2021-4-12 15:16 |

Ethereum is not getting flipped by Binance Smart Chain anytime sooner, shows on-chain indicators.

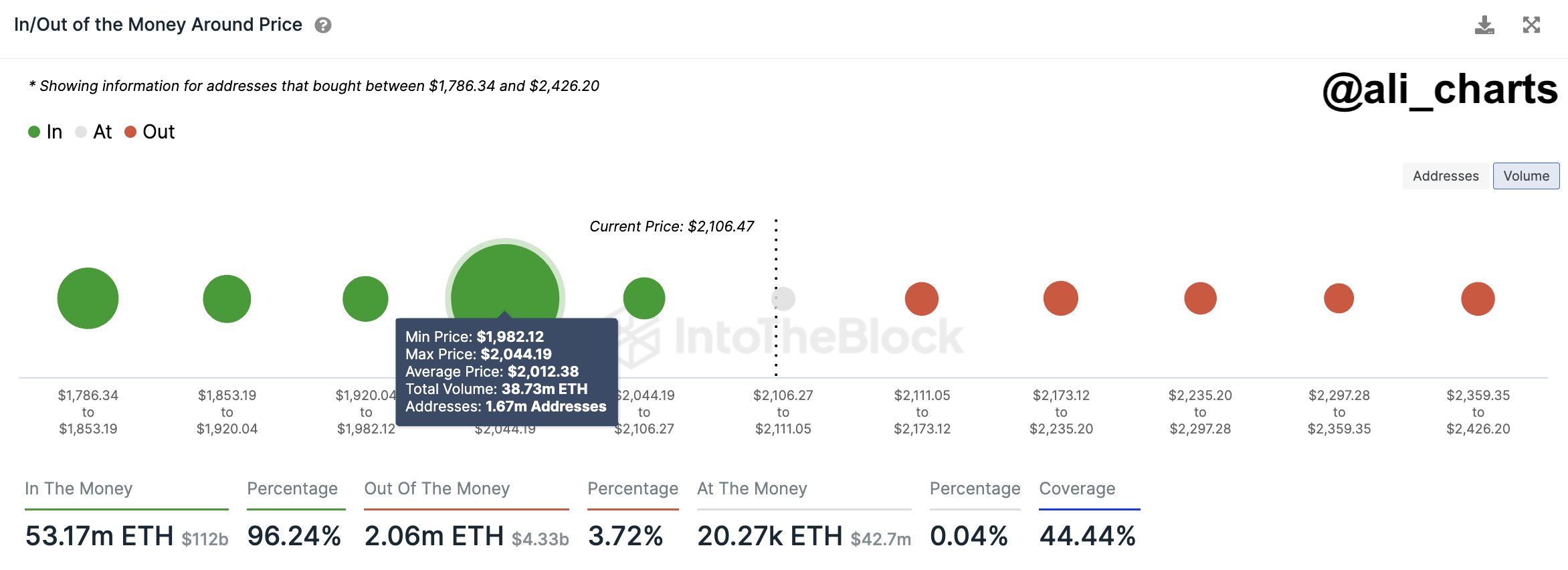

Blockchain analytics platform IntoTheBlock gathered data on Ethereum transactions with volumes greater than $100,000. The portal noted that the second-largest blockchain network processed $20.68 billion worth of transactions in the week ending April 11, leading to a record high volume transfer of $68.87 billion.

“These large transactions are representing over 77% of the daily on-chain volume,” it added.

Ethereum transaction volume in the US dollar. Source: IntoTheBlockIncreasing volumes on a blockchain point to its growth as a public ledger. Meanwhile, transactions carrying a larger capital points to transfers between wealthy entities. They could be exchanges, wallet services, and even institutional investors.

The last few weeks have witnessed Ethereum walking out of the shadows of Bitcoin as an alternative cryptocurrency and creating a niche of its own among institutional entities. The biggest example among all was Visa’s first stablecoin transaction via USDC, a token built atop the Ethereum blockchain.

A report published by CoinShares also noted that ETH-based investment products attracted $4.2 billion worth of capital inflows in the first quarter. Meanwhile, Grayscale Investments, a New York-based crypto-focused investment firm, increased its Ethereum holdings from 2.94 million ETH at the start of this year to 3.17 million ETH this April 12.

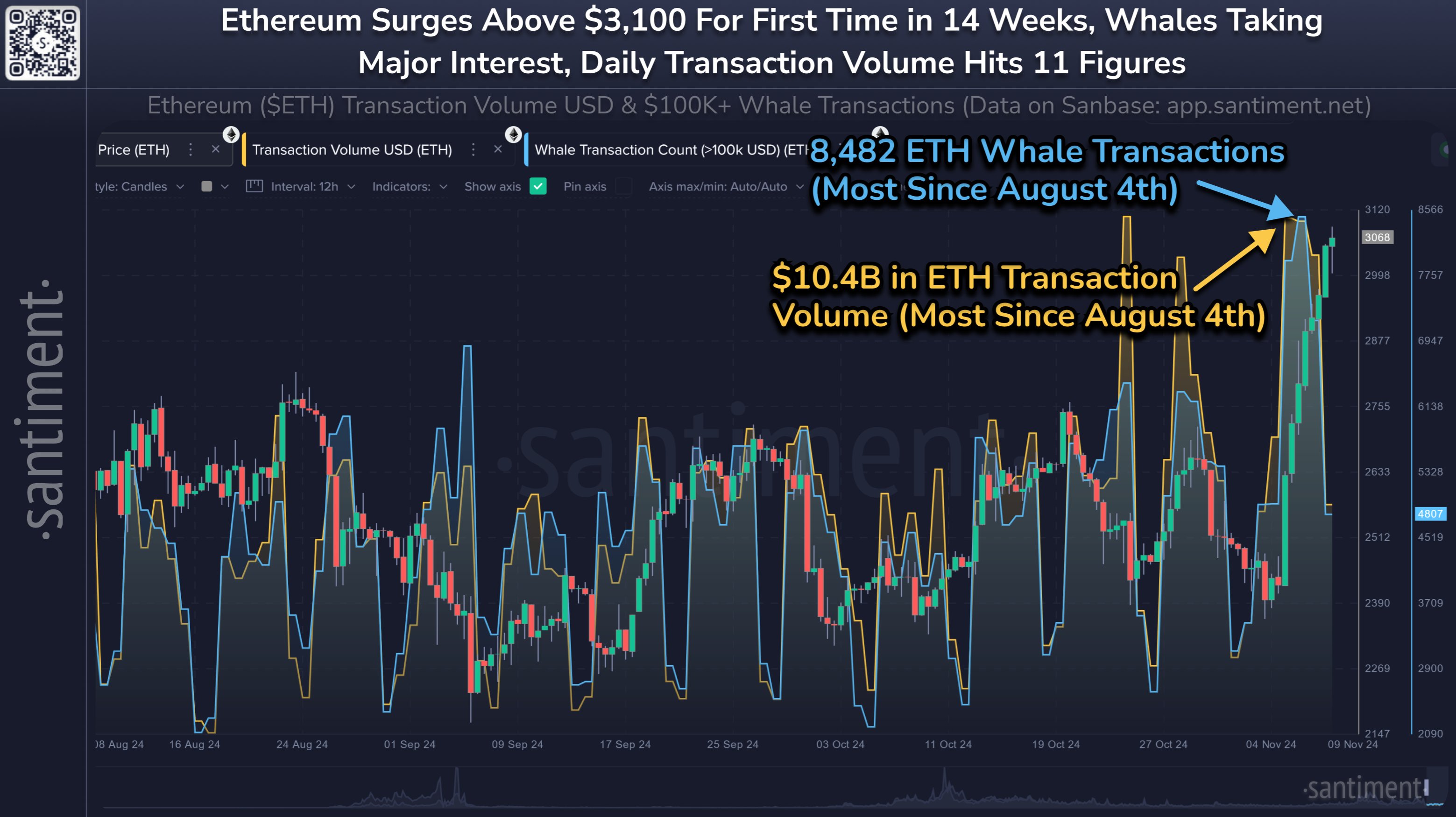

Ethereum Supply CrisisMarket sentiment analytics portal Santiment noted that increasing demand from “whales” — entities that hold a larger amount of cryptocurrency wealth — led to a supply crisis in Ethereum markets. Now, wealthy investors hold 68 percent of the total ETH supply in circulation. On the other hand, the number of Ethereum wallets holding anywhere between 10-10,000 ETH dropped to its lowest since September 2017.

Ethereum price trades above $2,100. Source: ETHUSD on TradingView.comSantiment also noted constant ETH inflows into the liquidity pools of decentralized finance projects. It also noted declines in the amount of Ethereum tokens sitting inside exchange wallets. It pointed at a brewing supply crisis in the Ethereum market while its prices achieve a new historic high above $2,000.

“Another aspect that contributed to Ethereum‘s all-time this weekend was the fact that average fees have dropped back to a 5-week low,” added Santiment. “With fees back to an average of $11.08, this is the lowest since March 5th, allowing for an increased ETH utility.”

Ethereum transaction fees turn lower. Source: SantimentSome bottleneck catalysts continue to pressure Ethereum lower, such as the Binance Smart Chain’s increasing control over the blockchain space. Its native token BNB surged towards $650 on Monday, up more than 1,100 percent on a year-to-date timeframe.

Meanwhile, Ethereum’s extremely positive correlation with Bitcoin continues to pose risks to its decline under the top cryptocurrency’s influence. Bitcoin’s uptrend has paused near $60,000 against the prospect of a stronger US dollar.

Photo by Nick Chong on Unsplash

origin »Bitcoin price in Telegram @btc_price_every_hour

Ethereum (ETH) на Currencies.ru

|

|