2021-10-24 16:29 |

Just like crypto, decentralized finance (DeFi) is also getting institutionalized. This week, Goldman Sachs put out a detailed report on the DeFi ecosystem that includes “many of the same products and services found in the traditional financial system” but with no centralized intermediaries.

“There are no banks, brokers, or insurers, only open source software connected to a blockchain.”

According to the authors of the report, analysts Zadi Paled and Isabella Rosenberg, the technology has the potential to disrupt existing market structures and is termed as “one of the most compelling use cases of blockchains.”

Blockchain is not just an alternative ledger or bookkeeping technology, and that’s why the applications are not limited, it said. The block-by-block updating of a smart contract blockchain is used to document not just peer-to-peer transactions but also any arbitrary change in the state of a complex system, as such allowing smart contract blockchains to run software and applications powering DeFi.

Compared to traditional finance, DeFi offers certain advantages in the form of easier access for underbanked populations, faster settlement times, unique products, faster innovation, higher transparency, and more efficiency.

But it is “very much a work-in-progress” experiencing plenty of hacks, bugs, and outright scams and further posing a challenge for policymakers which means “broader public adoption is likely still some way off,” wrote Paled and Rosenberg. They also pointed to structural weaknesses such as scalability to compete head-to-head with traditional financial services technology.

The report highlights Aave and Uniswap as two key protocols demonstrating the main applications of DeFi — lending and trading/exchange.

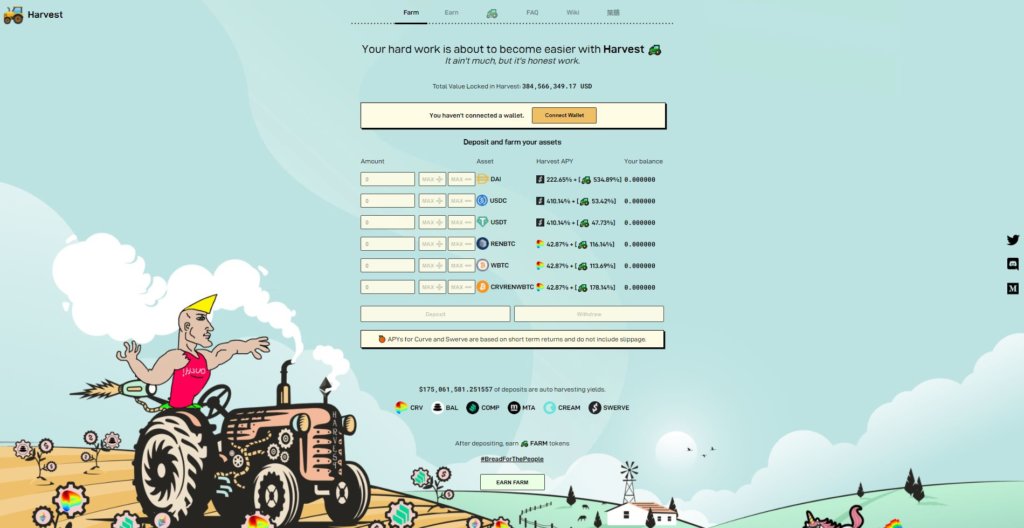

Disrupting The Existing Financial SystemTalking about the growth of the DeFi sector over the past year, the report cited stablecoin yields “much higher” than on insured bank deposits as the reason behind this. An estimated 3.5 million unique addresses have interacted with DeFi protocols.

These yields are typically 5%, “about ten times the yields available on insured bank deposits,” noted the report, adding these yields can further be enhanced.

It further pointed out Federal Reserve surveys showing that cash use declined across all age groups during the pandemic, and those of the 25-34yr age group used cash for only 10% of payments last year.

And this may be contributing to the adoption of digital payment technologies, including crypto-based stablecoins. Besides digitization, globalization is contributing to DeFi adoption along with its lack of KYC and AML rules, it said.

The report also mentions DAOs and covers “TradFi 2.0 Innovation” in the DeFi ecosystem that moves extremely fast. The market focus has recently moved beyond established protocols to newer projects such as Olympus DAD and Alchemix Finance, dubbed ‘DeFi 2.0,' the report stated.

“From the standpoint of the broader financial system DeFi is still a relatively small market segment and a suite of very new technologies,” it said adding, developers need to create new mechanisms for unsecured lending to make inroads into more areas of traditional finance. And while greater regulatory oversight seems inevitable, this could slow the industry's development.

“Nonetheless, the many innovations in decentralized finance point to avenues through which related technology might disrupt or be adopted by the existing financial system. They also demonstrate a compelling use case for blockchains and cryptocurrency technology that should help support market valuations for these assets over time.”

The post Goldman Sachs Reports on “TradFi 2.0,” says DeFi Should Help Support Crypto Asset Valuations first appeared on BitcoinExchangeGuide. origin »Bitcoin price in Telegram @btc_price_every_hour

Emerald Crypto (EMD) на Currencies.ru

|

|