2025-1-10 15:30 |

Leading altcoin Ethereum (ETH) is facing increased selling pressure as financial giant Fidelity transferred over $200 million worth of the cryptocurrency to Coinbase within 48 hours.

This significant influx of coins into the exchange has sparked concerns that it could potentially exacerbate the existing downward pressure on the Ethereum price.

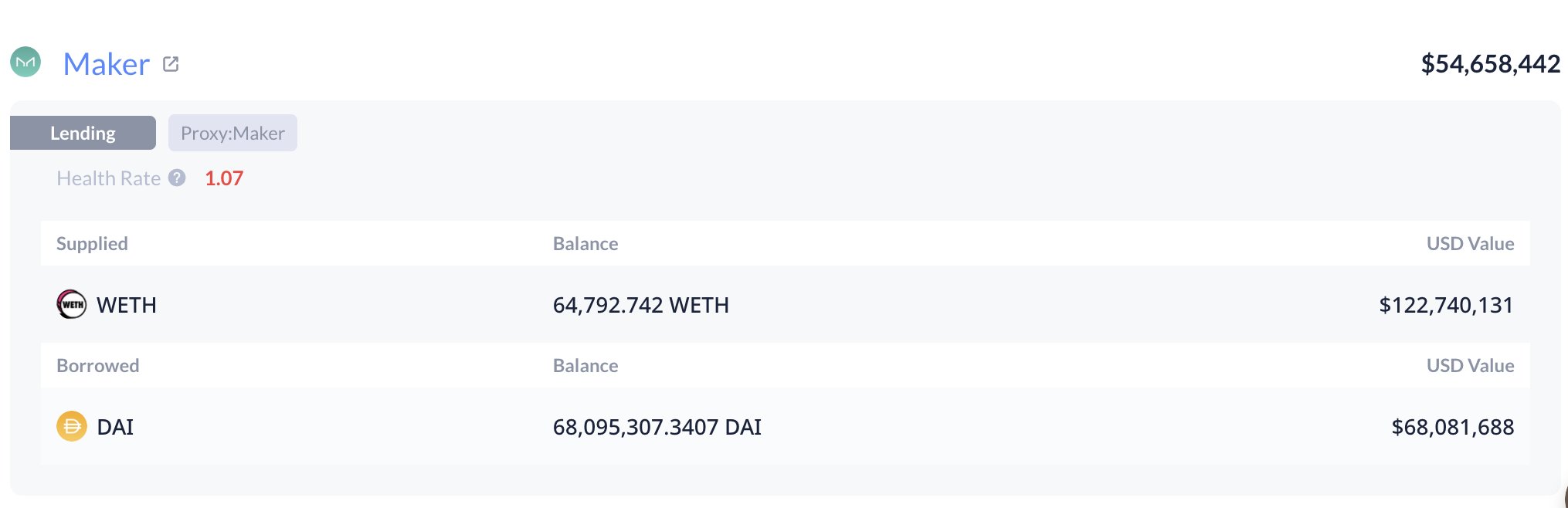

Ethereum Risks Decline As Fidelity Transfers ETH to CoinbaseIn a series of transactions over the past 48 hours, the crypto arm of asset management firm Fidelity has deposited $213 million worth of ETH to leading exchange Coinbase via Cumberland.

According to Arkham, the first two transactions involving the transfer of 20,000 ETH to Coinbase were completed on January 8. The last transaction executed on Thursday involved the deposit of 11,250 ETH valued at $36.51 million to Coinbase.

Fidelity Coin Transfers. Source: ArkhamThese ETH transfers have led to a spike in the coin’s exchange inflow volume. According to Glassnode, on January 9, a staggering 550,930 ETH, valued at over $1 billion, was sent to exchange addresses—marking the highest single-day inflow since December 20.

Ethereum Exchange Inflow Volume. Source: GlassnodeThis growing accumulation of ETH in exchange wallets could intensify the downward pressure on its price if market demand fails to absorb the increased supply.

When an asset’s exchange inflow surges, it signals increased selling pressure as holders transfer assets to exchanges, potentially to liquidate. If sell orders outweigh demand, this trend can lead to downward price movements.

ETH Price Prediction: Low Demand Worsens ConcernsReadings from the ETH/USD one-day chart have shown that no such demand exists in the altcoin market to absorb the growing supply. Its declining Relative Strength Index (RSI) reflects this weakening buying pressure. At press time, this momentum indicator is on a downward trend at 42.73.

ETH’s RSI readings indicate weakening momentum, with the asset nearing oversold territory but not yet critically undervalued. If buying pressure wanes further, ETH’s price could drop below $3,249 and plummet toward $3,027.

Ethereum Price Analysis. Source: TradingViewOn the other hand, if exchange inflow stalls and demand climbs, it may drive the Ethereum price up to $3,758.

The post Ethereum Under Pressure as Fidelity Transfers $213 Million ETH to Exchange appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Fidelity Token (FDT) на Currencies.ru

|

|