2022-3-25 21:41 |

When talking to people about cryptocurrencies, one of the top things people mention is how bad it is for the environment. This narrative has become prevalent in mainstream media, and we will mention several examples in this article.

Whereas five years ago, the most common anti-crypto argument was that it’s only a covert, anonymous network used by criminals on the dark web, today the biggest criticism is undoubtedly the anti-environment angle.

So, is it true? Is cryptocurrency actually boiling our oceans? Let’s find out.

Consensus AlgorithmsWe first dug into the attached data from Crypto Wisser, which ranks the top 100 cryptos by energy consumption. So, a high rank below indicates a heavy energy consumption, whereas a low rank signifies relatively light energy consumption (i.e. rank 100 means the most energy intensive crypto in the top 100, rank 1 means the least energy intensive).

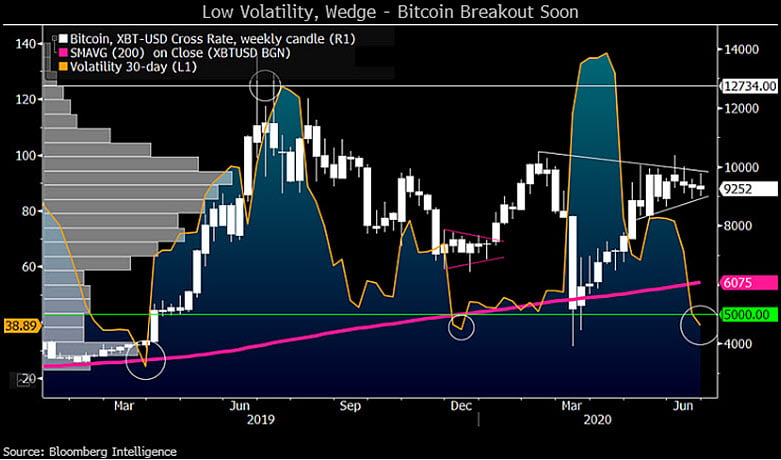

We filtered the data by consensus algorithm, in order to see which type of mechanism consumes the most energy, and created the below graph. The results are obvious: Proof-of-Work mechanisms are clearly the most energy intensive mechanisms, while Proof-of-Stake blockchains consume the least.

Graphing Crypto Wisser’s data, we see Proof-of-Work mechanisms consume by the most energy

Bitcoin & EthereumYou may have heard of the two biggest Proof-of-Work cryptos: Bitcoin and Ethereum. However, Ethereum will be transitioning to a Proof-of-Stake blockchain soon (well, we say soon. The merge has been repeatedly pushed back but the consensus is that it will finally happen this year). The hope is that Ethereum transitioning to Proof-of-Stake will reduce its energy output by 99%, and hence it would fall down the ranks in our graph above.

With this Ethereum move in the pipeline, alongside the anticipated energy reduction, we will focus our attention on Bitcoin. Let’s try to answer perhaps the most asked question in crypto: quite how bad is Bitcoin for the planet?

Provocative StatisticsIn September 2021, the New York Times reported that “The process of creating Bitcoin to spend or trade consumes around 91 terawatt-hours of electricity annually, more than is used by Finland, a nation of about 5.5 million”.

This was preceded four months earlier by a Forbes article in May-21, which reported that Bitcoin’s “annual electricity consumption is higher than Norway's 124 TWh and more than twice the level of Bangladesh's 70 TWh”.

BBC put their own spin on things another three months earlier, when they printed the shocking fact that “Bitcoin uses more electricity annually than the whole of Argentina”.

They certainly make captivating headlines, and the fun facts become oft-repeated rhetoric, at least by our experience. But in looking deeper, we noticed that all these reports comparing Bitcoin’s mammoth electricity consumption shared a common source: The Cambridge Bitcoin Electricity Consumption Index.

Cambridge Bitcoin Electricity Consumption IndexWe soon noticed that on the Cambridge page sat a section aptly titled “comparisons”. Within it lay the below quote:

“However, as indicated by the chart below, country comparisons without additional context provide only limited insight given the huge disparities between nations. The size of a country, both in geographical and population terms, does not always correlate with energy usage.

Instead, the energy profile of each country is a unique product of factors such as the energy demand of domestic industries and residents, the level of economic and social development, the stock of available energy sources, economic spending and production patterns, strategic policy actions to attract or outsource energy-intensive industries, and many more.

As a result, it should not be surprising that the energy footprint of a single large city in a developed country can match the total level of an emerging economy”.

Hence, the stats comparing energy consumption can be deceptive. An important point, and one that makes sense when you think about it. Yet none of the above articles made efforts to contextualize their reported stats.

Besides – and more importantly – what is actually the point in comparing Bitcoin to a country, in any case? Should we not be comparing to other asset classes or commodities? Would that not be more relevant?

Other AssetsBy far and away, the most referenced asset in relation to Bitcoin is gold. Enthusiasts hope that one day, Bitcoin can wrestle the store-of-value title from the precious metal. Protecting holders against inflation while circumventing governmental monetary control, if Bitcoin can reduce its volatility, it can become the ultimate store-of-value, or so the story goes.

Sticking with the same researchers for consistency purposes, Cambridge outline Bitcoin’s electricity consumption as 137 TWh per year. And how much energy consumption does gold mining consume? Nearly the exact same, at 131 TWh. Looking at the gold industry as a whole (not just mining), energy consumption is even larger at 241 TWh, according to this Galaxy Digital report – close to double what Bitcoin consumes. I guess “Bitcoin consumes roughly the same amount of energy as gold mining” or something similar doesn’t capture quite as many clicks, however.

While Cambridge data use strong metrics, it’s worth mentioning that other sources are even more aggressive in quantifying the chasm to gold. The Bitcoin Mining Council has gold mining’s energy consumption over double the size of bitcoin mining (with bitcoin mining’s energy consumption roughly equivalent to holiday lights!). Most studies, however, have the output coming in lower, such as this nasdaq piece which computes gold mining’s output as 265 TWh for 2020.

GMC does present a neat comparison to other sectors, however. We mentioned that Bitcoin mining energy consumption is similar to holiday lights, but the below data also reads that Bitcoin is dwarfed by aviation, shipping and US appliances, among others.

The same Nasdaq piece has the banking industry’s total output at 700 TWh for 2020, although we think this is a true apples-to-orange comparison and should be taken with a pinch of salt. You simply cannot compare Bitcoin to the entire banking class at this point in time with the required degree of confidence, not to mention the difficulties in actually quantifying the energy consumption of banking – what exactly is included and to what degree can be highly subjective with a sector that large.

Finite number of Bitcoins capped at 21 millionSo far, you may be brushing off our grievances as nitpicking. Perhaps. So let’s get a little more in-depth. Because we found one thing was missing from all the above articles, as well as similar ones like them in mainstream media. And it’s one that is vitally important to the equation – it’s Bitcoin’s supply cap and the corresponding mining schedule.

Satoshi Nakamoto designed the cryptocurrency so that there will only ever be 21 million mined. The supply schedule follows a predetermined route, with nearly 19 million already mined, corresponding to 90% of total supply. This means that, at the current price of circa $45,000, each bitcoin was mined at a much lower price than it currently trades at. If the asset continues to appreciate, this means society essentially got a discount on the mining.

Once all the bitcoins are mined (in the year 2140), miners will rely solely on fee income to sustain themselves. Therefore, fee income will grow to account for the lower mining revenue going forward. But this mining revenue is already falling, as Bitcoin is programmed for “halvings” every four years (the most recent of which was in 2020, with the next slated for early 2024).

And it is this halving point that is the vital point that can’t be overlooked when assessing Bitcoin’s energy consumption. This is because it implies that unless Bitcoin doubles in price every four years, the energy consumption by miners (i.e. their expenditure) will decrease, because their revenue is getting halved every four years.

It’s simple economics, but in reports extrapolating Bitcoin forward, such as statements like “if Bitcoin continues at this rate, it would require X times the world’s consumption limit to replace VISA” or something of that ilk, don’t take account of this point – they completely miss it (be it intentional or via ignorance). It's simply false.

Miner Rewards since Bitcoin’s inception: the halvings are easy to see, coming in Jan-09, Nov-12, Jul-16 and May-20, data via IntoTheBlock

FeesRelated to this fall in mining rewards, is what happens as mining dries up and miners are forced to rely on transaction fees. Nic Carter discusses a key point regarding this in his excellent piece assessing Bitcoin’s energy consumption. He states that “fees have a natural ceiling to them, as transactors must actively pay them on a per-transaction basis. If they become too onerous, users will look elsewhere, or economize on fees with other layers that periodically settle to the base chain”.

With this point made, he continues that “thus, it’s unlikely that security spend results in the world-eating feedback loop that has been posited in the popular press. In the long term, Bitcoin’s energy consumption is a linear function of its security spend. Like any other utility, the public’s willingness to pay for block-space will determine the resources that are allocated to providing the service in question”.

It's another major point that is simply not mentioned in a lot of the aforementioned pieces about Bitcoin’s onerous energy consumption.

Green Energy and Changes to MiningThe other glaring aspect of these headlines that tends to be omitted is Bitcoin’s movement towards green energy and continued improvement.

In May 2021, the Bitcoin Mining Council was set up to promote, encourage and report sustainable energy use by Bitcoin miners. Its Q2 report last year, for example, highlighted the portion of global Bitcoin mining energy consumed that is sustainable as 58%, higher than that of the EU at 43%, as shown on the below graph (incidentally, the EU last week voted rejected a bill proposing the banning Proof-of-Work mining).

Portion of sustainable energy of Bitcoin mining vs countries, data via Bitcoin Mining Council

Elsewhere, El Salvador’s high-profile move to adopt Bitcoin as legal tender has had a strong focus on renewable energy. Regardless of what you think of the economic consequences of adopting the nascent currency as legal tender, the Central American country is pushing forward with plans to harness geothermal energy from volcanoes to power Bitcoin mining – a move that will also help clean up Bitcoin’s carbon footprint.

Sustainable initiativesThere are numerous organizations and companies working towards lowering their environmental footprint, many even aiming to reduce this to zero. Amongst them, there are plenty in the crypto industry that have such goals. One of such examples is the cryptocurrency mining company called Stronghold Digital Mining, which is reportedly converting waste from old power plants into energy for hundreds of Bitcoin mining rigs.

In an effort to realize this idea, the crypto company collects coal waste, a leftover material from the coal mining process. The company claims to incinerate this in an emissions-controlled environment in its own power generation facilities.

The use of coal waste can cause various environmental problems. Some examples of this are water and air pollution. However, collecting this waste and disposing of it safely, while generating power for crypto mining, currently appears to be a productive way to tackle the issues.

The American state of Pennsylvania, where Stronghold Digital Mining is based, is the third-largest producer of coal in the United States. They estimate that the amount of coal wasted is about 880 pounds per 2,200 pounds mined. Converted, this equates to approximately 400 kilograms per tonne. According to Stronghold, Pennsylvania alone has more than 220 million tons of hazardous waste.

The Proof-of-Work consensus mechanism has attracted attention from different angles in recent months for its energy-intensive processes to mine and validate the network. Although the use of coal waste does not affect this energy-intensive process, it is a way to achieve cleaner energy in the short term.

In addition, other ways of making mining construction environmentally friendly are also being looked at. In Texas, for example, where Argo Blockchain has a significant mining installation, plans are underway to run solely on renewable energy. Elsewhere, earlier this month the oil drilling company ConocoPhillips started a program in North Dakota where it would sell the natural gas by-product from its operations to Bitcoin miners instead of burning it.

Just this morning, we got further evidence of the ability of Bitcoin to go “green”. Bloomberg reported that Exxon Mobile, the largest producer of oil in the US, is considering taking a gas-to-bitcoin pilot project to four countries. The report describes how the project, which was launched in January 2021, also in North Dakota, already consumes up to 18 million cubic feet of gas per month that Exxon couldn’t otherwise monetize.

In essence, it allows oil producers to sell the gas they discover by chance while drilling for oil. Given the lack of infrastructure nearby, such as pipelines, this energy would otherwise be wasted.

With Exxon now considering expanding the project to Alaska, Nigeria (Qua Iboe Terminal), Germany, Guyana and Argentina (Vaca Muerta shale field), it highlights how much economic sense these initiatives make – Exxon’s profits increase, while waste is reduced. That’s what they call a win-win.

Wasted EnergyTo build on this point, Bitcoin’s wider role in consuming energy that would otherwise be wasted is key. Miners are free to locate themselves anywhere, and therefore are in a unique position whereby they can exploit remote energy assets, powering their operations from otherwise wasted energy. The diagram below, from the same BMC report as above, shows just how much energy is wasted.

This is where crypto can do good. Governments should be pushing miners towards renewable energy as much as possible (taking a leaf out of El Salvador’s book) – miners will naturally gravitate towards renewable sources if costs are reduced, thus providing a willing home for renewable projects with excess supply – in essence, killing two birds with one stone.

This Horizon Academy report digs into this: “Overall, cryptocurrency mining is a way for renewable energy producers to temporarily utilize energy that the grid cannot transport to locations where it is needed. By mining with their excess energy, they can lower the financial risk of setting up a wind park, hydro dam or solar park. PoW might therefore pose a net positive for the global energy footprint”.

Similarly, it is a very neat way to export cheap electricity. Given the age-old problem that is electricity being so expensive to transport over long distances (as well as causing abundant waste), location independent industries which consume large amounts of power can fill this void.

The Horizon Academy report references the interesting case of Iceland, which has traditionally leveraged aluminium to use up its abundant renewable energy. ““We are based in the middle of the North Atlantic Ocean. We are not connected to the mainland Europe grid,” Bjarni Mar Gylfason, chief economist for the Federation of Icelandic Industries, famously said. “So we export energy in the form of aluminium.””

Well, why not Bitcoin mining for this?

Conclusion: What the Debate is Really Centred OnSo, with some misgivings about the environmental criticisms of Bitcoin pointed out, let’s move on and wrap this up. We compared earlier the energy consumption of Bitcoin against gold. Cambridge in their studies also collated energy consumption for several more industries, which can be seen in the diagram below.

Energy consumption of various industries, via Cambridge Bitcoin Electricity Consumption Index

So, one could also write the headline “Global air conditioning consumes 16 times the amount of electricity as Bitcoin”.

Your reaction to this may be that it’s absolutely ridiculous to compare these two things, but that’s kind of our point. It’s no more ridiculous than comparing Bitcoin’s energy consumption to a country without further context.

And this brings us to our conclusion, and what we think this debate really comes down to. Is Bitcoin worth it? It rings true that most of the people lamenting the crypto’s onerous energy consumption do not believe in Bitcoin. They believe that every watt of electricity consumed by the crypto is a waste. And, to be fair, if Bitcoin is worthless, then they’re probably right – it is wasting energy.

But Bitcoin being worthless is an enormous if, and, if it wasn’t already obvious, it is a statement we wholeheartedly disagree with. But in levelling our opinion like that, haven’t we summed up the crux of the issue? There are those who believe that Bitcoin is the most important asset since the Internet; that the existence of a decentralized, non-government-controlled currency will lead to a more democratic, fairer and transparent financial economy, and overall society. There are others who think it doesn’t make sense, and it’s simply a speculative, get-rich-quick scheme.

We simply don’t have the column space to open that can of worms here, but we think that is inherently what this debate about Bitcoin’s energy consumption comes down to.

Air conditioning is generally accepted as necessary, which is why we don’t see headlines such as “air conditioning consumes more energy than Japan, Brazil and Canada put together” (this is true, by the way). If people all believed that Bitcoin was necessary, these headlines would simply not be here.

But having said that, it still doesn’t mean that the logic used in some anti-Bitcoin environmental arguments, nor the explosive headlines written, are all factually correct.

So no, Bitcoin is in fact not boiling the oceans.

The post Global air conditioning consumes 16 times the amount of electricity as Bitcoin – Deep Dive on Bitcoin’s energy consumption appeared first on Coin Journal.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|