2021-1-17 15:44 |

Nikolaos Panigirtzoglou, JPMorgan Global Market Strategist, who called out for $146,000 per Bitcoin price target, sees Grayscale Bitcoin trust and Bitcoin futures as important vehicles for the market, which was also the reason behind the recent drop and recovery in price.

According to him, the recent 5% to 10% decline was much like the one seen before Thanksgiving. Panigirtzoglou, in his recent interview with Bloomberg, said.

“It looks similar to that correction, we occasionally get froth that is partly driven by momentum traders in futures spikes.”

“For bitcoin, the flow through the Grayscale Bitcoin Trust (GBTC) along with Bitcoin futures are important.”

He explained how GBTC was closed for two weeks for administrative purposes, and it was only two days ago that it was opened to institutions. And in just two days, the Bitcoin product of the world’s largest digital asset manager got $2 million of inflow, which is “significant.”

“For the whole month of December, we had a new flow of $2 billion. it is almost like $100 million a day.”

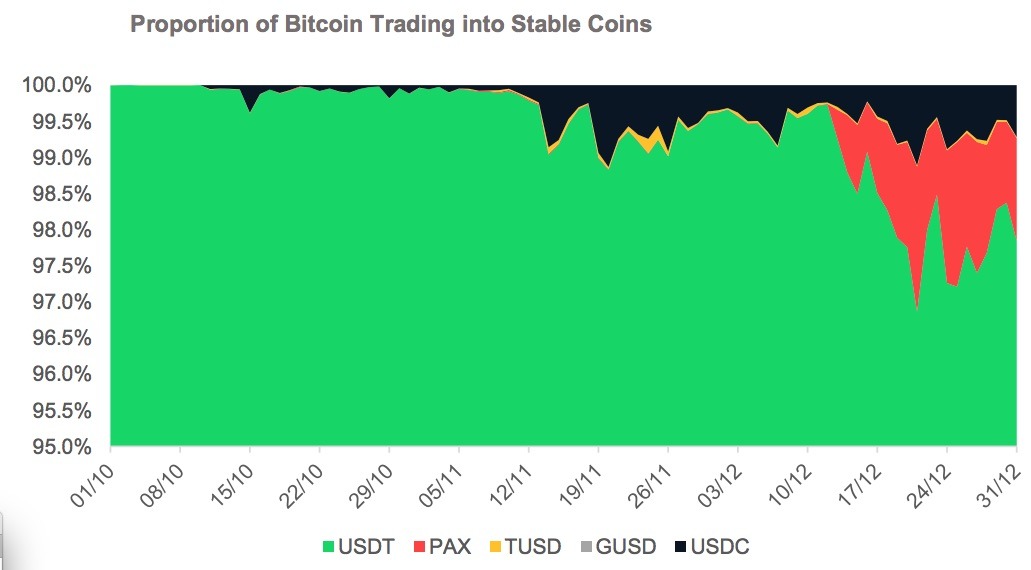

As for where this money is coming from, is it the retail money from the Robinhood crowd, the institutional crowd coming after the entry of big names like Paul Tudor Jones, or as per the Bloomberg host Matt Miller, it could even be the “alleged market manipulation through Tether.”

The money coming into Bitcoin is both institutional, and retail said Panigirtzoglou.

However, he says the thing with institutions is to emphasize here is that it is not all family offices or long-term institutional investors. Still, it is also institutional investors that are most secure and try to font-run others.

“Toward the end of the year, December in particular, it appears we have seen the institutional flow that started in October has led to a retail flow that is perhaps as strong as it was at the end of 2017.”

Nikolaos Panigirtzoglou JPMorgan Strategist

This retail flow has been reverberating more by traditional wallets… not by GBTC or Bitcoin Futures but from the likes of PayPal through which the retail is trading.

According to him, that retail is mostly speculative still. But the institutional flow that did not exist three years ago surged “in a very strong way” in 2020.

Bitcoin/USD BTCUSD 35,868.2820 -$1,255.39 -3.50% Volume 54.47 b Change -$1,255.39 Open$35,868.2820 Circulating 18.6 m Market Cap 667.26 b baseUrl = "https://widgets.cryptocompare.com/"; var scripts = document.getElementsByTagName("script"); var embedder = scripts[scripts.length - 1]; var cccTheme = {"Chart": {"fillColor": "rgba(248,155,35,0.2)", "borderColor": "#F89B23"}}; (function () { var appName = encodeURIComponent(window.location.hostname); if (appName == "") { appName = "local"; } var s = document.createElement("script"); s.type = "text/javascript"; s.async = true; var theUrl = baseUrl + 'serve/v1/coin/chart?fsym=BTC&tsym=USD'; s.src = theUrl + (theUrl.indexOf("?") >= 0 ? "&" : "?") + "app=" + appName; embedder.parentNode.appendChild(s); })(); var single_widget_subscription = single_widget_subscription || []; single_widget_subscription.push("5~CCCAGG~BTC~USD"); The post Retail is Mostly Speculative, But Institutional Flow is Surging ‘In A Very Strong Way’ – JPMorgan Strategist first appeared on BitcoinExchangeGuide. origin »Bitcoin price in Telegram @btc_price_every_hour

WayCoin (WAY) на Currencies.ru

|

|