2024-12-21 02:30 |

The EU’s imminent crypto regulations are raising alarms about potential disruptions to market liquidity as exchanges prepare to comply with new requirements under the Markets in Cryptoassets (MiCA) framework, Bloomberg News reported on Dec. 20.

The rules, set to take full effect on Dec. 30, mandate the delisting of Tether’s USDT, the world’s most widely used stablecoin, from EU-regulated platforms.

MiCA aims to bolster transparency and deter illicit financial activity by requiring stablecoin issuers to secure e-money licenses, maintain significant reserves, and oversee payment-related transactions.

However, Tether Limited has yet to obtain such a license, which has prompted its removal from crypto exchanges operating in the EU.

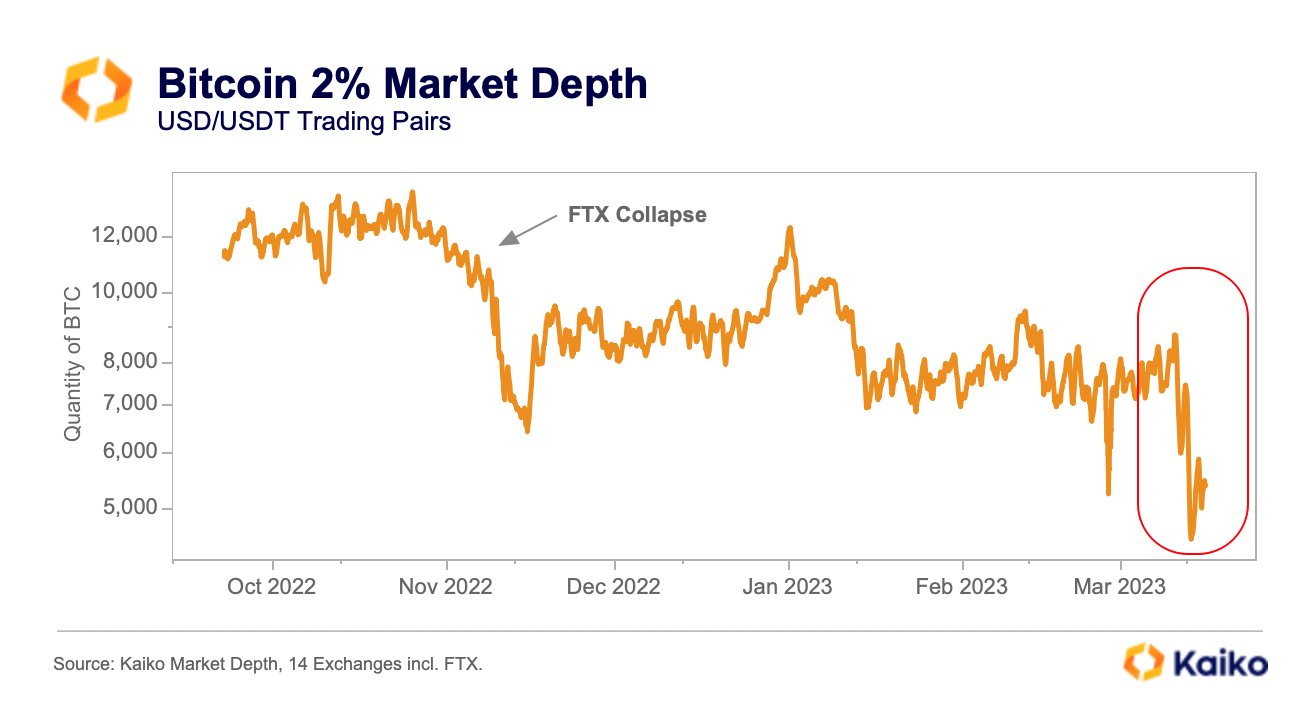

Liquidity challenges on the horizonUSDT’s dominant role in crypto trading pairs has made it a cornerstone of global liquidity. The stablecoin’s absence in the EU market is expected to disrupt trading activity and increase costs for investors who rely on it to move funds efficiently.

According to 3iQ Corp CEO Pascal St-Jean:

“A vast proportion of crypto assets trade against Tether’s USDT. Forcing investors to switch to other stablecoins or fiat currencies introduces inefficiencies and raises transaction costs.”

Exchanges such as OKX, which delisted USDT in Europe earlier this year, reported a shift toward fiat trading pairs among users. Despite this adaptation, market participants remain concerned about reduced liquidity and the potential fragmentation of trading activity.

The EU’s strict regulatory stance comes at a time of increasing optimism in the US, where President-elect Donald Trump’s pro-crypto policies have energized the market.

While MiCA is designed to enhance transparency and curb illicit activity, critics argue it risks pushing traders and liquidity providers to less restrictive jurisdictions. Analysts warn that Europe’s efforts to tighten controls could undermine its competitiveness in the global crypto market.

Mixed signalsDespite the challenges, the European Central Bank recently reported a doubling of crypto ownership in the eurozone since 2022, with 9% of the population now owning digital assets.

However, venture capital investment in European crypto startups has declined, reaching its lowest level in four years. This trend highlights broader concerns about the region’s ability to attract innovation and investment under stricter regulatory frameworks.

While the regulations aim to ensure greater market stability and transparency, their immediate impact on liquidity and investor confidence could test the bloc’s ability to maintain competitiveness in the rapidly evolving digital asset ecosystem

The post EU’s upcoming crypto rules could impact liquidity due to USDT delistings appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Liquidity Network (LQD) на Currencies.ru

|

|