2024-9-25 18:30 |

Since July, crypto whales have distributed Ethereum (ETH) in large volumes. This selling pressure affected the price, which cratered from over $3,500 at that time to $2,140 in the first week of September.

However, these same whales seem to have offered ETH a breath of fresh air with large-scale accumulation. In this on-chain analysis, BeInCrypto explores what this could mean for investors as the market adjusts to a more bullish environment.

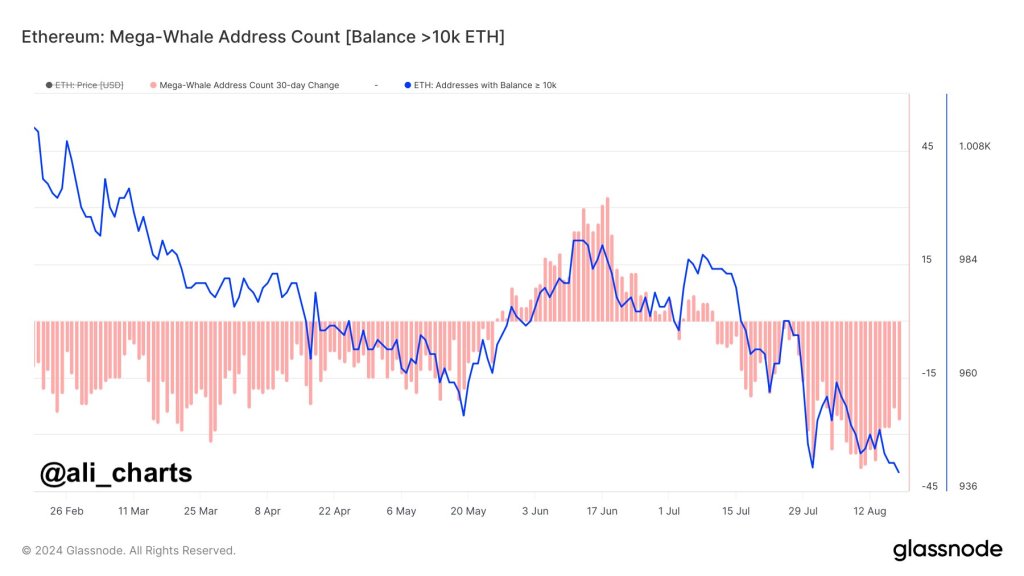

Ethereum Stakeholders Bought 70,000 CoinsAccording to Glassnode, the number of Ethereum addresses holding at least 10,000 ETH was 918 on September 16. As of this writing, that figure has increased to 925, indicating that Ethereum mega whales have accumulated at least 70,000 coins in the last seven days. At current prices, the purchase amounts to over $185 million.

A decrease in whale holdings is typically a bearish sign for a cryptocurrency, and it usually leads to a price decrease. Therefore, this significant accumulation suggests that Ethereum’s price might continue to appreciate.

Recently, the price increased from $2,295 to $2,640, fueling speculation that the cryptocurrency could be eyeing July highs.

Read more: Ethereum Restaking: What Is it and How Does it Work?

Ethereum Mega Whales Addresses. Source: GlassnodeWhile it might be too soon to conclude, the Bulls and Bears indicators seem to support a further hike. Bulls are addresses that bought at least 1% of the total trading period within a specific timeframe. Bears, on the other hand, are those that sold a similar volume.

According to IntoTheBlock, bulls have accumulated more ETH than bears in the last seven days. As such, rather than succumb to a price plunge, Ethereum’s price might continue its recently-found rally.

Ethereum Bulls and Bears Indicator. Source: IntoTheBlockRoy Hui, Founder & CEO of Ethereum Layer-2 blockchain LightLink Chain, also seems to agree with the sentiment.

“Despite the challenges, ETH still boasts the largest number of developers, projects, users, and overall adoption in the space. The network effect where the value of a network increases with the square of its nodes is critical, and I believe ETH is currently undervalued,” Hui told BeInCrypto.

ETH Price Prediction: Time for $3,037In terms of Ethereum’s short-term outlook, the In/Out of Money Around Price (IOMAP) shows that 2.7 million addresses purchased 52 million ETH around $2,279. This volume is higher than the combined number of coins accumulated between $2,717 and $3,037.

Generally, the higher the volume at a price range, the stronger the support or resistance. Therefore, $2,279 appears to be a strong support level for Ethereum.

Read more: How To Buy Ethereum (ETH) With a Credit Card: Complete Guide

Ethereum In/Out of Money Around Price. Source: IntoTheBlockBased on this status, ETH’s price might break past $2,717 once buying pressure intensifies again. If that happens, a rally beyond $3,037 could follow.

However, if Ethereum mega whales decide to stay on the sidelines or the Ethereum Foundation begins distributing, the prediction might be invalidated, and ETH’s price could decline below $2,500.

The post Ethereum Mega Whales Ease Selling Pressure with $185 Million Accumulation appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Ethereum (ETH) на Currencies.ru

|

|