2019-1-24 13:58 |

The search for a bottom in crypto markets has been arduous. Over the past year, day in, day out, pundits in this nascent community have sought to discern where the falling knife will stick. Yet, cryptocurrencies, like Bitcoin (BTC), have continued to trade without rhyme or reason, leaving a majority of consumers in a bear market-induced state of confusion. Yet, a leading pro-innovation venture capitalist has remarked that a bottom for blockchain-based assets is nigh, and draws ever closer with the passing of each day.

Related Reading: Prominent Bitcoin Short Seller Covers: Crypto Bottom Inbound? Crypto Bottoming May Take “Much Of 2019 To Play Out”Since BTC faltered as 2017 came to head, optimistic investors have sought to time the bottom. And while some cynical analysts have claimed that this long-awaited, highly-anticipated occurrence is years away, Fred Wilson, a co-founder of Union Square Ventures and a cryptocurrency proponent, has claimed that the process of bottoming has commenced. Wilson shared his thoughts on the matter via a blog post on AVC, his world-renowned blog that covers markets of all shapes and sizes.

In an extensive entry titled “What Is Going To Happen In 2019,” the investor noted that “large, liquid, and lasting crypto-tokens” (assets like BTC, Ether, etc.) are in the midst of discovering a bottom. Yet, he added that this market movement “could take much of 2019 to play out.”

Interestingly, this nebulous timeline lines up with a piece of analysis done by Filb Filb, which outlined that Bitcoin could bottom anywhere between Q4 2018 and early 2020. Tone Vays, a former institutional investor turned Bitcoin diehard, also recently echoed the idea that this market will find a long-term foothold during 2019, but was also vague about the precise timing.

Wilson didn’t stipulate where exactly cryptocurrencies would bottom but claimed that in the months to come, he expects for a fair share of “bullish runs” and influxes of “selling pressure” to push cryptocurrencies to retest their one-year lows. After Bitcoin finds some ground to stand on, the Union Square partner, who was presumably behind his firm’s investments in Coinbase and Polychain Capital, noted that he expects for this industry to enter its next bull season.

Catalysts For The Next Bull SeasonBut, as crypto’s hype has all but dissipated, with Ripple and Stellar co-founder Jed McCaleb even claiming that this hype-driven industry has calmed, many have been left asking what will push cryptocurrencies to new heights. Wilson outlined his thoughts on the matter in the aforementioned post, first drawing attention to the mass of unfulfilled promises made in 2017. The blockchain advocate noted that as 2017’s ambitious promises bear fruit, this industry’s fundamentals will likely get a solid stat boost, so to speak.

Touching on specific promises, the venture capitalist noted that he expects blockchain startups Filecoin and Algorand, two projects in Union Square’s diversified portfolio, to push product in the near future.

By the same token, Wilson explained that he also hopes to see “next-gen” smart contract and decentralized application platforms, such as “internet of blockchains” Cosmos, to finally go live and go head-to-head against Ethereum’s well-established hegemony. Yet, with increased competition, especially from multi-million dollar token sale raises, the investor added that he expects for the Ethereum open-source development team to rise to the occasion, meeting so-called “blockchain 3.0s” with new protocols.

And with the looming advent of the Constantinople hard fork, deemed an overall long-term bullish upgrade by researchers, it seems that one of Wilson’s catalysts is already coming true. Justin Drake, a leading Ethereum developer and team member, recently told Ran NeuNer that Serenity’s “Phase 0 (Beacon Chain)” will be finished sometime during 2019, before early-stage sharding is activated in 2020.

In Wilson’s eyes, solid development on the end of the aforementioned projects, along with growth in the adoption of stablecoins, crypto assets, and earn/spending opportunities, will allow cryptocurrencies to establish a bottom, before entering their next rally to the upside.

Yet, he added that crypto’s return from the netherworld won’t be an easy journey, as he claimed that there will likely be “pressure on the crypto sector in 2019.” More specifically, he drew attention to the fact that “misguided regulators,” potentially those that are too eager to swing their gavels, could enact action on “high-quality projects and [subsequently] harm them” without proper rationale.

Moreover, Wilson remarked that he expects for hacks, scams, failed projects, and poor investments to continue to paint this industry in a bad light. But overall, he noted that this is the case with any emerging technology, maintaining that he’s long-term bullish on cryptocurrencies. As reported by NewsBTC previously, Wilson once said:

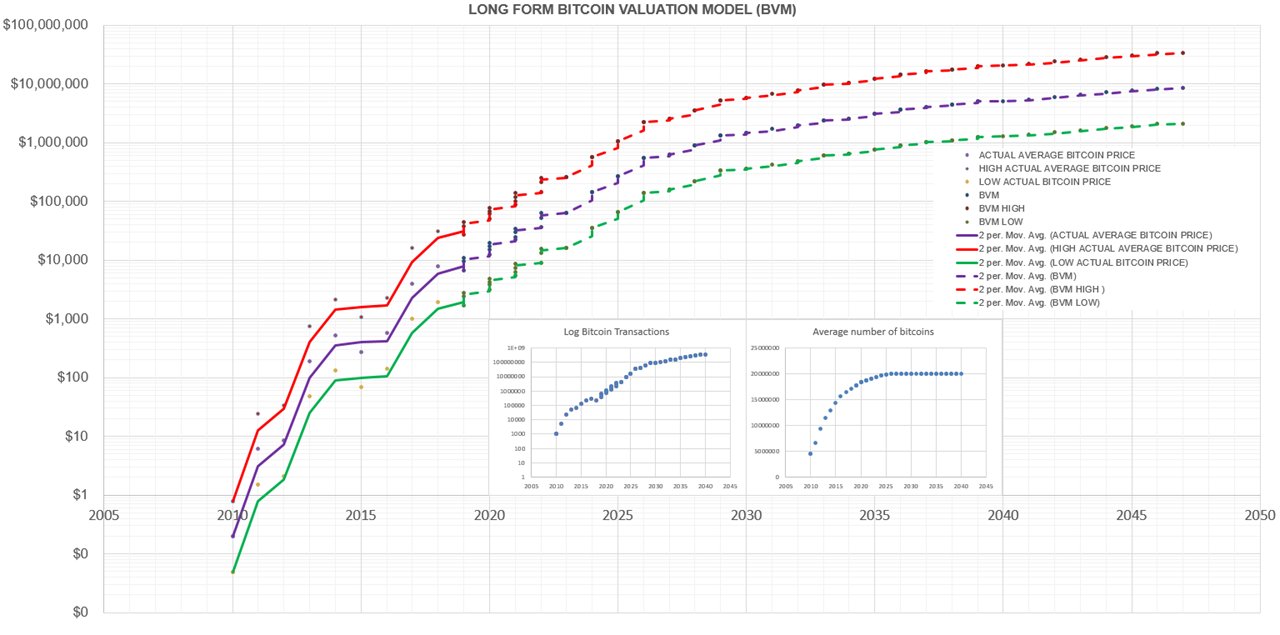

“I think some crypto asset (and possibly a number of crypto assets) will have a price chart like Amazon’s current one in 18 years. But we will have to do what Amazon did, hunker down and build value and survive, for quite a while to get there. And I think things will get worse before they get better.”

Featured Image from ShutterstockThe post Fred Wilson: Bitcoin May Take Much of 2019 to Bottom Out, But There Are Catalysts appeared first on NewsBTC.

origin »Bitcoin price in Telegram @btc_price_every_hour

Chronologic (DAY) íà Currencies.ru

|

|