2019-10-22 21:49 |

Economic uncertainty in the world’s second-largest economy may explain a sudden surge in the amount of Bitcoin (BTC) purchased with Chinese Yuan (CNY) as local traders place value into something believed to be uncorrelated to the world economy, and therefore potentially recession-proof.

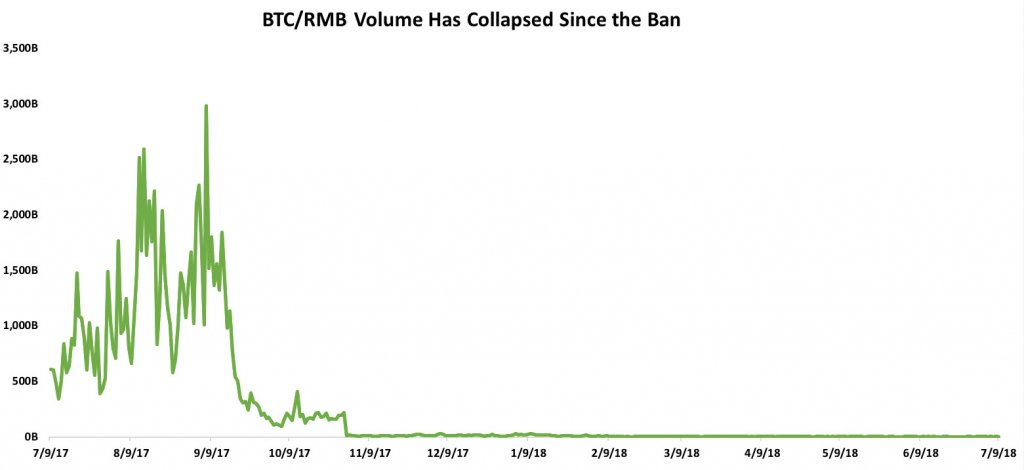

Data collected by cryptocurrency investment firm ID Theory found that CNY volumes on peer-to-peer trading site LocalBitcoins are outstripping those of other fiat currencies in the Asia region.

More than $2.9M worth of CNY was exchanged for BTC last week; more than $100,000 more than was traded the week before. Just over $1M worth of Indian Rupees were exchanged into Bitcoin, with $500,000 worth of Hong Kong Dollars moving into the digital asset.

The Thai Baht experienced the largest overall growth in volumes, moving from approximately $400,000 to roughly $600,000. But in comparison, that was still just 20% of the CNY volumes during the same timeframe.

The bar below is the week prior. Source: ID Theory

Relative to the size of other countries listed in the Asia region, it’s no surprise that CNY is the largest. Still, the increase in volumes has coincided with a substantial $28bn injection of CNY by the People’s Bank of China (PBOC) to provide additional liquidity into the economy as it faces external pressures caused from slowing domestic output and the trade war with the US.

China Slowdown, Bitcoin UptakeFigures released on Friday found that the country’s GDP grew at 6% in Q3, below many analysts’ predictions and placing it at the lowest growth level since the 1980s. Despite the country’s National Bureau of Statistics emphasizing strong growth in the next quarter, the figures show that the days of double-digit growth are drawing to an end, at the same time as a recession looms ever larger over the global economy.

Germany’s central bank issued a warning today that its export-driven economy – the largest in the Eurozone – may have entered a recession, citing the US-China trade war and Brexit as contributing factors. The IMF said last week that very high levels of corporate debt, especially in China and the US, could become unsustainable in the event of a global economic downturn.

Bitcoin has oft-been likened, rightly or wrongly, to the digital equivalent of gold. Although there is still no definitive evidence to suggest how exactly BTC and other cryptocurrencies will behave in a recession, analysts, fund managers and even billionaires have argued that the asset remains uncorrelated to the global economy.

Gloomy data coming from China, and returning concerns about a global recession, might have sparked a sudden increase in the CNY volumes. Over the past two weeks, Asia-Pacific (with the exception of India) has been the only region to have experienced growth.

Latin America, often the main focal point for crypto volumes, actually declined by approximately 5% over that same timeframe. Globally, LocalBitcoins activity has declined considerably since the end of September, following the implementation of new KYC/AML requirements.

Accounts that had not completed the verification process were unable to trade from the beginning of October. Volumes have dropped considerably from $61M just before the new rules came into force, to $37M at the end of last week.

Source: ID Theory

As the world braces itself for a recession, hedging strategies that include stockpiling BTC are beginning to become clearer – particularly if citizens are once again asked to bail out the banks.

The post Chinese And Thai Traders Stockpile Bitcoin As Asian Fears Of Recession Grow appeared first on Crypto Briefing.

origin »Bitcoin price in Telegram @btc_price_every_hour

Chinese Yuan (CNY) на Currencies.ru

|

|