2021-4-13 20:43 |

The DeFi industry offering an alternative to traditional financial services is evolving at a rapid pace. There are few platforms that are using the latest advances in the blockchain space to create DeFi solutions that could not only outperform their peers but also capable of adapting to new developments in the blockchain technology itself.

Holdefi is one such open-source, non-custodial decentralized lending platform that offers an attractive passive income stream to investors while enabling the masses to borrow at attractive interest rates. Like its counterparts, Holdefi allows users to instantly secure credit against crypto collateral. The platform does not require the borrowers to provide their KYC or prove their creditworthiness before borrowing. All they have to do is to deposit their crypto assets as collateral to secure a loan in any of the supported cryptocurrencies including stablecoins like USDC, DAI, USDT and BUSD. Users can deposit collateral in one or more types of crypto assets. Similarly, they can borrow different cryptocurrencies using single collateral as long as the value meets the platform requirements.

Attractive Interest Rates and Better ROIHoldefi uses a mechanism that calculates interest rates for borrowing based on the market and competitive conditions. By doing so, it will balance the demand and liquidity to provide an attractive interest rate to borrowers. Meanwhile, lenders providing liquidity to the supply pool will receive a portion of the interest payments in proportion to the invested amount.

Lenders on Holdefi will get a bigger share of interest payouts in comparison to those on other DeFi platforms as borrowers do not receive any reward or interest on their collateral deposits. So, the lenders end up receiving a proportional share from the overall interest received by the platform from its borrowers.

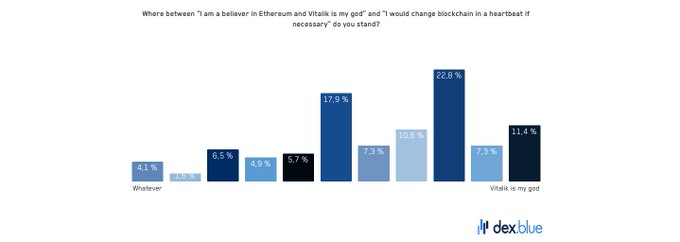

What Makes Holdefi Stand Apart from the Rest?Holdefi is an advanced DeFi solution based on the Ethereum protocol. Powered by a native ERC20 standard HLD token, the project is designed to work flawlessly on Ethereum’s existing PoW protocol while being future-ready to operate on ETH’s upcoming PoS upgrade.

The platform witnesses significant upgrades that impart certain qualities of CeFi platforms without affecting decentralization. One such sought-after feature of CeFi is the availability of collateral insurance. While such an option is not available with other DeFi projects, Holdefi solves the issue by separating the collateral deposits from borrowers and liquidity provided by investors into different pools. That way, the collateral won’t be utilized, and borrowers can withdraw it at any time, thus eliminating the need for insurance.

The separation of liquidity and collateral pool will also have a positive effect on Holdefi when ETH 2.0 is implemented as it will speed up the process while keeping transaction costs at a minimum.

Using HLDHLD is a native ERC20 utility token of the Holdefi ecosystem. Apart from being a mode of value exchange within the ecosystem, it also acts as a governance token imparting voting rights to tokenholders. It can also be used for liquidity mining, staking, and revenue sharing between the participants.

The project has set the maximum supply cap for HLD at 100 million of which 13 million was offered to investors through private and public sales. Recently, Holdefi successfully concluded its private and public sale.

The public sale, a 2-day event starting March 31 was completely sold out within hours of launch. Meanwhile, those who didn’t participate in the token sale can purchase HLD on Uniswap and PancakeSwap

Buy HLD and HODL?Holdefi is one of the few platforms that has made significant improvements to DeFi lending. It offers a lot of flexibility to users while maintaining strong security features. The future-proof design of Holdefi ecosystem is an added advantage that will make it popular with the crypto community.

While there is no definitive forecast on whether HLD will be an asset due to the volatile nature of crypto markets, Holdefi is an innovative project that is playing a major role in shaping DeFi platforms of the future.

Learn more about Holdefi at – https://holdefi.com/

origin »

Bitcoin price in Telegram @btc_price_every_hour

Defi (DEFI) на Currencies.ru

|

|