2022-8-24 20:00 |

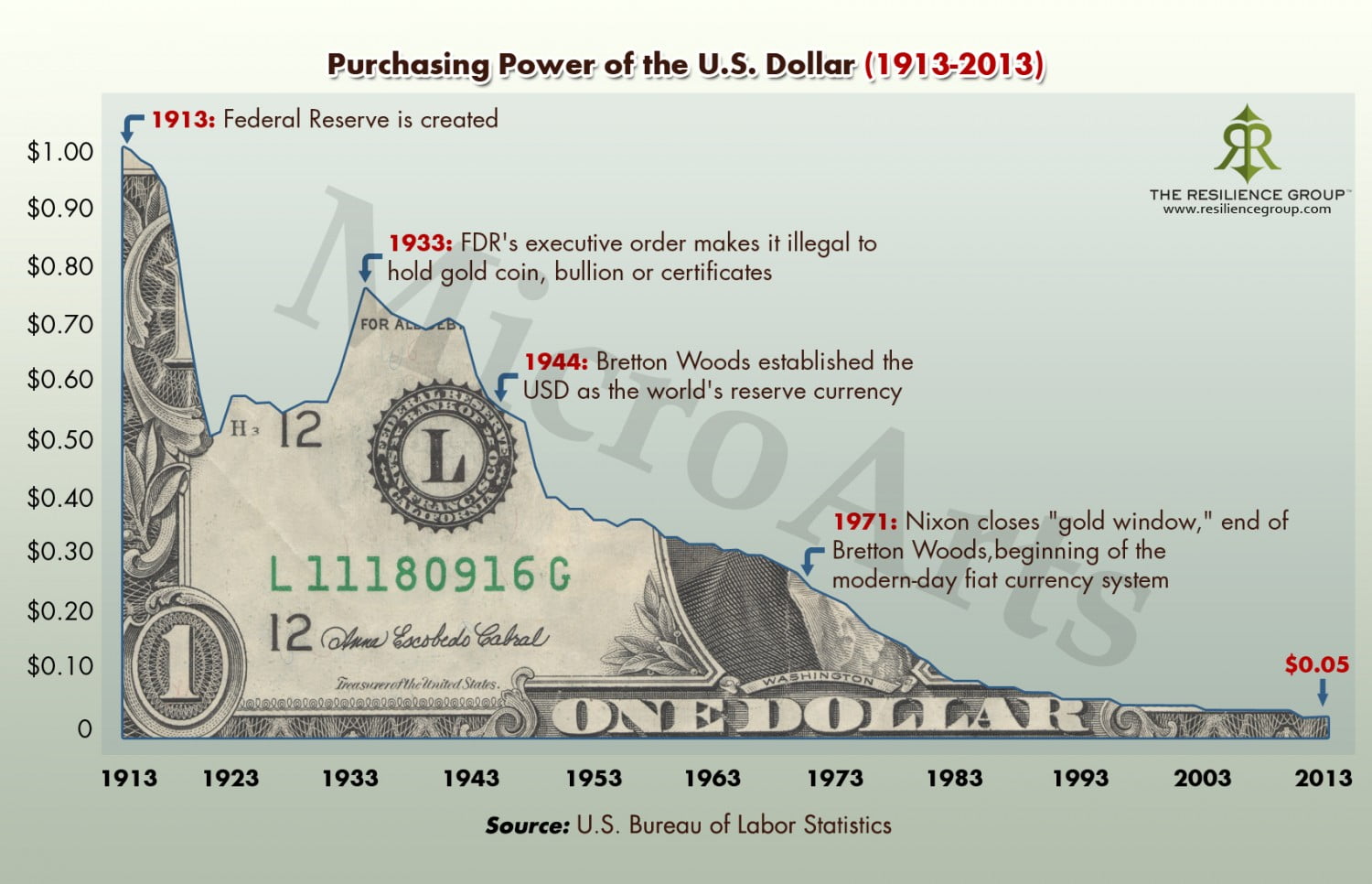

One of bitcoin’s main selling points has been the fact that its return has often put it ahead of the inflation rate. Due to this, it has gained notoriety as the “digital gold” as a good portion of the community put forward that the digital asset is a better inflation hedge than any asset. However, not every single proponent of bitcoin believes that bitcoin is an inflation hedge, at least not yet. One of those is the CEO of Skybridge Capital, Anthony Scaramuccci. Here’s what he thinks.

More Wallets Are NeededNow, bitcoin has grown tremendously since being launched over a decade ago. It is why it is impressive that the digital asset is being compared to counterparts that have been around for much longer. One of those is gold, which has previously proven to be the inflation hedge of choice for investors.

However, with BTC’s increasing popularity, it has been able to register as a potential inflation hedge. But despite so many believing that the digital asset qualifies as a good inflation hedge, Anthony Scaramucci does not believe so, and it mainly comes down to the adoption of the cryptocurrency,

Scaramucci explained during an interview with CNBC’s Squawk Box that while bitcoin has the potential to be an inflation hedge, it is nowhere near being one. According to the CEO, it is because the number of BTC wallets is still lower than 1 billion.

BTC price trading at $21,414 | Source: BTCUSD on TradingView.comPresently, there are about 300 million bitcoin wallets, but Scaramucci says that until BTC wallets are above the 1 billion mark, they cannot be considered an inflation hedge.

Bitcoin Is Still Too ImmatureHaving been around for only about 13 years at this point, bitcoin is still no doubt a very young asset. Add in the fact that it is a digital asset, and the cryptocurrency gets another added layer of uncertainty around it. And this immaturity is one thing that Scaramucci points to.

He explained that one thing that goes against BTC being an inflation hedge is its immaturity as a technical asset. However, this does not completely dismiss the cryptocurrency when it comes to its potential.

The limited supply of bitcoin has been a big pull for investors, and even Scaramucci has pointed to this as one of the key arguments for BTC, which he believes, given enough time, will come to rival and even beat gold, which is thousands of years old, mainly because bitcoin can be easily moved and easily stored.

Presently, it is said that less than 5% of the world’s population holds bitcoin. ARK Invest CEO has previously said in the past that if 5% of institutional money were to be moved into bitcoin, the digital asset is likely to reach as high as $500,000.

Featured image from ETF Stream, chart from TradingView.comFollow Best Owie on Twitter for market insights, updates, and the occasional funny tweet…

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) íà Currencies.ru

|

|