2022-7-7 20:57 |

Per a report from Sedaily, the trading arm of Korean startup Uprise has lost of all its clients’ funds. The platform was used by wealthy individuals and institutions to trade crypto futures contracts via an artificial intelligence (AI) tool.

Related Reading | Altcoins Take The Lead As Bitcoin Struggles To Hold Above $20,000

According to the report, Uprise advertised its AI trading tool as high operational stability and a high-risk management alternative. In addition to losing its clients’ funds, the company was reported to record a loss of around $30 million from its own capital.

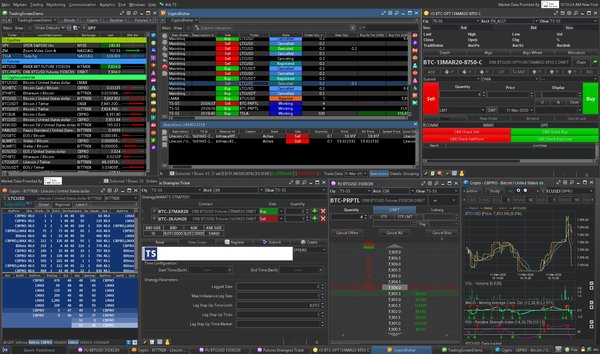

Uprise operates an AI trading platform and a crypto exchange platform. Users are encouraged to deposit cryptocurrency to trade with Uprise’s tool or to earn an annual percentage rate (APR) by holdings the assets on the exchange.

The local news media claims the platform is yet to inform its clients about the alleged massive loss. The report claims the trading AI placed several short positions on the failed cryptocurrency LUNA and was negatively impacted by the market volatility.

LUNA was Terra’s former native token which operated with a burning/issuance mechanism linked to the failed algorithmic stablecoin UST. Via the Anchor Protocol, Terra users were able to receive a 20% APR on their UST deposits.

Both UST and LUNA collapsed losing over 99% of their value in less than two weeks. Uprise is not the only firm negatively impacted by the collapse of the Terra ecosystem.

The fallout forced crypto hedge fund manager Three Arrows Capital (3AC), crypto lending company Celsius, BlockFi, and others to liquidate their LUNA positions recording millions of dollars in losses. As a consequence, the crypto market has experienced a steeper downside.

The report adds that Uprise “explained” and “informed” their users “in advance” about the high-risk nature of their product and about the “high possibility of a loss of principal” capital. However, South Korean regulators and law enforcement agencies could increase their scrutiny of the digital asset class.

Crypto Markets Still Recovers From LUNA CollapseThe South Korean startup apparently failed to register as a Virtual Asset Service Provider (VASP). Thus, it might have incurred an illegal action.

At the time of writing, there are no official statements from South Korean authorities. Uprise did confirm Sedaily’s report. A spokesperson for the platform said:

It is true that damage to customer assets has occurred due to unexpected great volatility in the market. We plan to finalize the report on virtual asset business soon,

The report claims the company might need to compensate its customers due to their losses. South Korean authorities have been investigating the events that led to the LUNA collapse. Thus, why the startup could take some heat if it is unable to make its clients whole.

Related Reading | Bitcoin Approaches 2018 Like Drawdown, Why $20,000 Is A Crucial Level

At the time of writing, BTC’s and larger cryptocurrencies are still trying to reclaim higher levels. The Terra fiasco might put more pressure on digital assets as other companies like Uprise come to light.

Crypto total market cap trends to the downside amid LUNA’s collapse. Source: LUNAUSDT Tradingview origin »Bitcoin price in Telegram @btc_price_every_hour

World Trade Funds (XWT) на Currencies.ru

|

|