2024-8-22 10:00 |

Ethereum is struggling for momentum and remains under immense selling pressure. As of writing, the second most valuable coin is inside a narrow range, trending within the $2,100 on the lower end and $2,800 on the upper end.

The local resistance level could mark the start of an impressive leg up, relieving the coin of the current sell grip from early August.

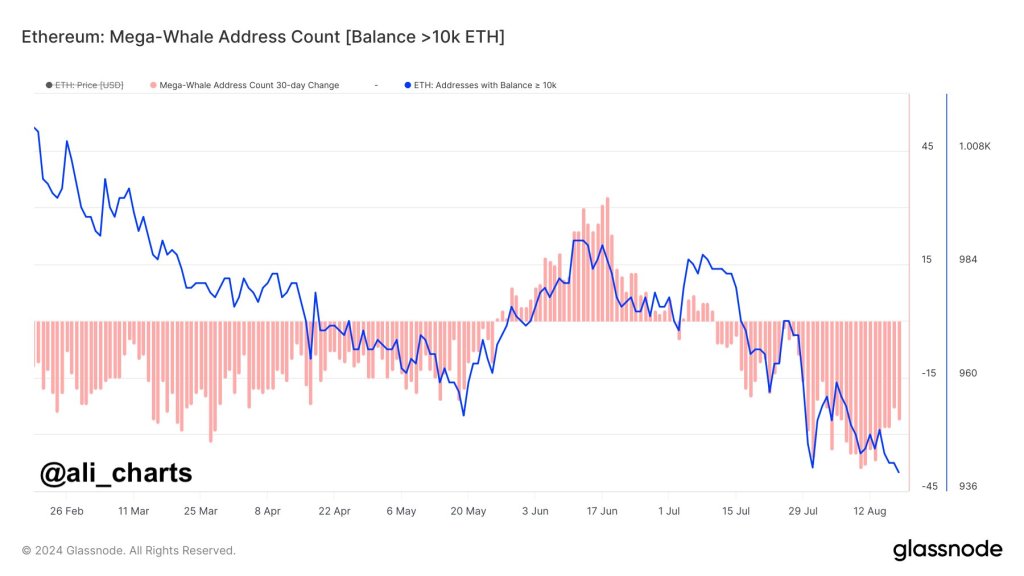

Ethereum Whales SellingAlthough supporters are upbeat, expecting the coin to trend higher, breaking above local liquidation lines in a buy trend continuation formation, there are concerns. Looking at Ethereum price action, the coin could post even more losses.

One analyst, citing on-chain developments, notes that Ethereum whales, or addresses holding at least 10,000 ETH, have been actively selling over the past month. Overall, their decision to sell could suggest that these entities, who are often closely monitored, are not confident about what lies ahead.

Therefore, others could follow suit by unloading their holdings, leading to a supply glut. Considering market forces, an uptick in supply could negatively impact prices, delaying the climb above the immediate roadblocks.

Massive Outflows From Spot ETH ETFsBeyond this, analysts are also deflated by the current trends of spot Ethereum ETFs. In May, prices shot higher when the United SEC unexpectedly fast-tracked the approval of 19b-4 forms for applicants. The approval of the S-1 registration forms was also received positively, lifting prices above the $3,000 mark.

However, days after the product began trading, there were more outflows, especially from Grayscale’s ETHE. Concurrently, demand has been lower than expected. Since its inception, over $247 million worth of ETH has been redeemed from ETHE. Subsequently, prices have been struggling and moving further away from March 2024 highs.

According to Farside data, all spot Ethereum ETF issuers posted outflows of around $6.5 million on August 20. This is mostly thanks to the millions of dollars of redemption through ETHE. This has been a consistent trend since August 15.

It suggests that though the smart contracts platform offers value, ETH’s immediate to medium-term outlook is bearish. Accordingly, investors are choosing to move their capital elsewhere.

origin »Bitcoin price in Telegram @btc_price_every_hour

Ethereum (ETH) на Currencies.ru

|

|