2020-8-18 15:00 |

Chainlink has been one of the best performing cryptocurrencies of recent memory. The asset is up approximately 75% in the past month, outperforming Bitcoin by many percentage points. The asset found a high last week at $20; it has since failed to surmount that level. While LINK remains at relatively high prices at $19, analysts think a reversal is coming. There are technical and on-chain signs to suggest so. What may also suppress Chainlink is Bitcoin undergoing volatility, which will remove capital inflows from the altcoin market. Chainlink May Be Preparing to Reverse Lower

There are signs that LINK wants to reverse lower after the show-stopping rally seen over the past month, which has brought the asset to $20. The asset at $20 trades at an all-time high, far above where it was just months ago.

According to a Telegram channel tracking signals formed by the Tom Demark Sequential, Chainlink is printing a reversal signal on a weekly timeframe.

The channel in question shared the chart below on Monday morning; it shows that LINK has formed a “sell S-13” candle on its weekly chart against BTC. This should precede a reversal to the downside.

The Tom Demark Sequential is a time-based indicator that forms “9” and “13” candles when an asset is poised to reverse or experience an inflection point in its trend.

Chart of LINK's price action against the dollar over the past few months from a Telegram channel tracking the Tom Demark Sequenital indicator. Chart from TradingView.comAs an important aside, Tom Demark Sequential “9” candles were also registered on LINK’s daily chart against the dollar. The same signal also formed against Bitcoin, further adding pressure to the leading cryptocurrency.

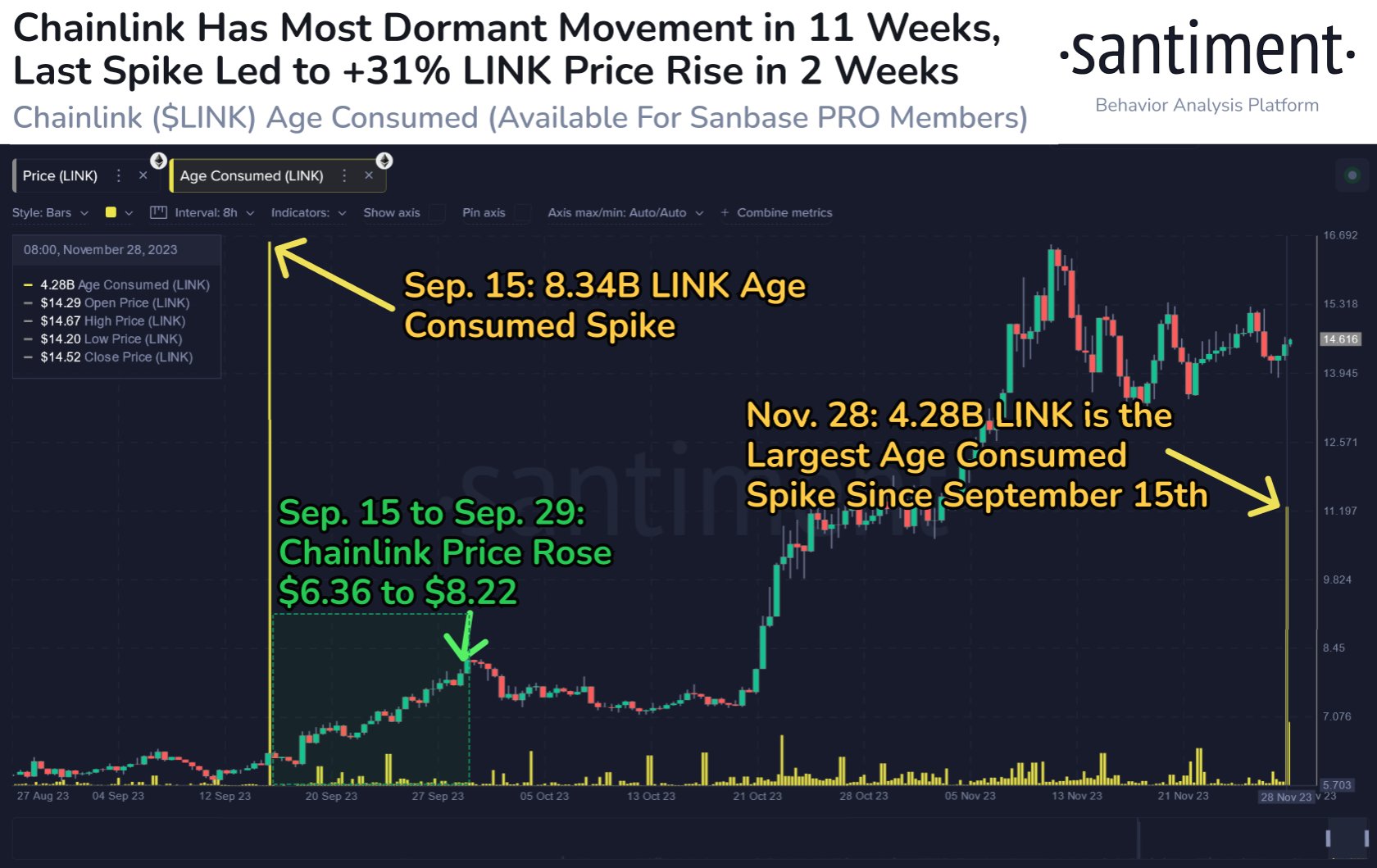

This isn’t the only signal suggest Chainlink will retrace. As reported by Bitcoinist previously, blockchain data firm Santiment found that there has been a spike of LINK deposits into exchanges. This suggests that there is an increase in selling pressure for the cryptocurrency. The last time LINK deposits into exchanges were this high, the asset found itself at a local top.

Bitcoin May Soon Steal the ShowBitcoin undergoing a bout of volatility could add further fuel to a LINK downtrend.

As reported by Bitcoinist previously, Brave New Coin crypto analyst Josh Olszewicz found that the Bollinger Bands are tightening to historically tight levels. The Bollinger Bands tightening are often seen prior to a spike in volatility, especially for Bitcoin.

This suggests that BTC will soon see a spike in volatility.

Analysts say that when Bitcoin undergoes volatility, all altcoins (Chainlink included) underperform. This is due to the fact that Bitcoin leads the crypto market on breakouts, so capital and attention is focused on it.

Featured Image from Shutterstock Price tags: linkusd, linkbtc Charts from TradingView.com Here's Why Chainlink (LINK) Could Soon See a Striking Reversal origin »Bitcoin price in Telegram @btc_price_every_hour

Dix Asset (DIX) на Currencies.ru

|

|