2020-10-2 05:00 |

The crypto industry was shocked to hear that the U.S. Commodities and Futures Commission (CFTC) formally charged the three co-founders of BitMEX today. This sent shockwaves throughout the entire market, while also particularly impacting the tokens within the DeFi sector.

Many smaller tokens saw massive 10%+ drops on the news, which came about as investors fled beta assets in search of greater stability.

Bitcoin itself saw a strong selloff, with the crypto’s price plunging from daily highs of $10,900 to lows of $10,400.

In the time since, its price has stabilized above these lows, and is even showing some signs of strength as it pushes higher.

Despite today’s selloff potentially just being a knee-jerk reaction to the news, it could have further implications for the market down the line.

One analyst is also noting that narratives regarding this being bullish for DeFi are bogus, and that it could indicate that regulators will eventually pursue those who are helping to drive forwards decentralized products and platforms.

BitMEX Owners Charged by the CFTC for Violating Regulatory LawsThe three co-founders of BitMEX are all facing charges related to the operation of BitMEX, which – despite not servicing US-based customers – has not put in place effective mechanisms to stop traders located within the country’s jurisdiction from utilizing their services.

The regulatory body also accuses the founders for violating the Bank Services Act, as well as conspiring to violate it.

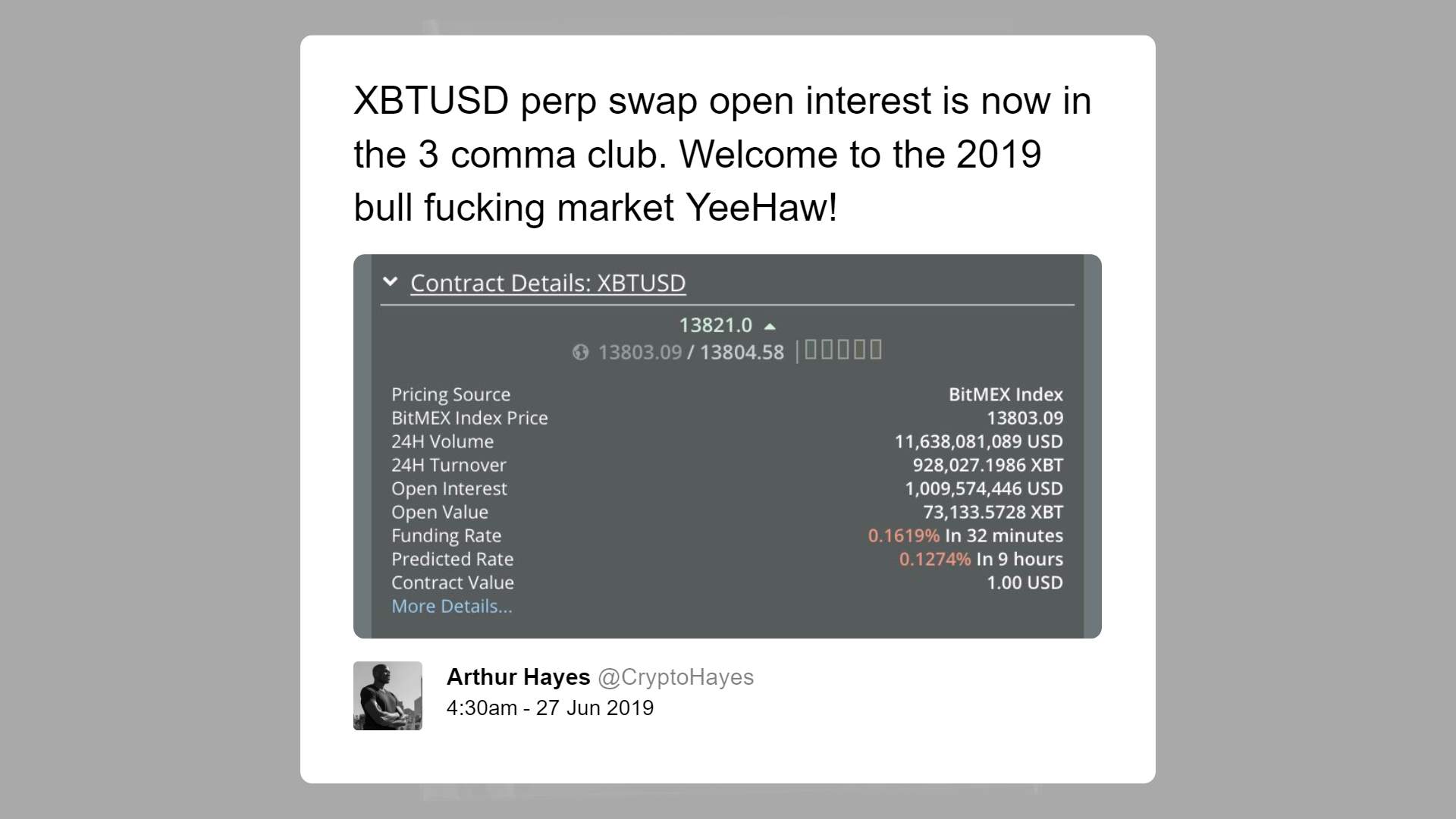

This resulted in one of the co-founders being arrested this morning at his Massachusetts home, while the platform’s CEO Arthur Hayes and the other co-founder still remain abroad.

Here’s Why the BitMEX News Isn’t Bullish for DeFiDespite the DeFi sector being hit particularly hard by today’s selloff, some analysts have speculated that the government going after centralized exchanges could perpetuate the shift towards decentralization.

One crypto-focused economist explained in a tweet, however, that this BitMEX news is not bullish for DeFi, and could continue hampering its growth in the near-term.

“Bitmex news not bullish DeFi. Reasons: #1 DeFi has the highest beta => flight to safety. #2 Allegations are criminal. They are going after managers individually. What if they can go after smart contract creators / promoters? Some [will] be thinking this regardless of if true/false.”

He further went on to explain that he doesn’t believe that news relating to this incident matters to the market beyond the initial selloff.

He points to the platform’s declining dominance over the margin trading market as a primary reason why it may not have too far reaching of an impact on Bitcoin’s price going forward.

Featured image from Unsplash. Pricing data from TradingView. origin »Bitcoin price in Telegram @btc_price_every_hour

Defi (DEFI) на Currencies.ru

|

|