2023-8-4 20:00 |

According to an analyst, there may be a pattern of the Open Interest and Bollinger Bands that Ethereum has followed in recent years.

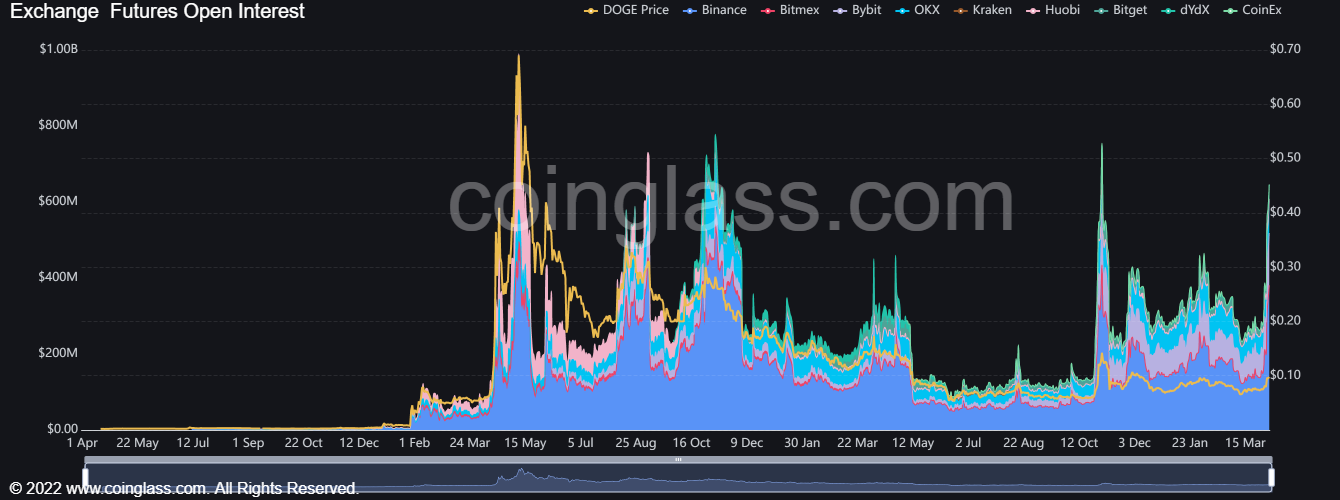

Ethereum Open Interest & Bollinger Bands May Have CorrelationAs explained by an analyst in a CryptoQuant post, the pattern of the ETH Open Interest and Bollinger Bands may be used to analyze the market’s movements. The first of these metrics, the “Open Interest,” refers to a measure of the total amount of Ethereum futures contracts that are open on all derivative exchanges.

When the value of this indicator is high, it means that the investors currently have a large number of positions in the market currently. Generally, during such conditions, the total leverage in the market is also high, which can lead to the price displaying volatility.

On the other hand, low values imply the futures market doesn’t have that many positions open right now, which can naturally result in the price becoming stable.

The other metric, the “Bollinger Bands,” is a set of three lines that are generally used for finding the volatility of an asset. The middle line in this technical indicator is the 20-day moving average (MA) of the coin in question, while the upper and lower lines are based on the standard deviation of the price from the 20-day MA.

Whenever the price approaches the lower or upper bound of the metric, it can be a potential sign that the asset is undervalued or overvalued, respectively, at the moment.

Now, here is a chart that shows the trend in both these Ethereum indicators over the last couple of years:

In the above graph, the quant has highlighted the points on the chart where a potential pattern between the Ethereum Open Interest and the Bollinger Bands could be apparent.

It looks like whenever the ETH price has made a touch of the upper bound of the Bollinger Bands while the Open Interest has been at relatively high values, the asset has observed a decline.

Similarly, when Ethereum has retested the lower bound of the metric and the Open Interest has been at low values, a rebound in the cryptocurrency has usually occurred.

Three of the retests have been seen this year alone, as the March and June rebounds both took place while the latter pattern had formed, while the peak in April had coincided with the former pattern.

From the chart, it’s visible that the Open Interest is currently at a level that is neither too high nor too low. The Bollinger Bands have seen a compression recently, as the asset has registered very low volatility.

The price is retesting the lower bound currently, but as the Open Interest isn’t at low values, it’s uncertain whether Ethereum would rebound here, as the pattern isn’t yet like the previous instances.

ETH PriceAt the time of writing, Ethereum is trading around $1,800, down 2% in the last week.

origin »Bitcoin price in Telegram @btc_price_every_hour

Theresa May Coin (MAY) на Currencies.ru

|

|