2020-2-3 15:00 |

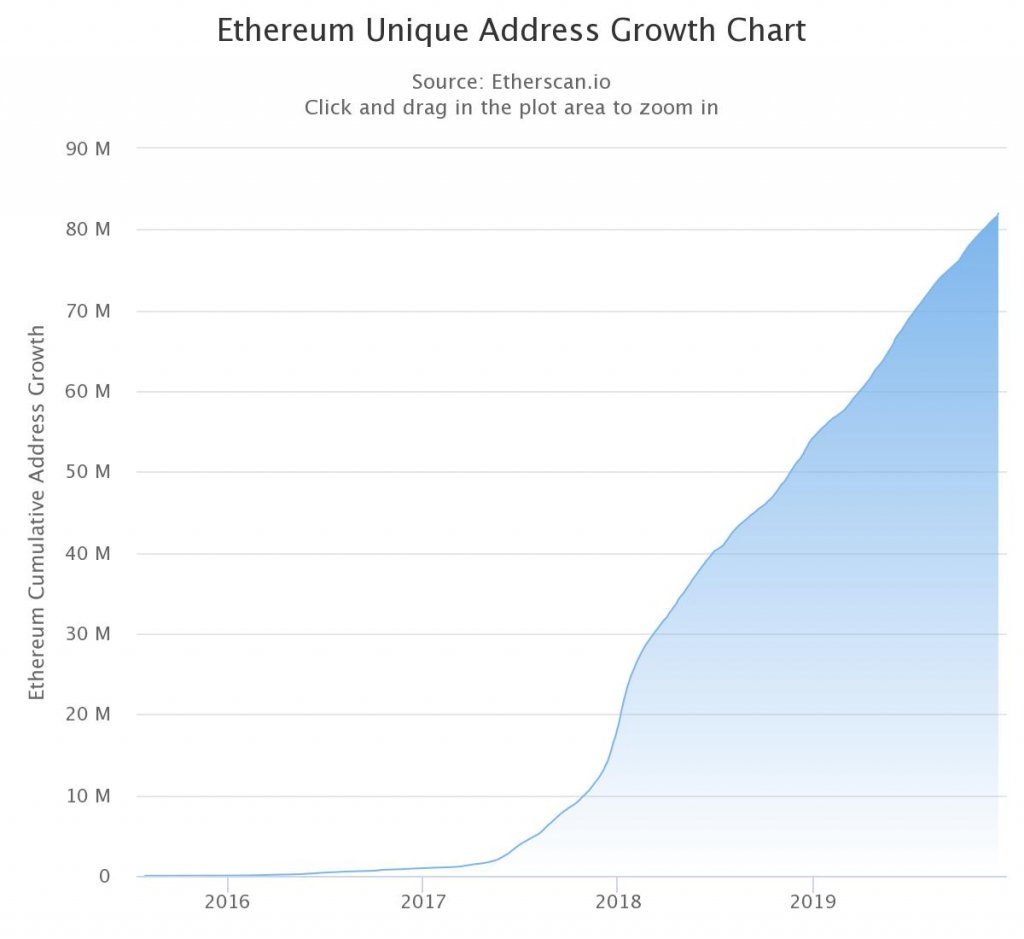

Ethereum has had a solid weekend with further gains lifting it towards $200. Network fundamentals have also been strong so far this year which has seen ETH gain 45%. Ethereum Up 5% ETH prices have gained 5% over the past 24 hours, topping $190 for the first time since early November. According to Tradingview.com Ethereum touched $195 briefly before pulling back slightly a few hours ago. Prices started out in January at around $130 and have since made over 45% to reach current levels. The psychological $200 barrier lies ahead and beyond that, analysts are targeting $220. Ethereum is still attractively priced at 86% down from its peak and can still be considered in a bear market. This will remain the case until it can top $400 which may well happen this year. ETH Trade update 50% profit booking target for COINBASE:ETHUSD by wallstreetsharks https://t.co/QrO1ifCNkH pic.twitter.com/BAroBYdG82 — Bitcoin (@bitcoinagile) February 3, 2020 Fundamentals Looking Solid Ethereum has had a good month in January both technically and fundamentally. ConsenSys has been looking into the figures which continue to strengthen for the Ethereum network. It has been a good month for decentralized finance with record amounts of ETH being locked up. There is over 3 million ETH locked as collateral for DeFi markets and in USD terms a record $909 million in total value according to defipulse.com. DeFi markets are not far off the $1 billion mark which could be just around the corner with rising Ethereum prices. Maker’s multi-collateral DAI surpassed the 100 million DAI threshold while MakerDao’s Oasis platform now provides a Dai Savings Rate (DSR) of 7.75%. The review added that popular no-loss gambling app Pool Together achieved its highest weekly payout to date of 700 DAI. More bullish Ethereum figures followed including the number of dApps on the platform which currently stands at over 3,300. January had 5,200 dApp smart contracts in use, and over 40,000 traders using DEXes. There are now three ETH 2.0 Testnets are available on Github and $650k in grants awarded by the Ethereum Foundation to infrastructure projects. Additionally, Gitcoin conducted a widely successful pilot of quadratic voting which provided 200k in grants to technology and media categories. Ethereum staking has already started to take off with over 1 million ETH already primed for Beacon Chain. The ETHDenver event is also less than two weeks away and this, the largest Ethereum hackathon in the world, is also attracting some huge sponsors. Ethereum has enjoyed a bullish start to the year and it is currently showing no signs of slowing down. Will ETH prices top $200 this week? Add your comments below. The post appeared first on Bitcoinist.com. origin »

Bitcoin price in Telegram @btc_price_every_hour

Ethereum (ETH) на Currencies.ru

|

|