Новости о Year Cme [ Фото новости ] [ Свежие новости ] | |

CME BTC futures premiums could indicate institutions are bullish on Bitcoin

If Bitcoin price movements in 2019 were compiled into a mystery novel, it would have the most twisted, unpredictable story ever written by mankind. Last year, the community sang choruses about how “The post CME BTC futures premiums could indicate institutions are bullish on Bitcoin appeared first on AMBCrypto. дальше »

2020-1-31 17:00 | |

|

|

CME Bitcoin Futures remain more bullish than other derivatives platforms

The new year has brought in increased demand for Bitcoin Futures, with the Chicago Mercantile Exchange [CME] reflecting increasing open interest. According to a recent report by Arcane, CME continued The post CME Bitcoin Futures remain more bullish than other derivatives platforms appeared first on AMBCrypto. дальше »

2020-1-25 12:00 | |

|

|

Bitcoin Options on CME report 610 BTC trading in one day

Bitcoin's journey this new year has left everyone on the edge of their seats. The coin has jumped by almost 17% but was noting an impending correction, at press time. Despite the crests and troughs inThe post Bitcoin Options on CME report 610 BTC trading in one day appeared first on AMBCrypto. дальше »

2020-1-21 11:00 | |

|

|

Open Interest on CME Bitcoin Futures Outgrowing BTC Price

Up over 21% in 2020 to date, Bitcoin is off to a great start of a new year. The leading cryptocurrency is currently trading at $$8,883 as per Coincodex, after hitting $9,000 level yesterday after two months. дальше »

2020-1-18 18:24 | |

|

|

JPMorgan Report Shows Bitcoin Institutional Demand is Rising, And It’s Crucial

According to JPMorgan managing director Nikolaos Panigirtzoglou, the activity of the CME bitcoin futures contract has increased in the past year. It indicates that the demand for BTC and new options contract for the dominant cryptocurrency is high. дальше »

2020-1-12 19:59 | |

|

|

BTC Futures' high premium rates on CME highlights bullish sentiment

If the idiom 'off to a fresh start' needed an example, Bitcoin will be an ideal candidate at the moment. After starting the year at a price under $6900 on 2nd January, the largest digital asset seeThe post BTC Futures' high premium rates on CME highlights bullish sentiment appeared first on AMBCrypto. дальше »

2020-1-11 16:00 | |

|

|

Why JP Morgan Sees CME Bitcoin Options as ‘Highly Anticipated’

US banking giant JP Morgan believes bitcoin traders are anxiously waiting for Monday’s CME BTC options debut. Highly Anticipated Bitcoin Options When Bakkt announced its bitcoin futures contracts last year they were widely seen as highly anticipated in the build-up to launch day in September. дальше »

2020-1-11 11:01 | |

|

|

CME Bitcoin Options Could Launch as Early as Next Week

The Chicago Mercantile Exchange (CME) Group announced last September that it would be launching options on its Bitcoin futures contracts in Q1 of this year. Bitcoin options on CME are set to launch on Jan 13, just five days away, pending regulatory approval. дальше »

2020-1-11 02:15 | |

|

|

Bitcoin Options trading may see CME getting top spot in 2020

2020 has been looked upon as a year that will contribute to many significant price movements in the dormant crypto-market, especially in light of the fact that the Bitcoin halving is just over four moThe post Bitcoin Options trading may see CME getting top spot in 2020 appeared first on AMBCrypto. дальше »

2020-1-8 01:30 | |

|

|

OKEx’s Andy Cheung: Bitcoin Derivatives, Self-Regulation, and Emerging Markets

In an exclusive interview, OKEx’s Andy Cheung talks derivatives, self-regulation, and emerging markets. Looking back, 2019 seems to have been a watershed year for cryptocurrency exchanges. The explosion of the crypto derivatives market has put many of the bigger exchanges into a position of competing with regulated institutional offerings, such as Bakkt and CME. дальше »

2019-12-11 07:00 | |

|

|

CME unveils launch date for options on Bitcoin Futures products

2019 has been a good year for the flow of institutional interest in Bitcoin Futures products, with a significant rise in curiosity around BTC derivatives and BTC Futures. In the same spirit, the ChicaThe post CME unveils launch date for options on Bitcoin Futures products appeared first on AMBCrypto. дальше »

2019-11-13 09:47 | |

|

|

Bitcoin turns bullish 20 days into CME Futures' expiry; Average return of 11% witnessed

Bitcoin's mania caused a major influx of retail, especially toward the end of the 2017 bull run. 2017 was a significant year for Bitcoin considering the development and launch of Bitcoin Futures. дальше »

2019-11-11 18:00 | |

|

|

Binance Futures Volume Exceeds Spot Volume While OKEx Leads the Futures Race

Bitcoin futures were first introduced in 2017, at the peak of the bull run by the CME Group and Cboe. After this launch, BTC price lost 84 percent of its value in 2018. Since then, however, while Cboe delisted Bitcoin futures, in March this year, many new entrants have heated the competition. Intercontinental Exchange’s Bakkt […] дальше »

2019-10-11 17:32 | |

|

|

Bitcoin, Gold Dips as Investors Appraise Trade War Escalation

Bitcoin prices edged lower on Monday, pressured by a current correction momentum that saw the cryptocurrency plunging by more than 40 percent since June this year. The BTC/USD instrument was trading at $7,863. дальше »

2019-9-30 16:00 | |

|

|

CME Group is introducing Bitcoin options contracts in 2020

The Chicago Mercantile Exchange Group announced that it will launch Bitcoin options contracts early next year to complement its Bitcoin futures. CME Bitcoin trading instruments CME Group’s Bitcoin futures contracts have been a success. дальше »

2019-9-20 19:15 | |

|

|

Chicago Mercantile Exchange (CME) Planning to Launch Bitcoin Options Trading

Coinspeaker Chicago Mercantile Exchange (CME) Planning to Launch Bitcoin Options TradingAfter a massive demand for its Bitcoin Futures Contract this year, the CME Group is planning to introduce Bitcoin options contracts as per the internal source. дальше »

2019-9-5 15:52 | |

|

|

Bitcoin Futures Become More Popular Among Institutional Investors as CME Numbers Rise

The trading of Bitcoin futures has surged over this year as the leading cryptocurrency found its way back to the heights associated with it. Cryptocurrency trading has become more popular, and more investors are beginning to consider the asset class for the portfolios. дальше »

2019-8-31 18:35 | |

|

|

CME Bitcoin futures volume up 130% YTD indicating institutional attention

The Chicago Mercantile Exchange’s Bitcoin futures are setting new trading volume records. Averaging 7,237 contracts per day, the growth represents a 132 percent increase from the same period last year—clearly indicating growing institutional attention for BTC. дальше »

2019-8-31 02:05 | |

|

|

CME Traded 2 Million Bitcoin Futures Contracts Since Launch

The Chicago Mercantile Exchange Group claims it has hosted trading of over 2 million bitcoin futures contracts with $70 billion worth of volume since inception. The derivatives marketplace said in a tweet Wednesday that it traded over 2 million contracts – which equals more than 10 million bitcoins – from December 2017 until July 21. дальше »

2019-7-25 20:12 | |

|

|

CME Bitcoin Futures Broke $10,000 Due To A Large Interest From Crypto Investors

Bitcoin Futures Reach $10,000 As the crypto spot market continues to grow, Bitcoin futures reached a new record high this year after being traded around $10,050. This is the first time that Bitcoin futures reach this price level since March 2018. дальше »

2019-6-22 00:40 | |

|

|

Bitcoin Price Targets $10,000 and Beyond, Thanks to Weak Dollar Sentiment

By CCN Markets: Price of Bitcoin established another year-to-date high on Friday, touching levels not seen in over a year. Earlier during the Asian session, the bitcoin-to-dollar exchange rate flew past the $9,800 level for the first time since May 6, 2018. дальше »

2019-6-21 15:30 | |

|

|

Bitcoin Futures Record Volume Reflects ‘Incremental’ Institutional Demand

Record Bitcoin futures volume in May is leading mainstream media to determine that Bitcoin is becoming a mature financial asset class. CME’s Half-Billion Dollar Bitcoin Market As Blockchain investor Oliver Isaacs noted June 13, CME Group’s Bitcoin futures set new records for both volume and open interest last month. дальше »

2019-6-13 13:00 | |

|

|

The Impact Of Mining All 21 Million Bitcoins, Scheduled To End Around Year 2040

The Impact Of Mining All The Bitcoins CME CEO Ted Duffy reported to Business Insider a few months ago on his view that Bitcoin’s finite supply poses a problem for regulators. “The governments can’t run unless they can run on a deficit. дальше »

2019-6-4 22:22 | |

|

|

CME Bitcoin Futures Could Have Their Best Month Since They Were Created Despite CBOE Exiting

Bitcoin futures could have their best month in May this year. This is according to CNBC Futures Now that said on Twitter that Bitcoin futures will be registering their best month since they were created in 2017. дальше »

2019-5-25 18:26 | |

|

|

Report: E-Trade is Finalizing its Crypto Trading Platform

New York-based online brokerage firm E-Trade Financial Corp. has plans to launch trading services for digital assets, Bloomberg reports. Bitcoin and ether will be the first assets to be supported by E-Trade’s crypto trading service, but the firm has plans to list other assets in the future. дальше »

2019-4-30 16:57 | |

|

|

Adamant Capital: BTC Price Bottom Is Likely In, Accumulation Phase Has Begun

Bitcoin fund Adamant Capital is convinced that the bottom of the bear market is in, and true to its name, the firm has laid out an unwavering case for this position with some persuasive hard data and fundamental analysis. дальше »

2019-4-20 22:59 | |

|

|

Bitcoin’s Catalyst for Next Bull Run: Institutional Interest Gaining Speed, Hitting New Highs

The surge of 2017 in Bitcoin prices saw the first major step from institutions when CME and Cboe launched Bitcoin futures. Throughout 2018 despite being a bear market we saw numerous developments in the form of Bakkt and Fidelity announcing their plans to enter the space among other projects undergoing the process. The year 2019 […] дальше »

2019-4-13 17:50 | |

|

|

Cboe Will Not Relist Bitcoin Futures Contracts for March

The Chicago Board Options Exchange (Cboe) announced that it will not list upcoming Cboe Bitcoin (“XBT”) futures contracts for trading in March 2019. The Cboe Futures Exchange said that the company is “assessing its approach with respect to how it plans to continue to offer digital asset derivatives for trading,” stating that it has no intention to list additional contracts for trading relating to the cryptocurrency. дальше »

2019-3-16 01:00 | |

|

|

CBOE To Put Bitcoin Futures On The Backburner, Could That Help BTC?

Just 15 months ago, history was made when the Chicago Board Options Exchange (CBOE) and CME, two of the world’s largest derivatives markets unveiled futures contracts for Bitcoin (BTC), then the hottest asset on Earth. дальше »

2019-3-15 09:27 | |

|

|

CME’s Duffy: Crypto Needs to Brown-Nose Governments to Succeed

Over the past year, crypto has struggled from a price standpoint. Thus, many investors that are looking to “HODL” have sought the light at the end of the tunnel that is institutional participation. дальше »

2019-2-17 00:00 | |

|

|

Объем торгов биткоин-фьючерсами на CME и Cboe снизился до значений декабря 2017 года

Исследователи TradeBlock пришли к выводу, что интерес инвесторов к биткоин-фьючерсам на американских биржах CME и Cboe постепенно затухает. We published a new report analyzing #bitcoin futures trading activity vs bitcoin spot trading activity over the past year: https://t. дальше »

2019-2-9 17:45 | |

|

|

Bitcoin 2019 Calendar: Here’s the Most Important Dates for Crypto Institutionalization This Year

More than a year passed since Bitcoin reached $20,000 and analysts were predicting an extended bull market for 2018. At that time, Bitcoin (BTC) experienced a bull run due to the launching of Bitcoin futures contracts by the Chicago Board Options Exchange (CBOE) and the Chicago Mercantile Exchange (CME). Nevertheless, the market was too euphoric, […] дальше »

2019-1-3 21:04 | |

|

|

BTC and Other Cryptos in the Red as CME Bitcoin Futures Expire Today, December 28th

On Christmas Eve this year, Bitcoin (BTC) surprised many as its value rose by $280 in a few hours from around $3,990 to $4,271. Many crypto enthusiasts were quick to label the rise in value as a Crypto Santa Clause Rally. дальше »

2018-12-28 12:37 | |

|

|

How Have Bitcoin Futures Performed One Year On?

This time last year, the market was abuzz with excitement as CBOE’s XBT futures contracts and CME Group’s bitcoin derivatives products launched for the first time. There is no doubt that BTC futures trading has given some legitimacy to the asset class. дальше »

2018-12-22 06:55 | |

|

|

How Bitcoin Futures Products Affected Cryptocurrency Markets in 2018

It has been a year since the start of Cboe’s XBT futures contracts and CME Group’s bitcoin derivatives products launched last December. With super bearish prices these past few months, a lot has changed since the cryptocurrency economy touched all-time highs on spot markets. дальше »

2018-12-12 01:55 | |

|

|

Federal Reserve Says 2018 Bear Market Was Caused By CME’s Bitcoin Futures Offering

While many people had glossed over this little-known statement released by the Federal Reserve earlier this year (in May), but according to the letter, the government body blamed the launch of Bitcoin futures markets on the Chicago Mercantile Exchange (CME) for adversely affecting the overall value of Bitcoin (as well as many other alt-assets available […] дальше »

2018-12-2 03:57 | |

|

|

NASDAQ Reportedly Looking Into Bitcoin Futures Despite Bear Market

An unconfirmed report released today, November 27, 2018, claims that NASDAQ has plans to launch bitcoin-based futures contracts, and that these plans are continuing to go forward despite the recent crypto crash. дальше »

2018-11-28 20:45 | |

|

|

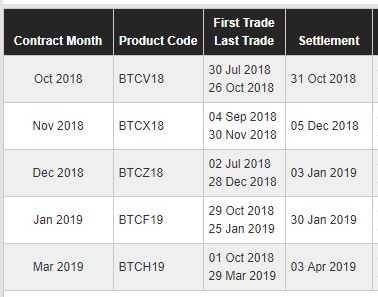

Quarterly Bitcoin (BTC) Futures Contracts by the CME Group Expire Today, October 26th

October 26th might be one of the most significant dates in the crypto calendars this year due to an event might catalyze a trend reversal in the crypto markets. The crypto markets have been on a free fall since February when news of banning crypto trading in China and South Korea hit the crypto-verse. дальше »

2018-10-26 15:37 | |

|

|

Bakkt’s Futures Platform Slated to Begin Trading in December

Almost a year to the day after the CBOE and CME launched their own bitcoin futures products, the Intercontinental Exchange’s Bakkt platform is heralding the launch of its own futures on December 12, though the platform is still pending approval from the Commodity Futures Trade Commission. дальше »

2018-10-23 01:16 | |

|

|

CME Report: Bitcoin Futures Trading Has Surged By 41 Percent in Three Months

The Chicago Mercantile Exchange, also known as the CME Group, has said in a tweet on October 17, 2018, that bitcoin futures trading on its platform is up by a whopping 41 percent in Q3 of this year as compared to the poor performances of the cryptocurrency futures trading product in previous quarters. дальше »

2018-10-18 17:00 | |

|

|