2020-7-22 20:00 |

Like Bitcoin, Ethereum’s price has flatlined over recent weeks. According to CryptoSlate data, the leading cryptocurrency has traded between $215 and $250 for the past seven or eight weeks, barely deviating from that range. Even still, the asset is up by around 180 percent since the March capitulation lows.

Analysts say that the asset is primed to move even higher as the on-chain case for Ethereum remains strong.

Ethereum’s on-chain case remains strongMultiple of Ethereum’s most important on-chain metrics remain decisively skewed in favor of bulls.

A trader noted that per Coin Metrics, the count of daily Ethereum transfers (meaning transactions sending ETH from wallet to wallet, not smart contract interactions) is now at two-year highs, ” as it continues to diverge bullishly away from price.” The chart indicates that price follows the metric higher. This has been attributed to growth in DeFi.

Simultaneously, the value of all ERC-20 tokens just flipped the value of all ETH. ERC-20 tokens, especially stablecoins, have become such a force that Messari noted on Jul. 20 that the Ethereum network “now settles significantly more value per day than Bitcoin.”

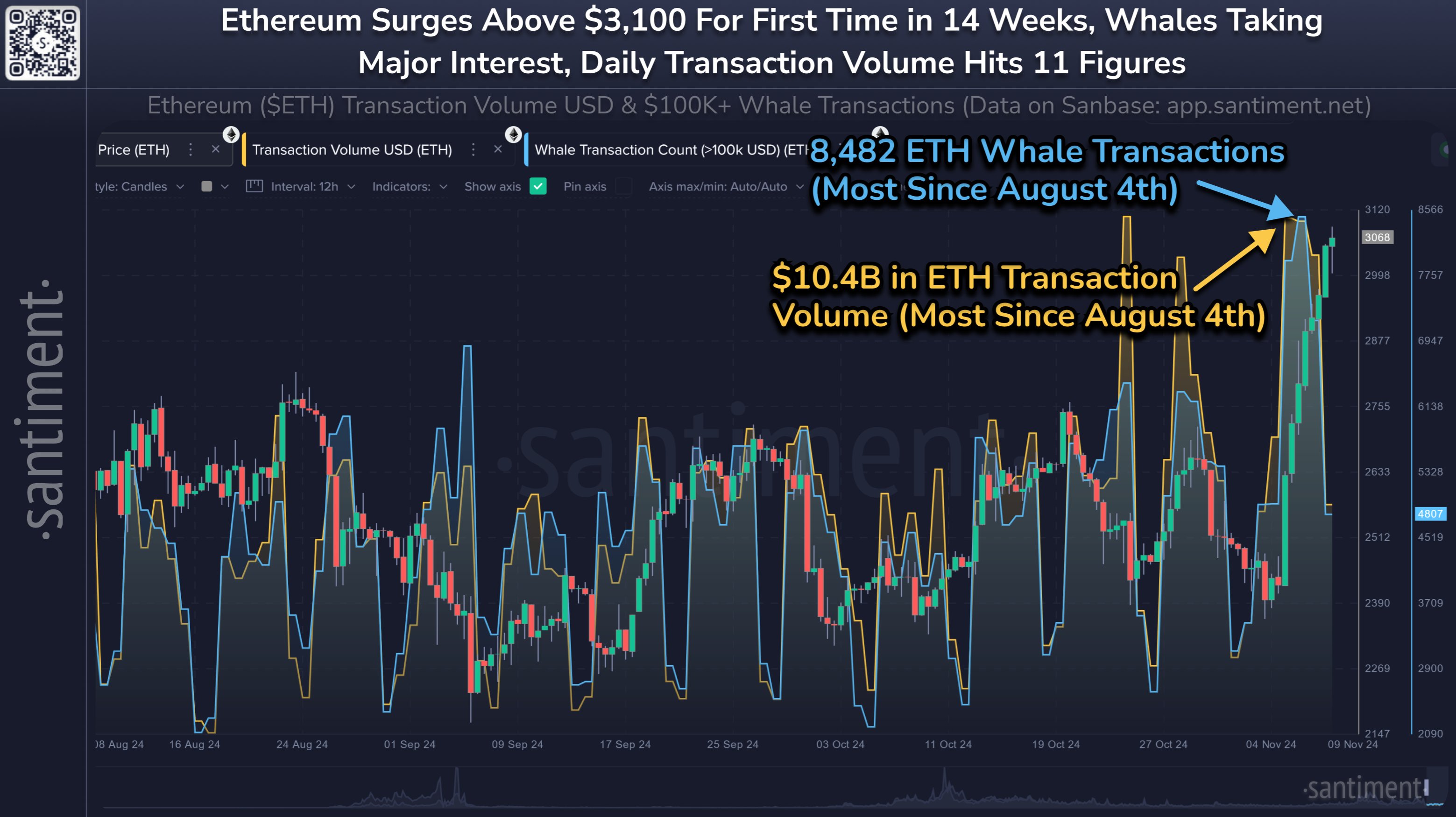

Investors are taking notice of these on-chain trends. Blockchain analytics firm Santiment shared the chart below on Jul. 18 to display that the number of smaller ETH addresses continue to grow to all-time highs. Santiment defines small addresses are those that hold less than 10 coins.

These metrics have almost consistently been growing higher since the start of the year, suggesting there has been an underlying bid for Ethereum for all of 2020 thus far.

Chart of the number of smaller ETH addresses from SantimentFurther boosting Ethereum, three prominent traders and investors in the cryptocurrency space recently came out in support of the asset, arguing there is a technical case for the asset to appreciate.

As reported by CryptoSlate previously, these individuals are Raoul Pal, the ex-head of hedge fund sales at Goldman Sachs and the CEO of Real Vision; Peter Brandt, a trader with multiple decades of experience in the commodities sector; and Tuur Demeester, the CIO of Adamant Capital and someone some would brand a “toxic Bitcoin maximalist.”

High transaction fees could change thisAlthough all these metrics and signals in tandem suggest that Ethereum will eventually revert to the upside, there remains the risk of high transaction fees stalling growth.

Data from Glassnode suggests that the average gas cost that users are paying to send Ethereum and interact with smart contracts is 500 percent higher than that seen in April.

Qiao Wang, a former head of product at Messari and popular crypto analyst, recently argued that as long as Ethereum transaction fees are high, the blockchain’s dominance is threatened by competitors:

“So long as ETH 2.0 is not fully rolled out, there’s an obvious opportunity for a highly scalable blockchain to dethrone Ethereum. Paying $10 transaction fee and waiting 15 seconds for settlement is just bad UX.”

As reported by this outlet previously, this is a sentiment that has been echoed by the CIO and VP of Exponential Investments — Steven McClurg and Leah Wald, respectfully. They wrote in a blog post that:

“The issues inherent in gas costs have created congestion, which is a negative network externality. Congestion on Ethereum has led to poor user experience, especially for traders in this highly volatile environment, as their leveraged positions may be liquidated before they can act.”

Until Ethereum can achieve strong adoption on low transaction fees, there remains the risk of ETH and its blockchain underperforming competitors, analysts say.

The post Ethereum has stalled after 180% rally but its on-chain case remains strong appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Ethereum (ETH) на Currencies.ru

|

|