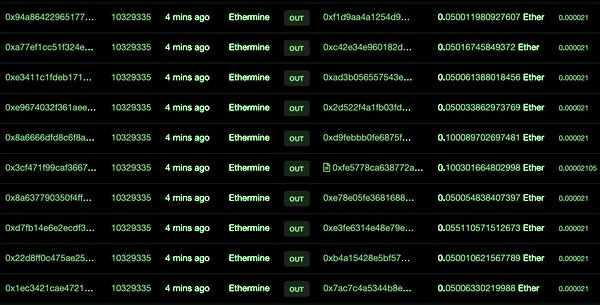

2025-7-3 08:42 |

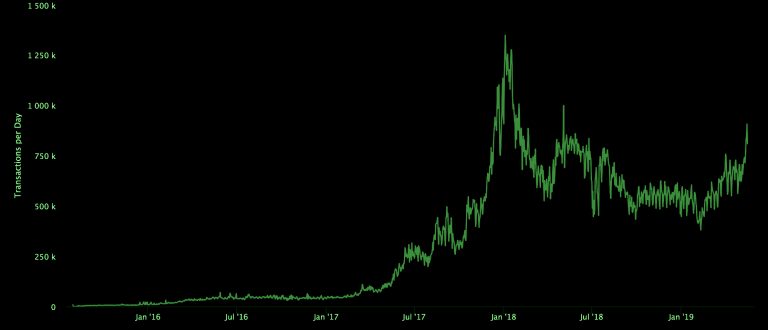

Ethereum daily transactions are soaring, reaching a peak of 1.729 million, the highest since January 2024.

This surge, fueled by a 50% spike in on-chain activity, signals renewed investor enthusiasm.

The price of Ethereum stands at $2,400 and above as its blockchain is busy giving a clue of a potential increase in price.

Meantime, another crypto asset gaining popularity in the market is an Ethereum-based altcoin, Mutuum Finance (MUTM), with a price of 0.03.

With its presale in Phase 5, over $11,400,000 raised, and more than 575 million tokens sold to 12,600 holders, MUTM is positioned for significant growth.

Could this altcoin ride Ethereum’s wave to hit $4 post-launch? Let’s explore.

Mutuum Finance presale acceleratesMutuum Finance (MUTM) is gaining traction in its presale’s fifth phase, with tokens priced at $0.03. This marks a 200% increase from the opening phase’s $0.01, reflecting strong investor demand.

Phase 5 is over 50% filled, signaling limited time to secure tokens at this price. The next phase will raise the price by 16.7% to $0.035, and the official launch at $0.06 guarantees a 100% return on investment.

Over $11,400,000 has been raised, with 575 million tokens sold to 12,600 holders.

Furthermore, Mutuum Finance has finalized a CertiK audit, earning a 95.00 security score with no vulnerabilities, bolstering investor confidence.

Innovative DeFi lending modelMutuum Finance (MUTM) is reshaping the decentralized finance category and introducing the dual lending system.

Peer to Contract model would automate the lending through the implementation of smart contracts and provide dynamic interest rates to be stable.

Meanwhile, the Peer to Peer model links borrowers and lenders through a direct connection, and it is perfect with volatile assets that require special terms.

The flexibility makes Mutuum Finance different in the crypto market and focuses on user control and transparency.

Also, the panel is working on a fully collateralized USD-pegged stablecoin on Ethereum that minimizes the risks of depegging in comparison with algorithmic currencies.

Consequently, this stablecoin will enhance liquidity and simplify transactions, making Mutuum Finance a robust DeFi solution.

Security and rewards drive growthMutuum Finance (MUTM) is prioritizing security through a CertiK-verified audit, achieving a 95.00 score with zero vulnerabilities in its smart contracts.

The team has launched a Bug Bounty Program with CertiK, offering $50,000 in USDT rewards across four severity tiers. This ensures ongoing protocol safety.

Moreover, Mutuum Finance is hosting a $100,000 giveaway, split among 10 winners, each receiving $10,000.

Participation requires a $50 presale investment and completing specific quests, like submitting a wallet address.

Additionally, a leaderboard rewards the top 50 holders with bonus tokens, incentivizing long-term commitment. These initiatives highlight Mutuum Finance’s focus on community and trust.

Ethereum’s surge fuels altcoin potentialEthereum’s daily transactions have climbed to 1.729 million, with active addresses jumping from 345,406 to 593,637 in days.

This uptick reflects growing investor activity, potentially pushing Ethereum’s price higher.

However, sell volume slightly outpaces buys, with $90 million in sales against $78.15 million in purchases. Despite this, the crypto market remains optimistic, with Mutuum Finance (MUTM) poised to benefit.

Analysts predict MUTM could reach $4 post-launch, a 13,233% increase from its current $0.03 price, driven by its innovative lending and stablecoin features.

As Ethereum thrives, MUTM’s Ethereum-based infrastructure positions it as a top crypto investment.

Looking ahead with confidenceMutuum Finance (MUTM) is emerging as a standout altcoin in a bustling crypto market. Its presale success, with over $11,400,000 raised and 575 million tokens sold, underscores its appeal.

The guaranteed 100% ROI at launch, coupled with a projected $4 price target, makes it a compelling choice.

The CertiK audit, Bug Bounty Program, and $100,000 giveaway further solidify its credibility.

As Ethereum’s daily transactions hit an 18-month high, Mutuum Finance leverages this momentum, offering investors a chance to join a promising DeFi project.

Don’t miss out—participate in the presale today to secure your stake in this rising altcoin.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://mutuum.com/

Linktree: https://linktr.ee/mutuumfinance

The post Ethereum daily transactions hit 18-month high — will price follow as $0.03 ETH altcoin targets $4? appeared first on Invezz

origin »Bitcoin price in Telegram @btc_price_every_hour

Ethereum (ETH) на Currencies.ru

|

|