2019-4-8 17:00 |

Fund manager Travis Kling believes that more people are becoming open to the idea of Bitcoin being a haven from central banks’ “irresponsible” monetary policy.

Bitcoin is Becoming a Safe HavenTravis Kling, chief investment officer at Ikigai Asset Management, believes that more people are becoming open to the idea of Bitcoin being a haven from uncertainties in the mainstream market.

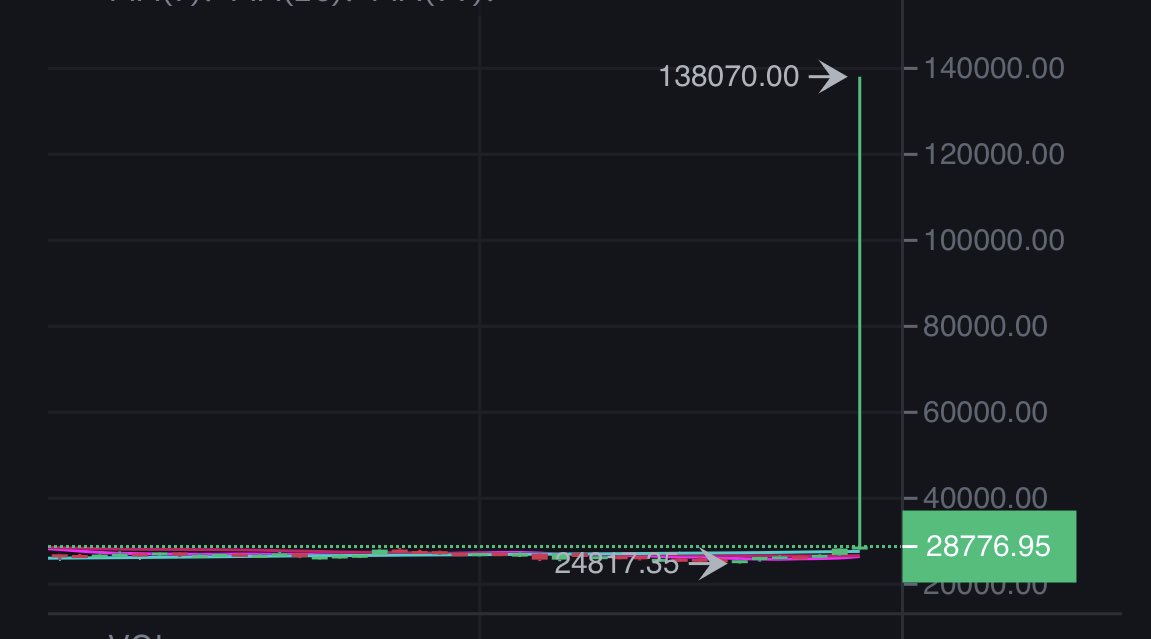

According to MarketWatch, Kling suspects that the recent decisions of the Fed, the European Central Bank (ECB), and the Bank of Japan among others with respect to monetary policies played a role in the April bitcoin price surge.

The Ikigai fund manager says central bank policies becoming more politicized might be causing a great deal of anxiety for investors. To deal with such uncertainties, many are flocking towards Bitcoin and other virtual currencies.

Commenting on the matter, Kling opined:

It’s [Bitcoin] become a hedge against irresponsible monetary and fiscal policy. We had the Fed do a complete U-turn into dovish mode, then everyone else followed (European Central Bank and Bank of Japan). We now have this set up where they [central banks] have become politicized both in the U.S. and globally. It’s the new world we are living in.

Kling’s talk of politicized central banking can be observed in the Fed’s decision to go into permanent quantitative easing (QE) in 2019. Many analysts attributed this move to political pressure from the White House.

For Kling, that decision highlights the original appeal of Bitcoin – an alternative currency based on decentralized technology that’s free from government meddling.

Kling adds that Trump’s influence on Fed policy is “So bullish” for cryptocurrencies.

…Look at whats happening with monetary/fiscal policies. And US policy isnt nearly as rekt as EU, Japan & China Close your eyes & imagine the next 5-10 years. Do you really think these policy ‘experiments’ are going to end well?

The Fed Always Stacks the DeckThe combination of QE – a euphemism for ‘money printing’ and fiscal deficits means that the burden of negative interest rates will most likely be transferred to consumer bank accounts.

According to the Ikigai fund manager, the Fed always has the deck stacked, saying:

You’ll never win betting against the Fed.

In a previously published interview with Bitcoinist, Max Keiser comes to a similar conclusion, saying:

The trend in Bitcoin’s price flipped from bear to bull once the Fed said it would ease-off tightening and engage in permanent money printing (‘permanent QE’). This is wealth confiscation by the bank cartels to keep their insolvent balance sheets from imploding. The impact on Bitcoin and Gold will be moving to new ATH as safe-haven money pours in.

To avoid the negative impact of negative rates and debt-monetization, the likes of Keiser and Kling say people are moving their wealth into Bitcoin. This trend could contribute to Bitcoin reaching a new all-time high.

Do you agree that Bitcoin can be a hedge against flawed central bank policy? Share your thoughts in the comments below!

Image via Shutterstock, Twitter/@Travis_Kling

The post Fund Manager: Bitcoin Becoming a Hedge Against ‘Irresponsible’ Banks appeared first on Bitcoinist.com.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) íà Currencies.ru

|

|