2024-8-30 04:00 |

Spot Bitcoin (BTC) and Ethereum (ETH) exchange-traded funds (ETFs) in the US helped improve liquidity in the crypto market, but it’s still not enough to absorb larger volatility, according to an Aug. 29 Kaiko report.

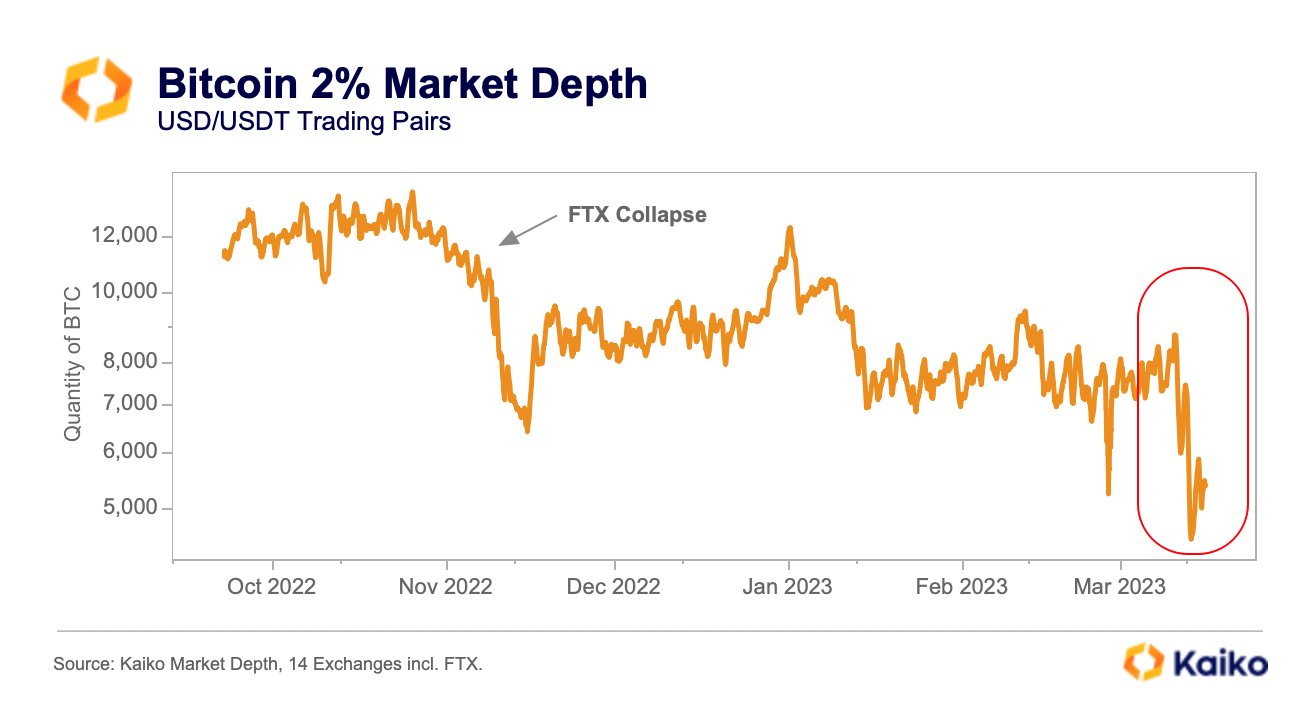

Kaiko said that liquidity has improved significantly since the FTX collapse in November 2022, with the daily trading volume of the top 10 crypto platforms growing 30% over the past year.

However, the report added that trading volume alone is not the most reliable liquidity indicator by itself, as volumes can be heavily influenced by fees and incentives offered by trading platforms.

Not ready for major impacts

Kaiko analysts found that trading volume should be coupled with market depth, which is the ability to sustain relatively large market orders without impacting the price of the asset. As a result, the volume-to-market depth ratio paints a more accurate picture, as volume can heavily surpass liquidity fueled by wash trading.

By applying this ratio, Kaiko found that the crypto market is not yet ready to brace for major impacts. The effects of low liquidity were witnessed most recently when Bitcoin orders were met with high slippage during the market crash on Aug. 2 after the Bank of Japan’s sudden rate hike.

Slippage occurs when there isn’t enough liquidity available to absorb a market order at a certain price, negatively affecting trading results. Some trading pairs, such as KuCoin’s BTC-EUR, saw slippage surpassing 5% that day.

Moreover, the report also identified slippage variations during different times of the day, which also suggests a lack of proper liquidity in the current state of the market.

Supply overhangKaiko also noted that a “supply overhang” continues to exert pressure on the crypto markets’ liquidity. The term refers to the amount of crypto that could be dumped in the market, driving prices down.

The first example mentioned by Kaiko is Mt. Gox’s estate, which has over 46,000 BTC — worth more than $2 billion — left to redistribute. The report noted that the first batch’s distribution was followed by a heavy dump.

Furthermore, governments such as the US, the UK, China, and Ukraine hold Bitcoin, which could be sold at any time as evidenced by Germany’s recent selling spree. The US government alone has over 200,000 BTC spread across various wallets.

The post Crypto market continue to struggle with liquidity post-ETFs despite improvements – Kaiko appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Liquidity Network (LQD) на Currencies.ru

|

|