2022-1-27 01:00 |

Bitcoin maintains its bullish short-term trajectory into the U.S. Federal Reserve FOMC meeting, suggesting the downtrend might be losing strength. BTC investors have feel the pain in the last weeks, as the cryptocurrency displays a high correlation with the U.S. stock market.

Related Reading | Bitcoin Whales Take Advantage Of Market Crash To Gobble Up Millions In BTC

As of press time, BTC trades at $38,301 with a 2.3% profit in 24-hours.

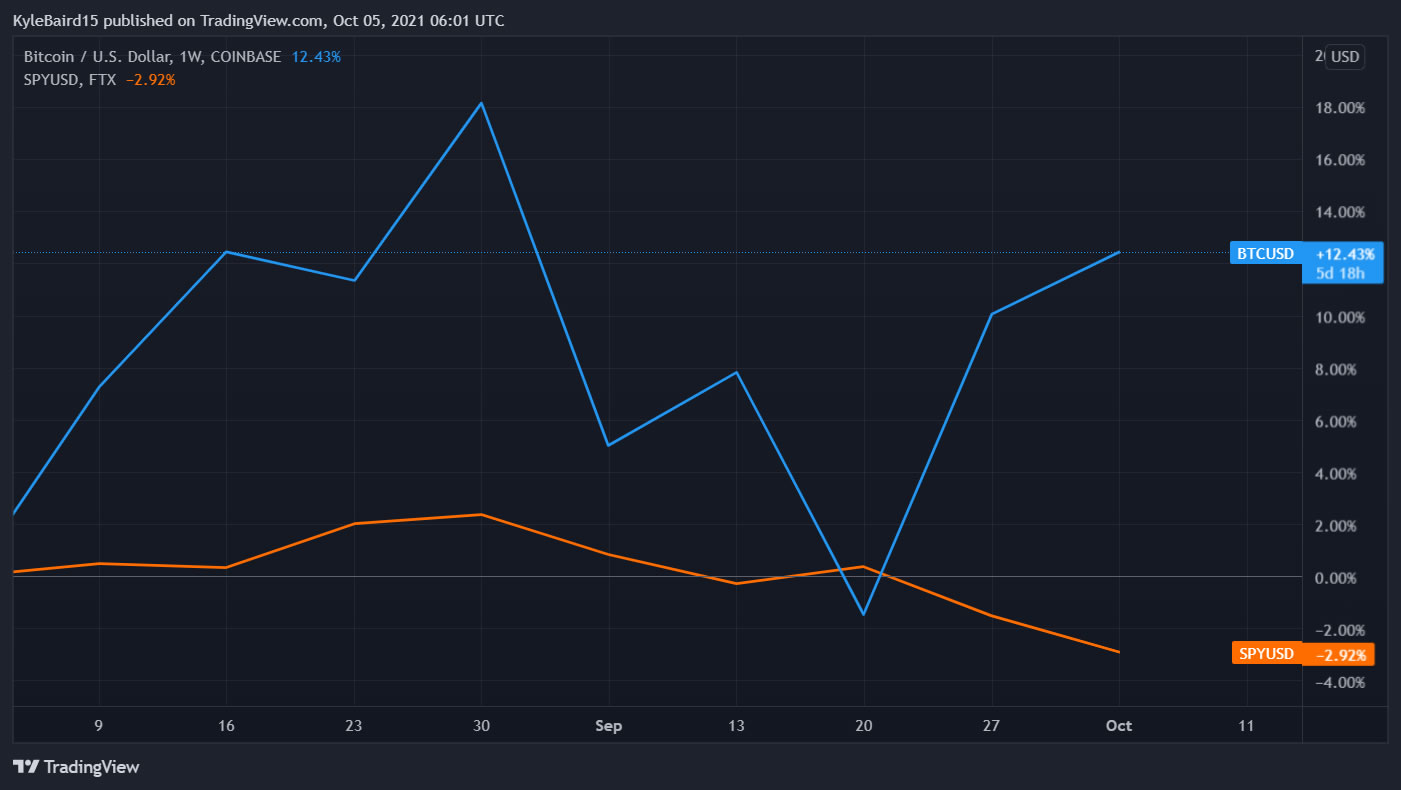

BTC with moderate gains in the 4-hour chart. Source: BTCUSD TradingviewData presented by Joe Orsini, Director of Research for Eaglebrook Advisors, Bitcoin has historically experienced a positive performance in terms of percentage on FOMC announcement days. As seen below, the current FED Chair Jerome Powell’s administration has boosted the price of BTC as much as 20% during these days.

Source: Joe Orsini via TwitterIn addition, the chart shows that the BTC percentage change in the daily chart it’s typically moderate during these events. Probably due to the market already pricing in any potential announcements.

With the exception of April 2020, every FOMC meeting is followed by moderate price swings on these timeframes with the largest downside change near 5%. If Bitcoin remains on its current trend, it could score yet another bullish post FOMC trading day.

However, when the current Bitcoin drawdown is compared to that of April 2020, and July 2021, BTC seems ready for further losses. On the latter periods, BTC dropped below 60% and 50% before a significant price reversion.

Source: Teddy Vallee via TwitterOn the contrary, it only briefly recovered when it failed to drop below the aforementioned percentage. This suggests more downside after a dead cat bounce probably to the $40,000 area.

Bears Ready Ammunition? Bitcoin Reacts To Macro-FactorsDuring the current price action, investment firm QCP Capital has seen an increase in selling pressure for the spot market. In addition, short terms option contracts have experienced “aggressive buying” as large investors hedge their positions.

Related Reading | Fidelity Says What We’ve Been Thinking: Countries & Central Banks Will Buy BTC

QCP Capital has seen more confidence in the market as BTC recovers, but the firm is “not sure” if the market has seen the lows and will resume its full bullish trend. The firm compared the change in At-the-money options volumes for BTC and ETH when its price crashed in May 2021, and today.

10/ While front-end vols spiked hard with BTC 1-week from 70% to 100% and ETH 1-week from 85% to over 120%, the longer end of the vol curve remained relatively tame. The curve from March onward moved higher by only 5-6% to a very modest 75% level. pic.twitter.com/f2smBbl4dB

— QCP Capital (@QCPCapital) January 26, 2022

At that time, the metric recorded a spike of up to 250% for ETH while current volumes remained “relatively tame”. In other words, the options sector seems to suggest BTC could be in for more blood. The firm added:

Does this mean that the market has yet to reach it’s true point of pain? Below 30,000 level in BTC perhaps? A lot of the short-term price action is going to depend on the Fed statement later today (…). Given the bloodshed in equities, chances are that we’ll get a fairly neutral statement and mkt will take that as an excuse to rally. A short squeeze across the board is likely.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) íà Currencies.ru

|

|