2021-5-22 16:46 |

Late in May 2020, Goldman Sachs’ report on cryptocurrencies had said that they are “not an asset class.”

But this week, amidst the deep market rout, the banking giant released its latest report in which it talks about crypto as “a new asset class.”

The bank had surely come a long way from 2014 when it first wrote about Bitcoin, a cryptocurrency with “no income, no practical uses, and high volatility.”

The report is a comprehensive one that covers the network fundamentals for crypto as a whole along with Bitcoin and Ethereum separately. It covers the infrastructure, protocol, services, and applications layers of the crypto industry.

Going beyond the basics, it touches upon the intricacies of the largest network. Besides how it works, the report mentions the demand and supply dynamics of it as well.

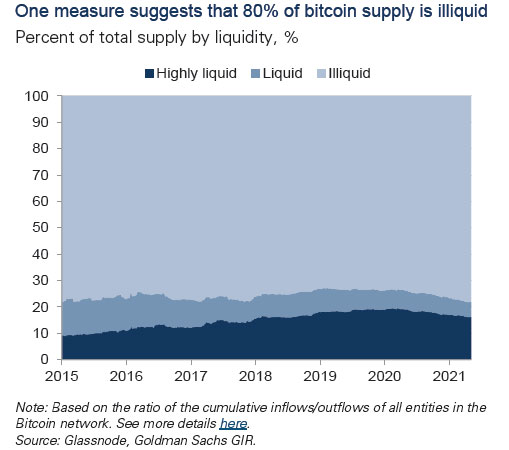

While 80% of bitcoin supply is liquid, Bitcoin’s short-terms holders are small in number, reads the report.

It is bitcoin's potential for widespread social adoption that makes it “a plausible store of value for future generations,” said Zach Pend, GS Co-Head of Global FX, Rates, and EM Strategy.

According to Pend, institutional investors should treat bitcoin as a macro asset, akin to gold.

GS commodity analyst Mikhail Sprogis and Jeff Currie, Global Head of Commodities Research, also argue that cryptos can act as stores of value. But to Currie, legal challenges to their future growth loom large due to their decentralized and anonymous nature.

Goldman has labeled Ether as just as important and given a separate section as Bitcoin as the bank sizes its market.

While Ether’s supply is not capped like Bitcoin, the pace of new creation is going down, states the report, which shows chart representations of the network’s fees and dapps built on it.

The report notes that while remaining extremely volatile on the back of regulatory crackdowns, environmental concerns, and heightened tax scrutiny,

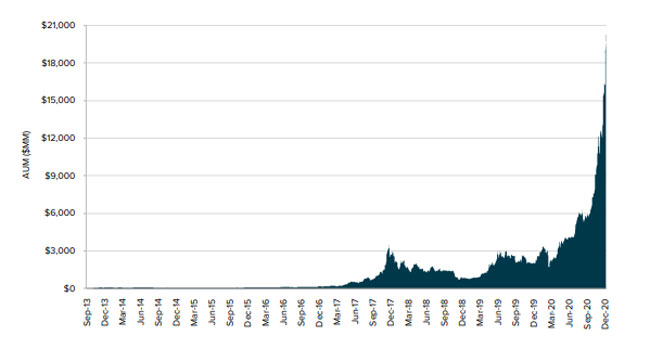

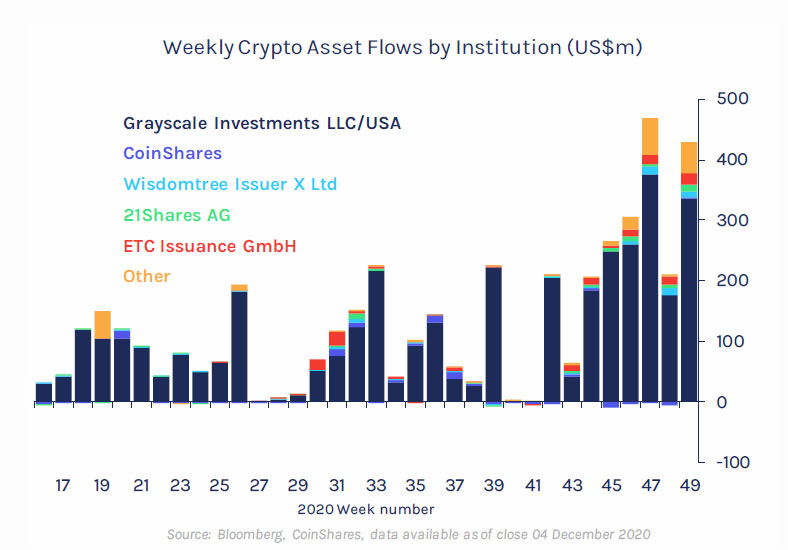

“Interest in crypto assets from credible investors has been rising, and legacy financial institutions—including ourselves—have been launching new crypto offerings.”

This year, Goldman Sachs rebooted its crypto desk because of “client demand.”

Mathew McDermott, GS Global Head of Digital Assets, elaborated in the report that interest in crypto differs between their client types. While asset managers are seeking portfolio diversification, high-net-worth clients are increasingly looking for exposure to broader crypto use cases and hedge funds that are largely aiming to profit from the basis between spot and futures market.

Bitcoin BTC $ 38 182.51 +2.65% Ethereum ETH $ 2 349.75 -4.51% Tether USDT $ 1 -0.03% The post Goldman Sachs Publishes a Comprehensive Report on Crypto As A “New Asset Class” first appeared on BitcoinExchangeGuide. origin »Bitcoin price in Telegram @btc_price_every_hour

Dix Asset (DIX) íà Currencies.ru

|

|