2020-5-5 19:00 |

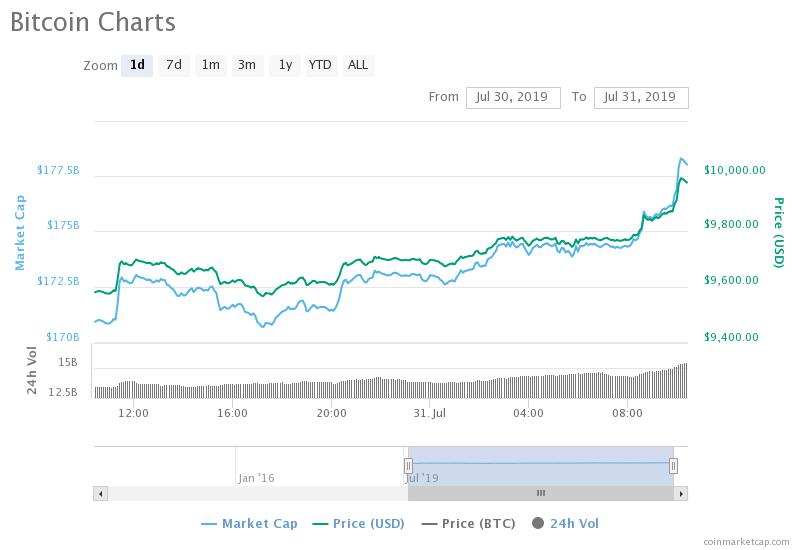

Interest on the Chicago Merchantile Exchange – otherwise known as CME Group – in Bitcoin futures contracts, has reached a record high. However, each time this has happened in the past it’s marked a local top. Will this latest achievement in open interest on CME cause yet another price drop across the crypto market? CME Bitcoin Futures Reach All-Time High Open Interest During the tail end of 2017, there was a perfect storm brewing for Bitcoin and cryptocurrencies. The economy was booming with excess money being invested in tech stocks and other speculative investments such as cryptocurrencies. People were buying up Bitcoin to take advantage of the free coins that would be created as a result of the BCH hard fork, and retail investors were FOMOing at every chance they got. Related Reading | Sell Bitcoin in May and Go Away? Ominous June Event Could Cause Crash There were also tons of bullish sentiment surrounding Bitcoin being taken more seriously by institutions, with the launch of the CBOE and CME futures trading. CME Bitcoin Future's open interest seems to have hit an ATH. pic.twitter.com/I5u7pcSIGF — CL (@CL207) May 4, 2020 The two institutional-focused trading desks launched the contracts in late 2017, which marked the top of the historic rally. Open Interest Reaching Record-Levels Triggers Local Top in Crypto Market Later, it was revealed that futures were debuted as a means to keep Bitcoin prices at bay, and have acted as a marker for local tops ever since. As the cryptocurrency trading platform BitMEX hits historic lows for its open interest, CME Group is experiencing all-time highs on their Bitcoin futures open interest. CME OI above $300m might have the same effect that BitMEX OI above $1b used to have. At least, it's marked the last two tops pretty well. $BTC pic.twitter.com/83SNJviFgm — Zack Voell (@zackvoell) May 3, 2020 But similar to how BitMEX open interest has acted as a marker for calling Bitcoin tops after it reaches a certain level, the same thing is occurring now on CME futures. Coinciding with each record-level of open interest, Bitcoin crashes. It called the June 2019 top and the recent February 2020 top that later was followed by an over 60% drop. Now, the metric has surpassed the key level that in the past has acted as a dangerous trigger for a BTC price drop. Related Reading | Black Thursday Has Destroyed BitMEX Bitcoin Open Interest, Hits Historic Lows But what exactly is fueling the sudden surge in open interest? It could be Bitcoin’s halving and an expectation of extreme volatility surrounding the event. It could be due to Bitcoin’s latest crash causing trading volumes to return in a big way to the crypto market. Another theory offered by DataTrek Research co-founder Nicholas Cola, who claims that these CME Group traders may be bored with quarantine conditions, and are trading Bitcoin as a ” temporary substitute for gaming and sports betting.” Cola says that retail interest has also moved to the stock market as a result, and Bitcoin could be enjoying a similar boost. Featured image from Pixabay origin »

Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|