2020-8-26 22:16 |

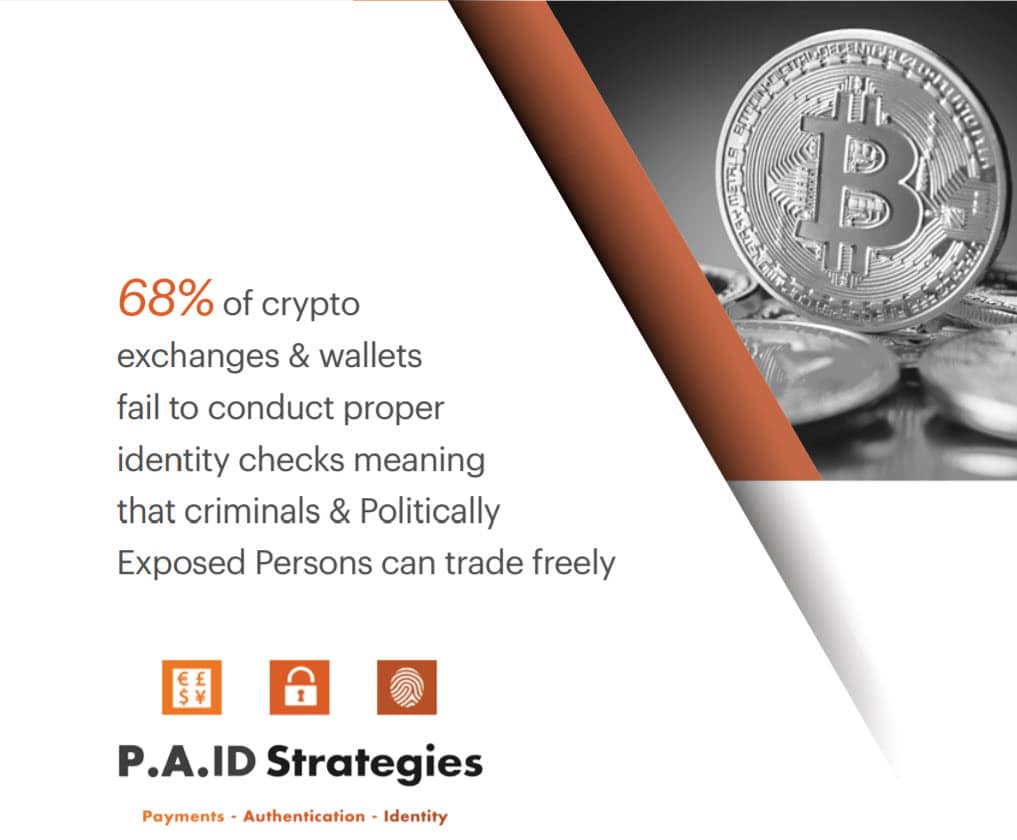

The UK’s top regulatory body, the Financial Conduct Authority (FCA), has proposed a new policy for crypto exchange and wallet custodians. This policy requires crypto companies to submit a detailed history or report on potential money laundering. The FCA noted that they are planning to extend certain obligations for crypto companies for the reporting of money laundering risks associated with their customer accounts.

The FCA first started demanding an annual crime report from financial institutions in 2016. As per the latest proposal made by the regulatory body, “crypto-asset exchange providers and custodian wallet providers” must provide the FCA with a report about their financial crime risk, “irrespective of their total annual revenue.”

It is to be noted that the policy is just a proposal at present, which has been put up for comments by the regulatory body until November 23rd and based on the feedback they receive, the FCA plans to release a policy statement along with new rules by the first quarter of 2021.

How Would New Policy Pan Out?As per the new policy introduced by the FCA, some further information that crypto businesses might be required to submit the lists of customers put in the ‘high-risk’ category. List of customers who refused to provide their details or left because of the information demand from them along with the top 3 prevalent frauds.

The crypto companies would be required to submit “from their next accounting reference date after 10 January 2022.” The FCA also made a critical change towards crypto exchanges, which open their base in tax-havens but operates all around the globe. The new FCA policy defines “operates” as “where the firm carries on its business or has a physical presence through a legal entity.”

The FCA revealed that the main reason behind such policy changes is to harvest data from potential fraudulent companies so that the right amount of resources could be dedicated to these companies, which in turn would help in containing the money laundering risks. The FCA also stated,

“There may be additional reporting obligations that we might require of crypto-asset businesses in the future.”

origin »Bitcoin price in Telegram @btc_price_every_hour

Emerald Crypto (EMD) на Currencies.ru

|

|