2018-7-24 13:00 |

Millionaire investors in China are still utilizing significant cryptocurrencies like bitcoin and ether to purchase properties overseas, despite the crackdown on digital asset trading by the Chinese authorities.

Bitcoin as a Preferred Method of Payment

Chinese investors have reportedly injected hundreds of millions of dollars in the real estate industry of Hong Kong, to avoid the government’s scheduled investigation into foreign financial accounts operated by Chinese residents and citizens.

In June 2018, South China Morning Post reported that local financial authorities have started to require investors to disclose their holdings in properties and business assets established outside of China and vowed to strictly follow its Common Reporting Standards (CFS) as well as the Foreign Account Tax Compliance Act (FATCA), to eliminate the platform most local investors rely on to evade taxes and scrutiny from the Chinese tax agency.

Consequently, the real estate industry of Hong Kong, which excludes Chinese investors from tax investigations, has seen an exponential increase in demand and value, due to the influx of millionaire Chinese investors entering its market to purchase residential properties valued at several million dollars.

“Home prices have picked up very fast in Hong Kong in recent months, and worries on the introduction of CRS was one of the drivers,” said Jennifer Wong, an advisor at the Association of Hong Kong Accountants.

Most recently, Yao Xiaoguang, the vice president of Tencent, one of the largest internet conglomerates in the global market, purchased a $12.57 million penthouse in Hong Kong.

However, the issue in dealing with the real estate market of Hong Kong for local investors is the involvement of banks and regulated financial institutions that are required to forfeit the financial information of their clients upon the demand of the Chinese government.

The transfer of large amounts of Chinese yuan through regulated financial institutions could lead investors to face strict capital controls imposed by the Chinese government, which limit the outflow of the Chinese yuan to prevent the devaluation of the national currency.

Throughout July 2018, the Chinese yuan has depreciated against the US dollar and other reserve currencies, continuing to demonstrate volatility and instability.

The rapidly declining value of the Chinese yuan has pressured the Chinese government to tighten its capital controls and limit the amount of yuan that leaves the country on a regular basis to leading economies like the US and Japan.

To circumvent the strict monitoring of outgoing transactions by banks and local financial authorities, Chinese investors have started to use bitcoin to transfer money out of the country, by purchasing the cryptocurrency in over-the-counter (OTC) and peer-to-peer (P2P) markets.

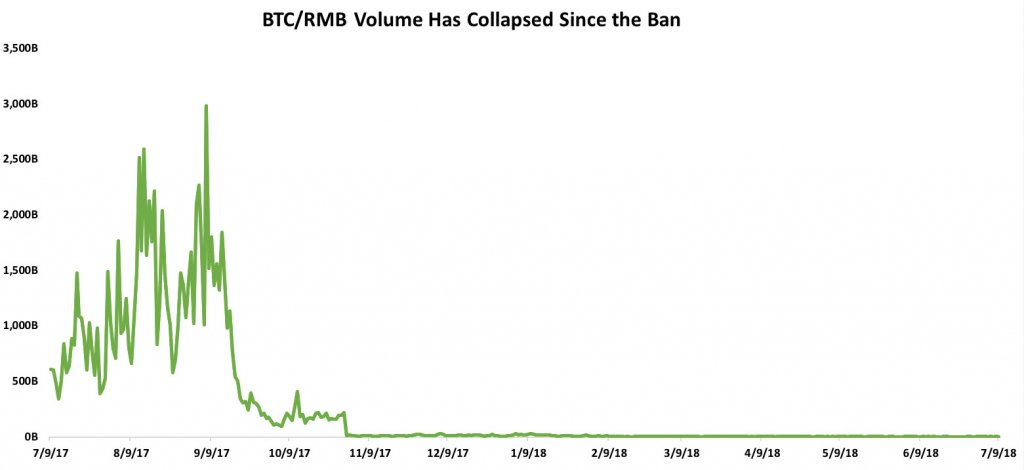

Chinese Investors are Still Trading CryptocurrenciesAt the Blockchain Open Forum held in Seoul, South Korea, crypto exchange BTCC’s CEO Bobby Lee said that despite the ban imposed by the Chinese government, local investors have continued to drive high volumes.

Lee added:

“Cryptocurrency trading is better than most believed to be in China. The government banned crypto trading but volume is gradually increasing and people are still trading cryptocurrencies.”

Continuous efforts of the Chinese authorities to tighten capital controls and limit the outflow of the Chinese yuan will inevitably lead investors to search for alternative ways to bring money outside of China.

If the local cryptocurrency exchange market operated by OTC and P2P trading platform providers consistently demonstrate strong volumes from local investors, it is possible that bitcoin evolves into a significant alternative to the Chinese yuan in the short-term.

The post How Chinese Millionaires Are Still Using Bitcoin to Buy Properties Overseas appeared first on BTCMANAGER.

origin »Bitcoin (BTC) íà Currencies.ru

|

|