2023-7-22 15:07 |

For eighteen months now, the macro picture has revolved around the “i” word: inflation. The biggest cost of living crisis since the 1970s has forced the Federal Reserve into the fastest rate-hiking cycle in recent memory; after a decade of near-zero interest rates, T-bills are now paying north of 5%.

Last week, however, the latest CPI number of 3% was announced, revealing a faster-than-anticipated cooling of the price rises that have suffocated the economy and forced the Fed’s hand. Down from 4% the prior month, stock markets closed at 15-month highs as investors grow hopeful that the tightening cycle may finally be coming to a close.

Against this backdrop, we present a quick snapshot of the state of play for Bitcoin, which has been tossed around like a ragdoll by the conflicting forces of inflation and rising interest rates over the past eighteen months (as well as some rather unsavoury happenings in cryptoland).

How sensitive is Bitcoin to interest rates?The single most important lever available to policymakers is the interest rate, which quite literally sets the price of money and flows through to all aspects of the economy. Bitcoin is no exception; in fact, it is even more sensitive than most, given how far out on the risk spectrum it lies.

Plotting the two-year Treasury yield, which moves with interest rate expectations, against Bitcoin in the below chart highlights how vital Jerome Powell is with respect to the price of Bitcoin (yields plotted on an inverted axis).

With inflation cooling off through the first half of 2023 much quicker than was expected back in Q4 of last year, this helps explain Bitcoin’s surge this year, up 80%. The move comes despite most news from within the industry over the past six months being largely bearish, highlighted by the great regulatory crackdown occurring in the US.

It now feels like somewhat of an infliction point. The worst of tightening is undoubtedly over, meaning the heavy anchor holding Bitcoin down may be loosening. Then again, it is important not to be overly optimistic about the CPI number. Core inflation remains stickier than the headline figure, and if the Fed is intent on hitting the 2% target, there could still be a price to pay.

On this note, when backing out the probabilities from Fed futures, the likelihood of a 25 bps hike at the Fed meeting next week is actually higher this morning than it was at this time last month, as presented in the next chart (up from 74% to near 100%).

Jerome Powell himself outlined it better than I at last month’s meeting:

“Looking ahead, nearly all committee participants view it as likely that some further rate increases will be appropriate this year to bring inflation down to 2% over time”

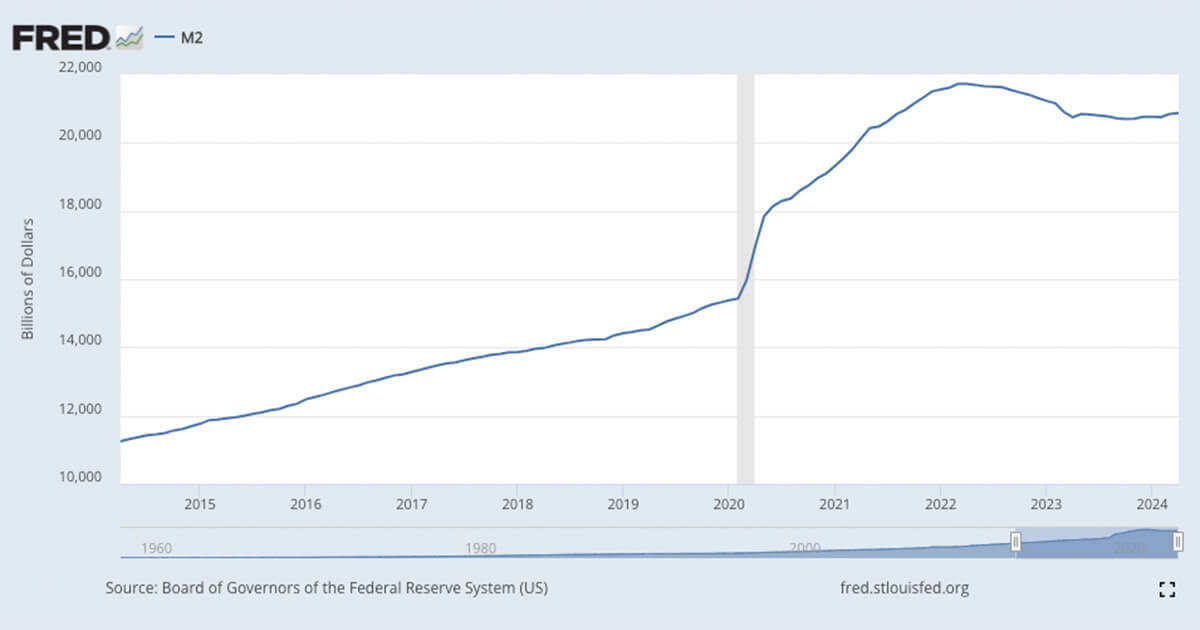

Even if future hikes are coming to a close, and largely priced in, we need to be prudent when stepping back and analysing Bitcoin (and the markets at large). Let us not forget the scale of the monetary tightening that the economy has endured; last month’s meeting was the first time in fifteen months that rates were not increased. Not only that, but these hikes came off the back of nearly a decade of historically low rates.

This is key because monetary policy notoriously operates with a lag. It takes time for the full extent of the tightening to filter through, which should provide caution to those market participants who are quick to celebrate the coveted soft landing as mission accomplished. While inflation is undoubtedly coming down far quicker than previously thought, and with almost no softening in the labour market, the full effect of the enormous liquidity drain from the economy may not be over yet.

Finally, in terms of Bitcoin specifically, there is one more major caveat which should be mulled over. Many simply assume that the whims of the crypto market mean bear and bull markets are inevitable, and a relentless bull market is guaranteed once all this argy-bargy subsides. Because in the past, every dip has been followed by a more euphoric high.

That may be true again, but assessing past data for an asset that was only launched in 2009 should be done very carefully. Bitcoin’s liquidity was also paper thin in its first years (even today, liquidity in spot markets is still an issue), meaning the reliable trading history we can analyse is from an even smaller sample size again.

Additionally, until last year, Bitcoin had only ever existed in what was one of the most glorious and explosive bull markets in history. Born out of the embers of the 2008 financial crisis and launched two months before the stock market bottomed in March 2009, the macro landscape was set up perfectly for the asset.

Obviously, this has now changed – as the 2022 return of the stock market on the above graph shows. Therefore, it is not an exaggeration to say that Bitcoin is in totally uncharted waters, a completely unprecedented situation for the youthful orange coin. Last year was the first time it saw the concept a sizeable interest rate, something which was until then only an abstract concept.

All in all, things are far brighter now than they were at the start of the year. The price of Bitcoin reflects that – as does the stock market, with the Nasdaq printing its best half-year return since 1983.

But don’t rule out the lagged effect of monetary policy tightening, and be wary of celebrations that may turn out to be premature. Beyond monetary policy and the macro situation, there is also the small matter of a war in Europe, a still up-in-the-air regulatory situation with a number of ongoing cases (Coinbase, Binance and Ripple to name a few, which there will no doubt be more twists and turns coming down the road), and myriad other variables which could turn one way or another.

Uncertainty still reigns, even if things are improving. For Bitcoin and the crypto markets, that means caution is still wise.

The post Falling yields are a boon for Bitcoin, but prudence is still wise as sentiment picks up appeared first on Invezz.

origin »Bitcoin price in Telegram @btc_price_every_hour

Global Currency Reserve (GCR) на Currencies.ru

|

|