that profits and losses are settled in USDT rather than through delivery of the underlying asset.)

Phemex operates a unified margin system, enabling the same USDT balance to be used across gold, silver, and crypto futures. Because these contracts track price rather than involve physical settlement, custody and operational complexity are reduced.

As with cryptocurrency perpetual contracts, TradFi futures can be traded with leverage, allowing traders to increase exposure and improve capital efficiency without committing the full notional amount typically required by traditional brokers. Historically, access to equities or commodities—whether via direct ownership, ETFs, or futures—often required substantial upfront capital and fragmented infrastructure.

As demand grows for continuous market access and more flexible risk management, crypto-native platforms are increasingly addressing these structural limitations. Phemex positions itself within this shift by offering infrastructure designed for continuous, multi-asset trading.

The Modern Market Is Open 24/7Market evolution is no longer a question of if, but how. As crypto and traditional assets increasingly respond to the same macro forces, their separation at the infrastructure level has started to break down.

The objective isn’t to replicate stock exchanges on crypto platforms. It’s to build faster, more flexible systems that allow traders to access traditional asset exposure with the efficiency they expect from modern markets.

Phemex is approaching this by replacing ownership friction with futures-based access. By using price-tracking contracts rather than physical settlement, traditional assets can be traded alongside crypto within a unified, USDT-settled environment.

Moving into the second quarter of 2026, trading across asset classes from a single margin currency is no longer a differentiator; it’s becoming the baseline for how modern markets operate.

As part of the launch of its TradFi futures offering, Phemex has introduced a limited-time campaign aimed at familiarizing traders with the new product. The campaign includes a temporary zero-fee trading period, loss-protection incentives for first trades, trading leaderboards, and task-based rewards. The initiative is designed to support early adoption and allow traders to explore TradFi futures within a controlled, risk-aware framework.

The post How TradFi and Crypto Are Converging — And What It Means for Traders appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

REAL (REAL) на Currencies.ru

|

|