2020-7-9 14:00 |

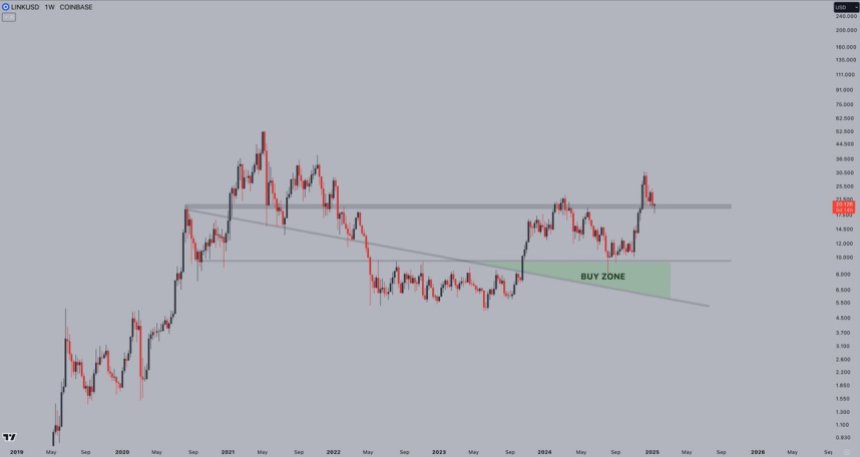

Chainlink’s LINK token is amid a “full-blown parabolic advance,” according to forex analyst Cole Garner. The on-chain data investigator mentioned a string of technical and fundamental indicators that hint further gains for the altcoin. The analogy appeared as LINK climbed to its lifetime high against Bitcoin on Wednesday.

LINK, an altcoin powering the Chainlink’s decentralized oracle network, is beating its top rival Bitcoin in terms of exchange rates.

The twelfth-largest cryptocurrency established its all-time high at 69,415 sats this Wednesday, a move that brought its year-to-date returns up by 182.69 percent. LINK’s rally appeared during a market-wide upside move that saw its peers Cardano (ADA) and VeChain (VET) rising by 270 percent and 250 percent YTD, respectively.

A majority of those bullish altcoins hinted pullbacks as they headed into the Thursday trading session. LINK also dropped by 4.54 percent, indicating that individual traders are selling the yearly top to secure short-term gains.

Chainlink's LINK crypto corrected lower after setting a lifetime high a day earlier. Source: TradingView.comNevertheless, an on-chain investigator sees the Chainlink token continuing its uptrend, suggesting that it may rise by as much as 80 percent in the coming sessions.

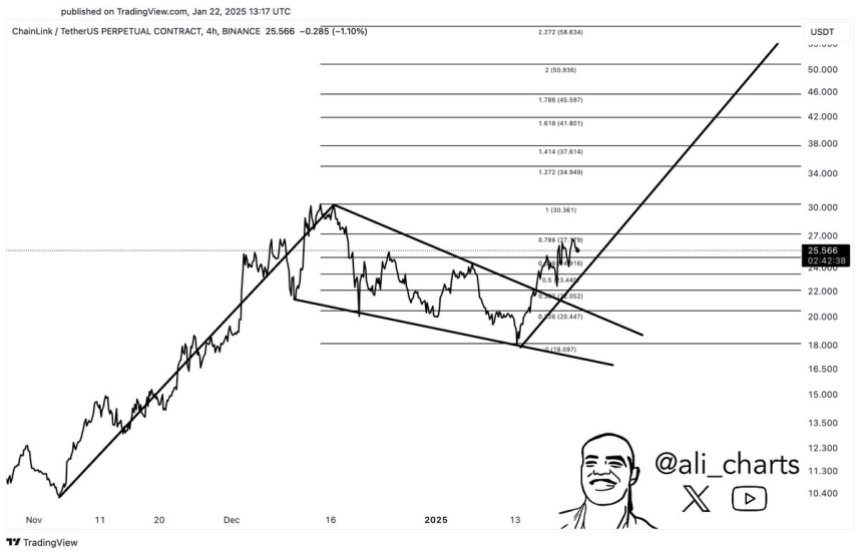

Chainlink in “Parabolic Advance”Forex analyst Cole Garner said Wednesday that LINK is trading amid “full-blown parabolic advance.”

He noted that the Chainlink token formed small bullish parabolas within a large one, taking cues from its significant upside moves from last year. Mr. Garner placed the 2019’s uptrend on a Fibonacci retracement graph, illustrating a fractal repeat in the current scenario.

It roughly put LINK’s resistance target at least 50 percent higher from where it is trading presently. Meanwhile, the best-case scenario envisions LINK/BTC up by 80 percent – at 94,457 sats, as shown in the chart below.

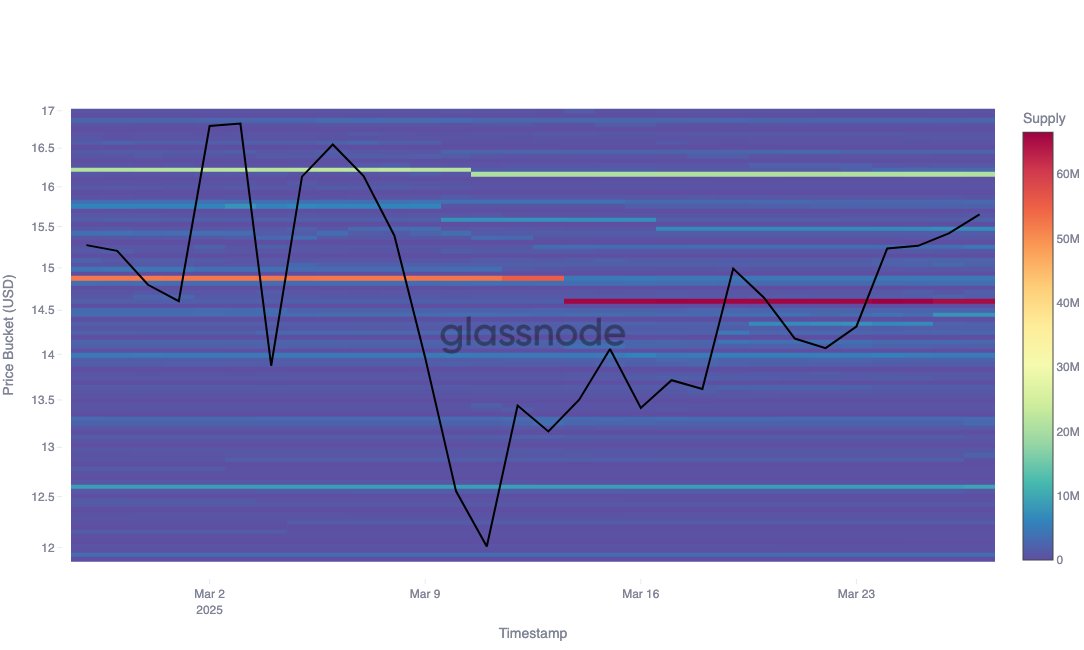

Chainlink's parabola fractal sees LINK price 80% higher. Source: Cole Garner, TradingView.comMr. Garner further placed the technically bullish narrative alongside supportive fundamental signals. For instance, LINK’s Mean Dollar Invested Age started curling down. It typically coincides with the beginning of a price uptrend.

Bullish cues also came from exchanges that reported a plunge in their LINK’s balances. It indicated that traders prefer to hold the Chainlink token during its parabolic phase. One of the trading platforms, Binance, meanwhile showed investors are “skewed long” on LINK.

When is Pullback?Mr. Garner highlighted that LINK is now sitting at attractive long-term profits that may allow investors to offload part of their positions. Meanwhile, the analyst advised traders to look for certain cues in the Chainlink market to decide when the token is breaking out of its upside parabola.

“I want to see Mean Dollar Invested Age drop hard, at the same time that on-chain volume prints a huge spike,” he said. After that, I expect Binance orderbook delta to skew heavily short.”

Mr. Garner added that he expects to take some profits when LINK/BTC hits 75k sats.

Photo by Frank Busch on Unsplash

origin »Bitcoin price in Telegram @btc_price_every_hour

ChainLink (LINK) на Currencies.ru

|

|