2025-1-15 22:01 |

London, London, January 14th, 2025, Chainwire

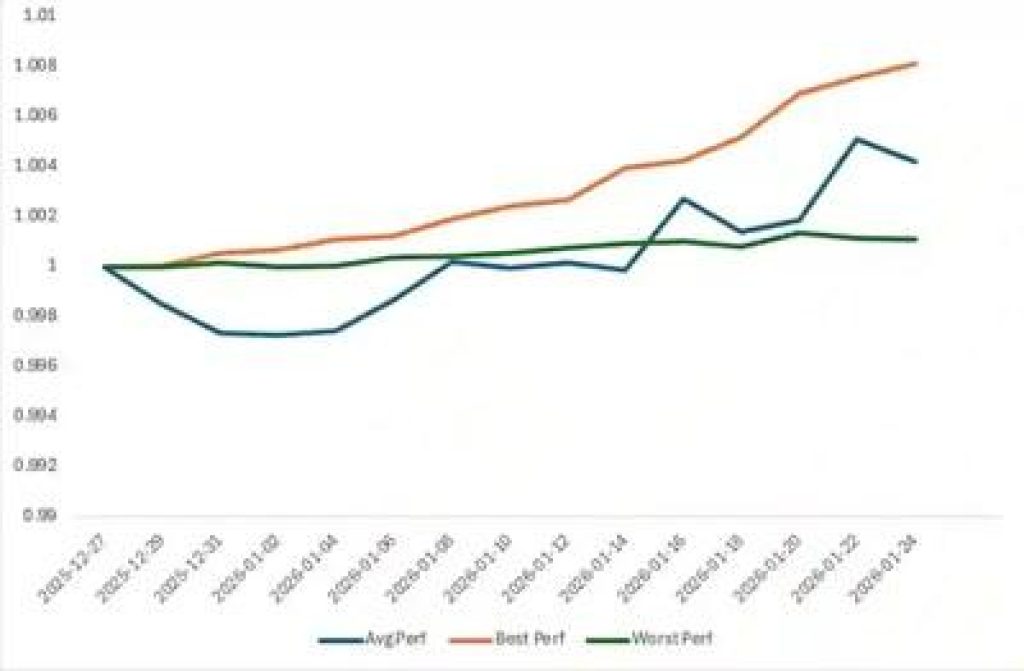

Good Market, built by fintech veterans from M2 Exchange and Freetrade, introduces a new trading platform that combines AI-driven trading with human-centered design. The platform enters closed beta testing with an initial group of 500+ traders, targeting a significant reduction in emotional trading errors – a key factor in the well-documented 90-95% failure rate among retail traders.

The platform streamlines complex trading processes through systematic execution and automated risk management, addressing key issues that typically lead to trading losses.

“Current trading platforms are part of the problem, not the solution,” says Good Market’s development team. “While Binance, Coinbase, and other exchanges focus on transaction volume, they’ve neglected the fundamental issue: traders lack systematic execution tools that prevent emotional trading and enforce disciplined strategies.”

Demo: Good Markets platform

Good Market’s Smart Assist Intelligence tackles this crisis head-on by automating trade execution and risk management. The platform allows traders to configure up to 300+ parameters, including technical indicators and entry/exit conditions, without writing code. This systematic approach eliminates the psychological biases that plague manual trading of popular tokens like Polygon (MATIC), Chainlink (LINK), and Avalanche (AVAX).

Core Platform Features:

AI-assisted analysis with semi-auto or fully automated execution AI-prompted strategy builder with 300+ parameters (no coding required) Automated position sizing and risk controls A community marketplace for verified strategies Integrated technical and fundamental analysisGetting $GOOD

The platform’s native token, $GOOD, offers practical benefits including trading fee reductions of up to 20% and access to premium features. The initial token sale begins at $0.025, with 4 million tokens available in Phase 1 before moving to $0.05 in Phase 2.

Early Investor Benefits:

Beta platform access Invitation to London investor meetup Founder-tier platform status Premium features for holders of 10,000+ tokens Input on platform developmentAbout Good Market

The Good Market team combines deep expertise in cryptocurrency trading and traditional finance, including key architects from M2 Exchange who managed over $2B in trading volume and product leaders from Freetrade. Development began in February 2024, building on years of direct experience with retail trading challenges.

The platform will move to public beta in Q1 2025. Early investors can participate at www.goodmarket.ai.

Note: Trading cryptocurrency and other assets carry a significant risk of loss. Good Market provides tools for systematic trading but does not guarantee trading profits. Popular cryptocurrencies mentioned like Bitcoin, Ethereum, and others experience high volatility and should be traded with caution.

Connecting with Good Market:

Website: www.goodmarket.ai Email: [email protected] Telegram: @goodmarketai Twitter: @goodmarketai YouTube: @goodmarketaiMedia Contact: [email protected]

www.goodmarket.ai

ContactMr

Chike Chiejine

Good Market

[email protected]

The post Good Market Launches No-Code Trading Platform to Address Retail Traders’ $2.1 Trillion Challenge appeared first on CaptainAltcoin.

origin »Bitcoin price in Telegram @btc_price_every_hour

United Traders Token (UTT) на Currencies.ru

|

|