2024-11-15 21:11 |

SG-FORGE, the digital asset subsidiary of Societe Generale, is set to launch its Euro-pegged stablecoin EURCV on the XRP Ledger (XRPL), a move aimed at enhancing cross-border payment systems in Europe.

Scheduled for 2025, this expansion to XRPL is part of SG-FORGE’s broader multi-chain approach, following deployments on Ethereum and Solana.

By leveraging XRP’s infrastructure, SG-FORGE hopes to meet Europe’s regulatory standards under the Markets in Crypto-Assets (MiCA) framework, addressing transparency and consumer protection.

This step reinforces the company’s goal to offer stable, compliant digital assets that cater to institutional needs across multiple blockchain networks.

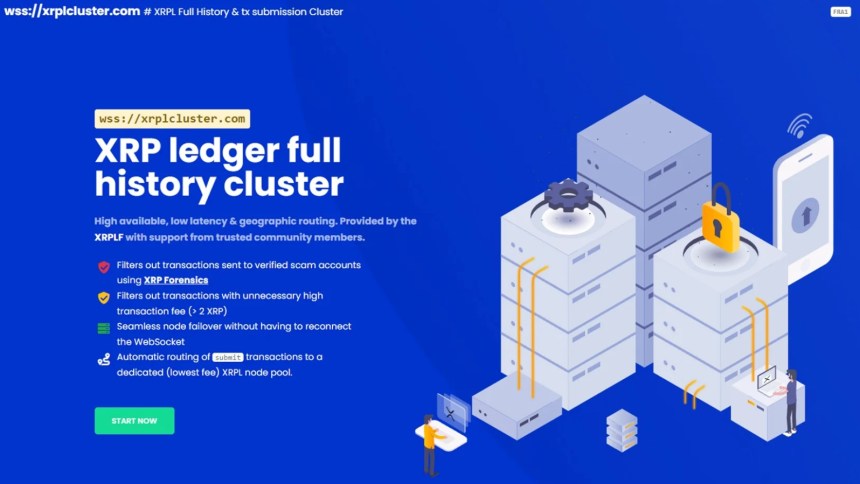

Why SG-FORGE chose XRP LedgerThe decision to launch EURCV on XRPL stems from the platform’s established reputation for low-cost and high-speed processing, qualities essential for SG-FORGE’s cross-border payment ambitions.

XRPL, since its inception in 2012, has processed over 2.8 billion transactions and currently supports over 5 million active wallets.

These capabilities are well-aligned with SG-FORGE’s institutional focus, as they provide a scalable and secure foundation for digital asset transactions in Europe’s financial ecosystem.

SG-FORGE’s Chief Revenue Officer Guillaume Chatain emphasises that XRPL’s infrastructure aligns with the company’s vision of providing secure and efficient digital assets tailored to institutional finance.

For SG-FORGE, this integration is a strategic step towards creating a compliant, efficient cross-border transaction network within the EU’s regulatory landscape.

MiCA compliance for transparency and consumer protectionEURCV is designed to meet the regulatory standards established by MiCA, Europe’s pioneering framework for cryptocurrency oversight.

MiCA mandates strict compliance measures for digital assets, particularly concerning transparency, market integrity, and consumer protection.

By ensuring that EURCV meets MiCA’s stringent requirements, SG-FORGE aims to offer a stable, institutional-grade asset that mitigates risks often associated with digital currencies.

SG-FORGE’s focus on MiCA compliance reflects its dedication to providing secure, interoperable digital products that are adaptable across blockchain platforms.

This emphasis on compliance not only strengthens EURCV’s position in the market but also promotes a regulated environment for digital currencies in Europe.

How EURCV compares to volatile cryptocurrencies in transaction stabilityUnlike highly volatile assets like Bitcoin, which have seen price fluctuations of over 5% within a day, stablecoins like EURCV are pegged to fiat currencies, in this case, the euro.

Stablecoins offer a more predictable transaction medium, which is essential for large financial institutions dealing with cross-border payments.

EURCV aims to provide the stability required by institutional finance, differentiating it from typical cryptocurrencies and making it a suitable choice for cross-border payments that need reliability.

This stability allows businesses and financial institutions to rely on EURCV without the significant risk of value fluctuations, thereby facilitating a more seamless transition to blockchain-based payment systems.

SG-FORGE’s role in bridging blockchain with traditional financeAs Societe Generale’s digital asset arm, SG-FORGE has established itself as a leader in blockchain integration within the traditional finance sector.

Since its founding, SG-FORGE has introduced multiple digital assets aimed at bridging the gap between decentralized technologies and regulated financial institutions.

Its focus on compliance and institutional needs has allowed it to develop products that align with Europe’s stringent regulatory frameworks.

SG-FORGE’s dedication to creating compliant digital assets places it at the forefront of blockchain adoption within traditional finance. Its expansion onto XRPL with EURCV reflects a calculated approach to integrate blockchain benefits, like transaction speed and efficiency, into traditional finance systems.

SG-FORGE’s expansion into XRPL is not a standalone initiative but part of Societe Generale’s broader digital asset strategy. Scheduled for full launch in 2025, EURCV is expected to act as a cornerstone in the institution’s blockchain initiatives, providing a reliable stablecoin that meets the needs of institutional finance in Europe.

By expanding EURCV across various blockchain networks, SG-FORGE reinforces its commitment to a multi-chain, interoperable approach in the rapidly evolving digital asset market.

Societe Generale’s long-term vision for EURCV is to establish it as a trusted asset in the institutional finance sector, enabling seamless, secure, and compliant cross-border payments.

This initiative highlights the bank’s proactive approach in shaping the future of digital finance by balancing innovation with regulatory compliance.

The post French firm SG-FORGE plans EURCV stablecoin launch on XRP Ledger appeared first on Invezz

origin »Bitcoin price in Telegram @btc_price_every_hour

Quantum Resistant Ledger (QRL) на Currencies.ru

|

|