2024-10-19 08:08 |

Christine Kim, Vice President of Research at Galaxy Digital, shared details of the proposal via X on Oct. 17 following Ethereum’s “All Core Devs” meeting. The EIP will allow the Ethereum consensus layer to dynamically adjust Blob gas targets and maximum values, which is expected to enhance the efficiency of Layer 2 (L2) transactions.

What Are Ethereum Blobs?Ethereum Blobs are large, temporary data chunks incorporated into Ethereum transactions. Blobs were first implemented in Ethereum’s Dencun upgrade on March 13, 2024, via EIP-4844 to reduce the cost of L2 transactions, but the fixed blob count is now approaching capacity. Vitalik Buterin, the co-founder of Ethereum, recently expressed concerns that this limit could impede scalability if not addressed quickly.

Kim believes that the EIP-7742 update may increase the blob count in the Pectra upgrade. Other potential scalability improvements, such as altering the gas limit or slot time, are unlikely to be included in this fork. Ethereum developer Alex Stokes elaborated further on GitHub, explaining that a more flexible target value for blob parameters will reduce the rigidity caused by the current fixed limits.

The Pectra fork is anticipated to roll out by the end of 2024 or early 2025. Another proposal, EIP-7623, aims to create more space for Blobs by reducing Ethereum’s maximum block size from 2.7 MB to around 1 MB.

This development aligns with Buterin’s broader objective of enabling Ethereum to achieve 100,000 transactions per second by incorporating mainnet and Layer 2 scaling solutions, a vital component of Ethereum’s “The Surge” strategy.

Layer 2 Scaling’s Impact on Ethereum’s RevenueLayer 2 scaling methods have significant drawbacks, even though they promise cheaper transactions. According to Matthew Sigel, Head of Digital Asset Research at VanEck, Ethereum’s revenue share from transactions has dropped significantly as Layer 2 networks take over a larger portion of the ecosystem.

Sigel pointed out in an Oct. 17 post on X that over the last four months, the revenue split between Ethereum mainnet and Layer 2s has shifted to 10:90, a complete reversal of the 90:10 ratio used in earlier forecasts. It forced Sigel to revise VanEck’s bullish prediction that Ether would surpass $22,000 by 2030, which was estimated under the assumption of a 90:10 revenue split—the exact opposite of what’s happened over the last four months. If that split remains the same, Sigel said VanEck’s Ether price target would fall 67% to $7,330.

It could get even worse with one of Ethereum’s largest revenue drivers, decentralized exchange Uniswap, pivoting from Ethereum by creating its new layer 2 “Unichain.”

Ethereum Demand SlowsThe Ethereum price has been on a steady decline since its recent peak of $3907 on May the 27th. Source: Brave New Coin Ethereum Liquid Index

According to FxStreet, US spot Ethereum ETFs experienced three days of inflows and one day of minor outflows, totaling $79.9 million by Thursday. Tracking ETF flows can provide useful information about institutional opinion toward Ethereum, but the current level of inflows must increase dramatically before it can have a significant impact on its price.

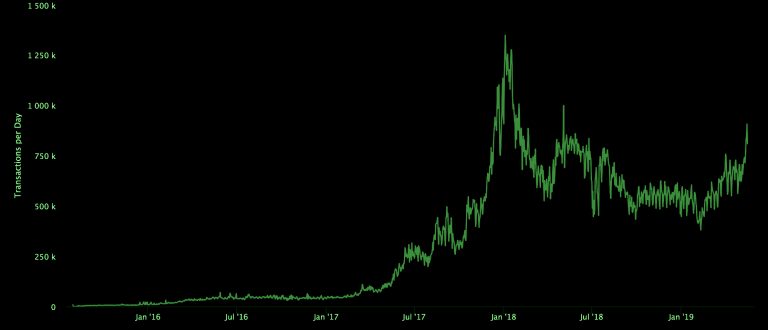

Compared to other cryptocurrencies, Ethereum’s price has not performed as well since the bull market began in late 2023. The lukewarm debut of US-listed spot ETH ETFs and sluggish demand are two reasons for this shortfall. Between August and October, Open Interest (OI) rose by 28.57% to reach $9.6 billion, but this is still significantly lower than the $13 billion seen in June.

origin »Bitcoin price in Telegram @btc_price_every_hour

Ethereum (ETH) íà Currencies.ru

|

|